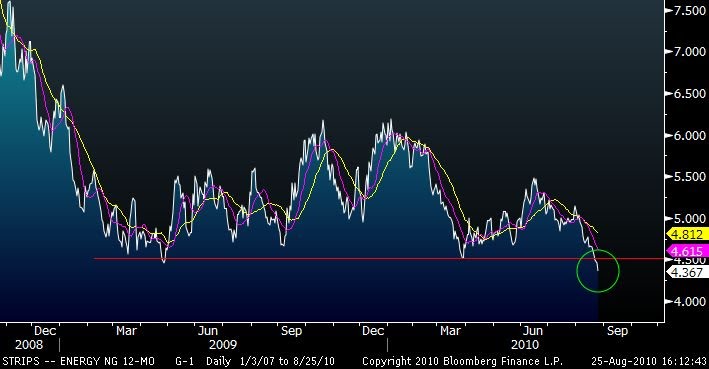

As I commented a few months ago, gas prices are at risk and have now fallen below $4/mcf on the Henry Hub 12 month strip, and we are at growing risk of a prolongued downturn in prices unless producer discipline is restored, as the weakness is occurring into shoulder season where marginal demand for power becomes very weak and its challenging to compensate the oversupply of gas by taking out coal of the merit order, so the risk is relevant until heating season. In the US total working storage is now at 3,052 Bcf versus the 5-year average of 2,875 Bcf and last year’s 3,250 Bcf level.

This is where finally I expect some producers to respond with a combination of capex cuts and asset disposals. This will drive prices back to more normalized $4.5/mcf levels. A few brokers are calling the seasonal nat gas trade this week (historically this is the low season for spot pricing which is what the equities trade off of). The only difference between this year and the last one is that the contango has weakened. This will make equities less reactive, but it will also make it less attractive to drill nonsensically and hedge as financial institutions will not be so keen when the curve flattens.

Yes, most of the independents claim to be the “low cost” producer, most will say they make money at $3.5/mcf, however, this is not 2008. On one hand, service charges have increased, and on the other hand, the benefits of scale achieved in the “fracking revolution” are becoming less apparent.

So in order to bring the market to balance we need to see a good cut to c62BCF/d from current 65-66BCF/d. I believe this environment will drive majors to look for M&A opportunities (they love their US gas acreage) and as such US gas independents are always a risk if you want to short them for more than 1-2 weeks. I would use this pull-back to play arbitrage winners (LNG) and look at those companies that remain disciplined, strong on balance sheet, low cost and well placed for M&A… and monitor the producer discipline very carefully. Unfortunately the rig count is not a good indicator any more (as we saw in 2009, rig count can drop severely and production still rises due to efficiency improvements). So it will all be about company messages.

One question to ask ourselves: What will Exxon do with XTO? Maximize production or be disciplined and look at high returns?. The new entity controls 15% of US gas production, and Exxon has been disappointing in results in the past four quarters. Surely sub-$4 gas is not ideal environment for mass growth in output for a company that prides itself in maximizing ROCE. I hope they will stick to that principle.