Fans of monetary stimulus always ignore the biggest and best push for the economy. Cheap energy. Finding oil and gas.

The United States have achieved an economic stimulus equivalent to 1.3% of GDP thanks to the energy revolution brought by fracking. It is a very significant positive effect, both on the supply and demand side.

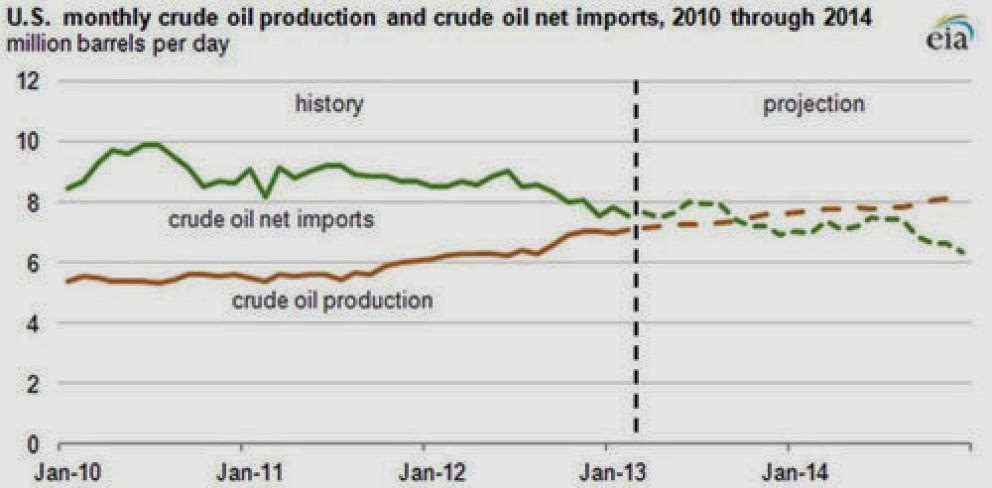

- On the supply side, it has led the U.S. to be energy independent in gas and in oil very shortly. In October 2013, domestic crude oil production exceeded imports for the first time since 1995 (7.74 million barrels a day compared with imports of 7.57 million barrels per day). In fact, imports of crude oil in North America have dropped to the lowest level of the past 17 years.

- On the demand side, although the economy is growing and industrial production increases, technological efficiency is improving consumption very significantly consumption. In 2008, the United States spent 10% of gross domestic product in energy. In 2013, it will not reach 8.5%.

At the close of this article, the spread between U.S. benchmark oil (West Texas Intermediate) and the European benchmark (Brent) stood at nearly $15/bbl. The lack of infrastructure does not allow to evacuate and export the surplus from the U.S. to the world, and that isolates the U.S. and Canada price as separate and autonomous market dynamics.

The spread between West Texas Intermediate and Brent is likely to remain at $15/bbl. The lack of infrastructure does not allow evacuating and exporting the surplus from the U.S. to the world, and the Keystone filling is not enough to offset the rise of production.

Total product demand in the US on a trailing four week basis is 20.1m b/d, +5.6% y/y. Gasoline demand is up 3.3%, distillate demand growth + 0.1% and jet fuel demand is up 8.1%.

At 386mb crude stocks are well above the upper limit of the average range for December. Gasoline inventories are in the upper half of the average range. Distillate stocks are below the lower limit of the average range for this time of year.

The price of gas in U.S. is $ 3.9/ mmbtu compared to the European average of $ 8.5 / mmbtu. More than twice. Meanwhile, in Japan, energy costs have skyrocketed in 2013 and the price at which the country imports liquefied natural gas exceeds $ 15/mmbtu … five times more expensive than the U.S. gas.

Not only the U.S. imports less, but the cost is lower than that of its competitors in the OECD countries. It is the way to energy independence in the U.S. I already commented in 2012 here.

The effect produced by this energy revolution is twofold:

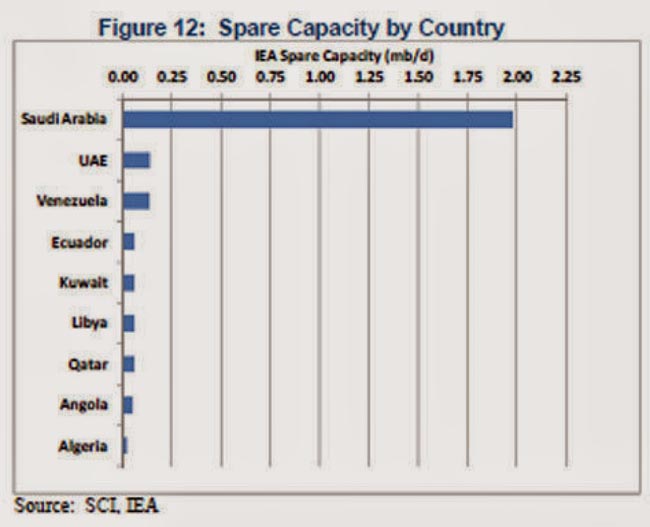

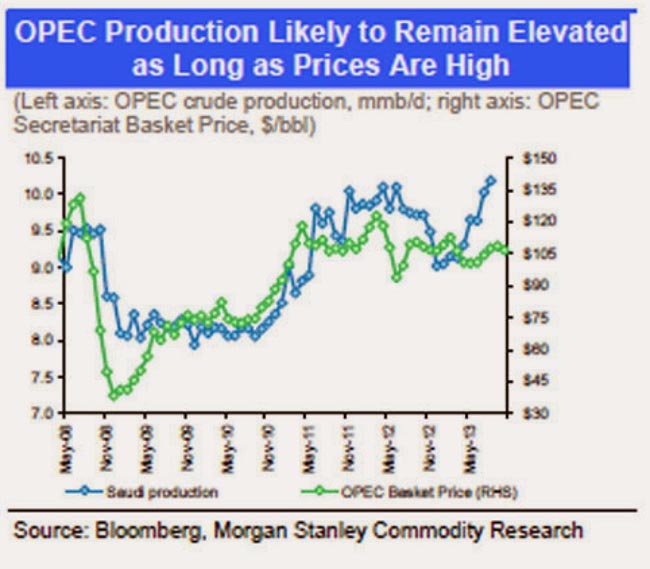

It greatly reduces the “geopolitical premium” to be added to the price of crude . Even though Brent reflects an obvious geopolitical risk, it is much smaller than in the past because the balance between supply and demand is very well covered. That the price of Brent is “only” $110 a barrel in an environment of decent demand growth and supply problems in Libya, Syria, Iraq and Iran is a clear proof of how well the market is supplied .

Brent price dynamics is lateral, despite supply problems in Libya due to internal protests, which led the country to export less than 90,000 barrels per day (compared to the country’s capacity of 1.25 million barrels per day), sanctions to Iran (which led the country to export about 1 million barrels a day, compared with its capacity of 2.5 million) and the political difficulties to boost production in Iraq after the war. In fact, Iraq is likely to slash its production guidance by 35%. Meanwhile, Iran is aiming at adding 500kbpd to supply, but technical challenges remain, more important than sanction lifting. At the OPEC meeting, Iran stated that it was ready to open its doors to the oil majors from Europe and the US, but the seven companies named by Iran to boost oil output are unanimously sceptical about the growth targets set by the country (BP, RDS, Total, ENI, Statoil, Exxon and Conoco).

Not only the spare capacity of OPEC countries is adequate to address specific risks, but the oil price still includes a negative impact of production incidents – unexpected cuts to supply from military or political crises – of 2.7 million barrels a day. If those unexpected cuts are normalized, the geopolitical premium in oil prices will fall further .

There is enough spare capacity and the incremental production comes from so-called “safe” countries, the U.S. in particular. Of the newly added production capacity in the oil value

One thought on “The Oil Market Is Well Supplied. Thoughts for 2014”

Comments are closed.