The pace at which emerging market economies are losing FX reserves is staggering. In March, emerging economies lost around $1.5 billion in foreign exchange reserves per day, according to Bloomberg.

Saudi Arabia alone lost $27 billion in reserves in March, according to Goldman Sachs, and it is one of the countries with the best capacity to endure the current crisis.

China, that still hods $3 trillion in FX reserves despite the crisis, is also among the strongest countries in FX reserves, but the apparently large level is offset by a large US-dollar denominated debt liability. As such, China’s 60% of China’s reserves are there to cover existing liabilities.

India is also one of the strong countries. As a large importer of commodities, the current slump in activity and lower commodity prices has allowed India to maintain a very healthy level of reserves.

Which countries are suffering the most? Argentina, Brazil, Mexico, South Africa, Turkey rank among the most impacted.

What is causing this collapse in reserves and rising dollar shortage?

- The decline in global trade and economic activity due to the forced lockdown weakens export revenues. The outlook for 2020 is bleak with trade possibly declining by between 13% and 32%., according to the World Trade Organization. Some recovery is expected in 2021, but the likelihood of recovering 2019 global trade activity before 2023 is small.

- The collapse in commodity prices destroys the trade balance of producer nations. Not only demand is falling to unprecedented levels, but storage is also filling up rapidly and overcapacity at producer nations is building to decade-highs. This problem is not happening just in oil and natural gas, but also in coal, aluminum, soja and, to a lesser extent, in copper.

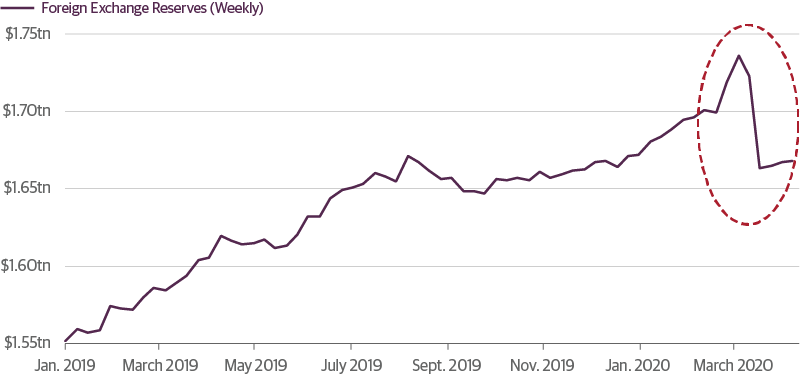

- Local currency collapse leads to central bank intervention. Central banks in emerging economies were smart in 2008-2011 and kept their reserves at very good levels, significantly above foreign currency liabilities. However, the recent slump in many currencies relative to the dollar has caught many emerging market central banks unprepared. Despite the massive increase in the balance sheet of the Federal Reserve and almost unlimited quantitative easing, many emerging currencies have collapsed and led to their central banks to sell dollars to defend the currency, a big mistake. reserves fall, and the currency remains weak.

- Since 2009, many emerging markets have ignored the risk of building imbalances and have entered into large twin deficits (fiscal and trade), as well as issued record-level of US-dollar denominated debt because domestic and international investors did not want local currency risk. This means that emerging markets face a massive wall of US-dollar denominated maturities of more than $2 trillion in the next two years while refinancing and new debt requirements soar.

- The Federal Reserve will continue to increase money supply… But investors have abandoned the risky “carry-trade” of suing cheap dollars to buy high risk emerging market exposure. Understandably, investors have pulled more than $120 billion in emerging market financial assets in March.

The “Sudden Stop” in emerging economies that I warned of in my book Escape from the Central Bank Trap (BEP 2017) is happening in front of us. It means that even with massive easing from the Fed, many economies will not see a large flow of funds into local investments, and the countries with the largest fiscal and monetary imbalances simply stop receiving foreign funding.

Some readers may see this as a great opportunity for China to extend massive loans in Yuan to address the rising shortage of dollars. There is only one problem. The economies that face the sudden stop will sell those Yuan to buy US dollars and repay loan commitments which could create a risk of capital flights in China that the country cannot afford, especially when it is managing its reserve base as well as it can.

The only thing that can reverse the sudden stop or mitigate it is a return to normal economic activity. Even so, the likelihood of investors jumping on the “negative dollar carry trade” of the past is very low.

I believe that until China sells all its dollars, the stop in economies will not stop

China cannot and will not sell its dollars. It would destroy the Yuan.

Very interesting and useful article. Thank You.

Is there any way to know how the Fed has “transferred” US$ to those countries which have a shortage of dollar?

The Fed is buying their bonds?

No, the Fed does not transfer USD to those countries. Investors buy their bonds and assets.

Can u pls guide in the sense to india as u have not mention in the currency graph the Indian currency also

Indian rupeee is also under pressure, but not as much as the Brazil real because India reserves are much stronger

These investors would be Black Rock

This dollar squeeze is the last thing the Americans want is this the dollar blow off? Ahead of world money, the type kaynes called bancorp at Bretton woods in 1944?

I also thought that the Fed transferred some USD to friends and allies through swap lines. And the reason for doing that , is to prevent those countries ( who own more US asset/ bonds ) from dumping their US bonds into the open market , in the heat of the moment of dollar shortage .

Noble Lacalle, I am a great admirer of Professor Fernando Ulrich, with your interview with him I started to admire you even more, with his teachings of great relevance when dealing with some of the most important subjects of the human being “Economics”, so I want to thank these true classes taught by Noble Lacalle! Thank you!

Great insights Mr. Lacalle!

Thanks for sharing!

What do you think about commodities expressly zinc? Short -Medium & Long terms.

I like gold, palladium, silver and zinc. I am more bearish copper and oil long term

Daniel,

February the 17th: 1 Euro – 4.66 Reales Brasileños

May the 8th: 1 Euro – 6.5 Reales Brasileños

Am I wrong in assuming that things can get even worse for Brasil?

Let’s say 1 Euro – 10 Reales?

Thanks a lot

The crisis added to commodities collapse does not help the Brazil real.

Watch: https://www.youtube.com/watch?v=ShuLxvAtZXI

Hi Daniel,

Can we assume that the emerging market dollar shortage is already priced into the USD?

I do not believe so. Most investors still have the carry trade in place.