Any tax cut will always be attacked by the interventionist crowd. The main argument is deficits. Something I find amusing because those same interventionists are the ones that defend massive deficits when it comes from rising expenditure. Why? Because government spending empowers politicians and their crony sectors while tax cuts empower citizens.

I am glad to say that tax cuts are not only working fine, but better than expected.

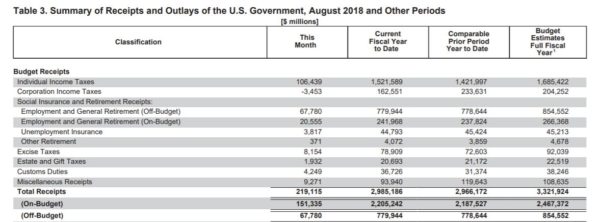

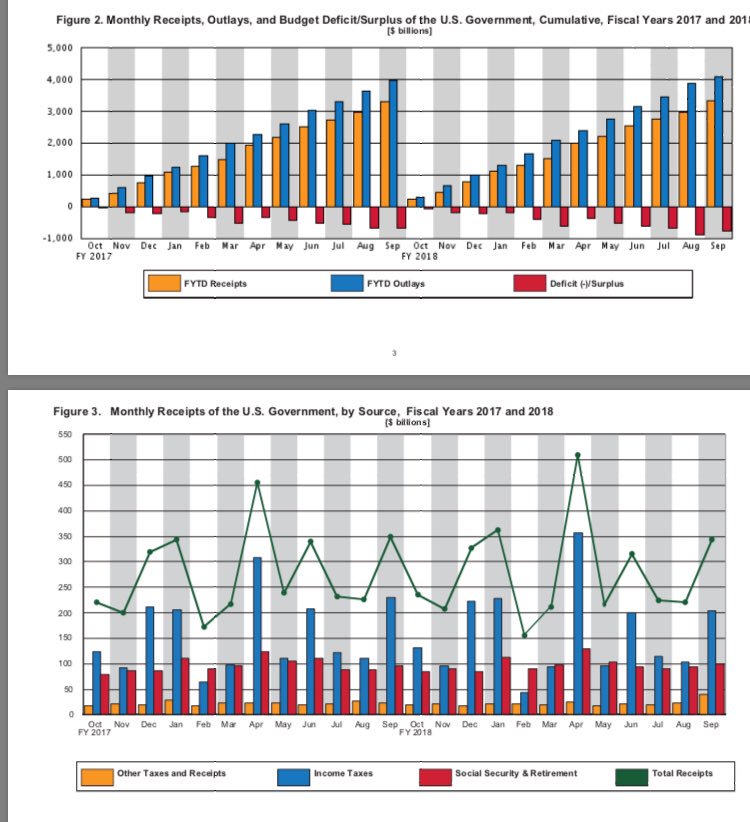

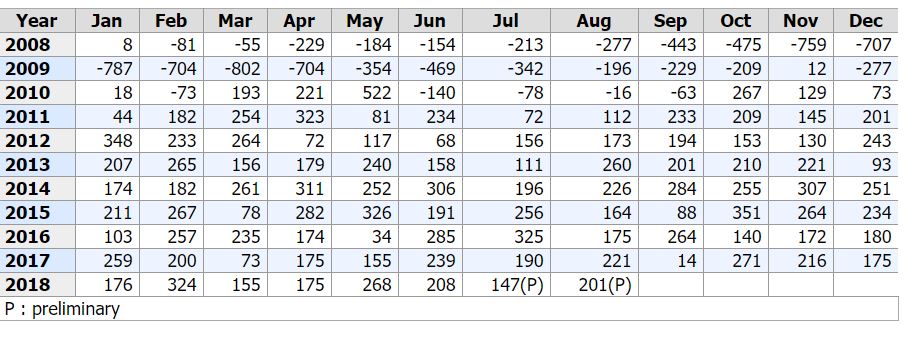

Tax Revenues are growing and $779bn above budget.

According to the Monthly Treasury Statement, revenues are rising and above budget, showing how the tax cuts are improving the economy with higher inflows. So far, then the tax cuts have paid for themselves.

(Monthly Treasury Report, August 2018)

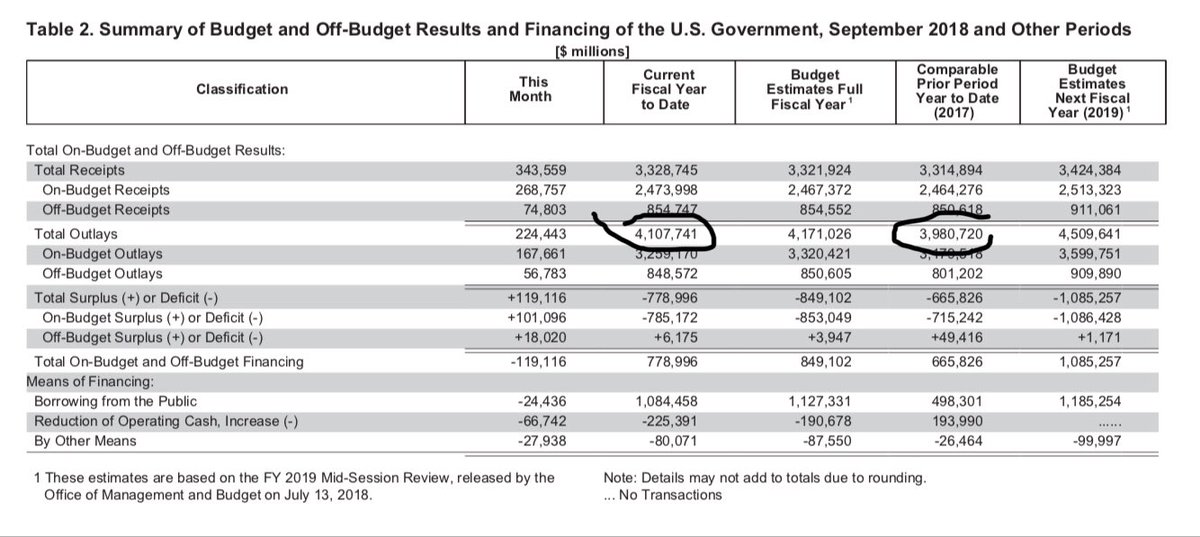

Update: Full fiscal year receipts are better than expected.

(Monthly Treasury Report, September and October 2018)

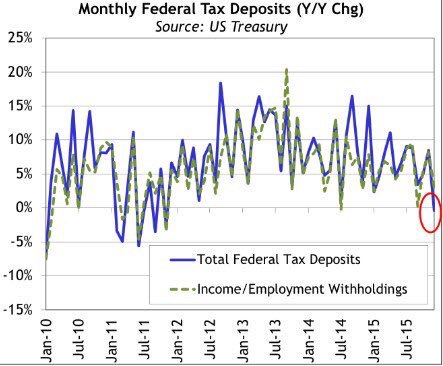

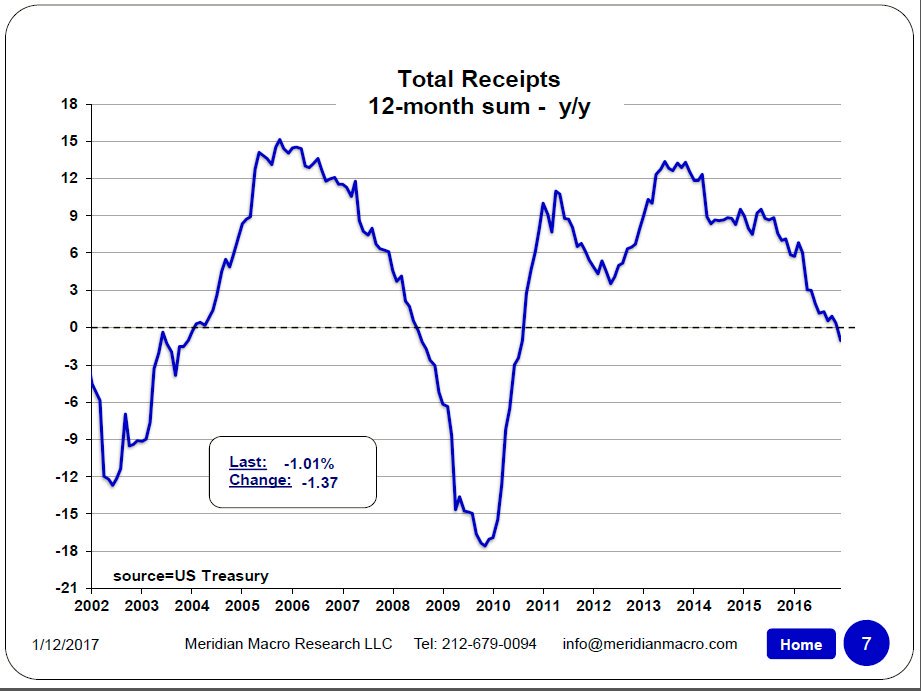

Remember that Tax Revenues were falling before the Tax Cuts and Jobs Act and with one of the highest corporate tax rates in the world.

(Courtesy Eric Pomboy)

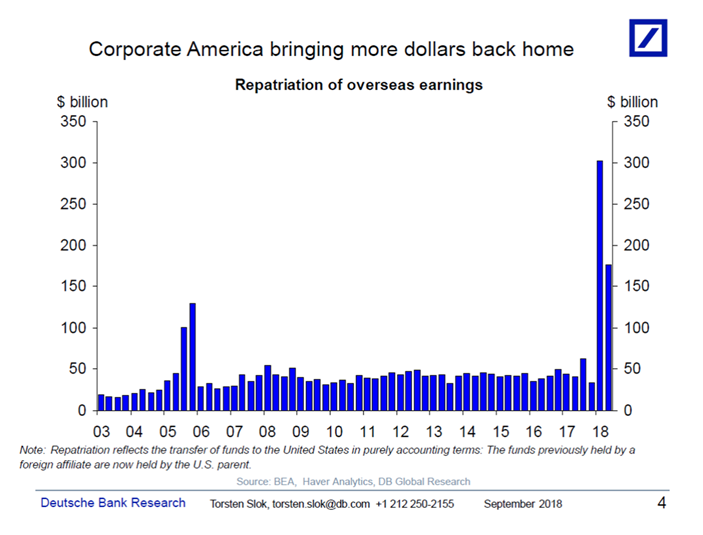

Repatriation of capital exceeds all expectations, above $300 billion.

Many analysts expected a timid response to the tax cuts, stating that many companies would not decide to repatriate capital just due to the fiscal stimulus, because there were other reasons why multinationals kept in excess of $2 trillion of cash abroad. Guess what? The capital repatriation in less than eight months exceeds the brokers’ estimates for the entire period.

(Courtesy Deutsche Bank)

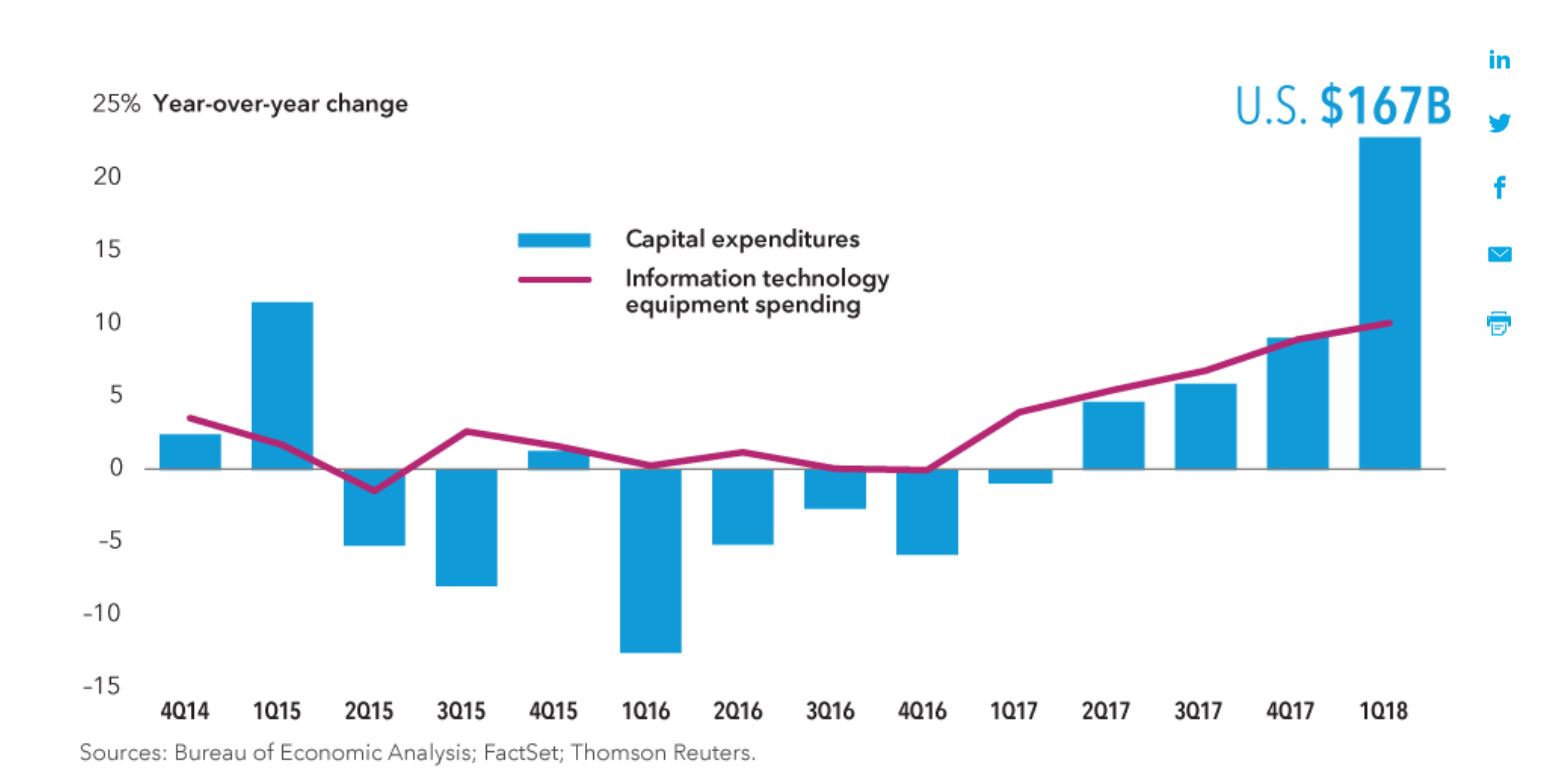

Investment is back. Capital expenditure is up 19% after years of stagnation.

For years, analysts and the administration wondered why capital expenditure (capex) was not growing in the US. Simple. An unsustainably high tax wedge.

The Tax Cuts and Jobs Act has unlocked billions in new investment.

(Bureau of Economic Analysis, Reuters)

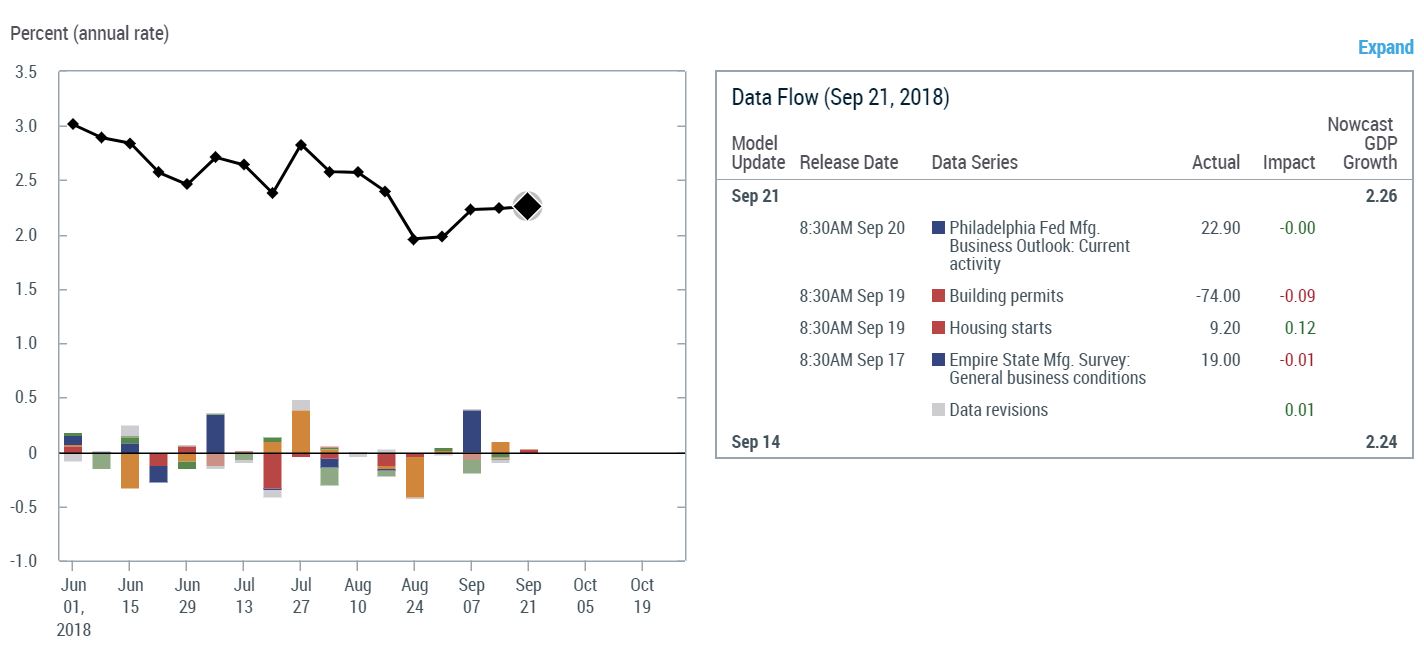

Growth above cycle and trend.

Let us not forget what analysts expected for 2018. Growth slowdown. It has been the opposite. Current expectations for the third quarter estimate a 2.6-3.0% annualized GDP growth while the Atlanta Fed GDPNow estimate is close to 5%.

(New York Fed Nowcast Sept 2018)

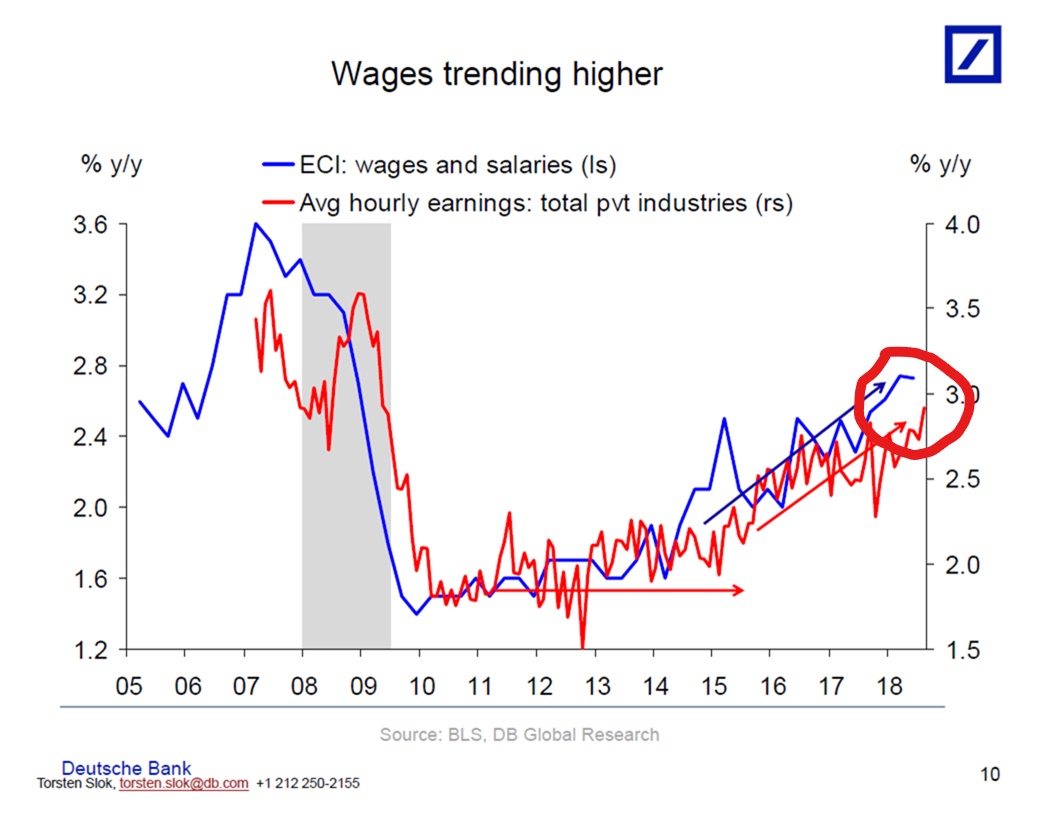

1.6 million jobs and wages above trend.

In a year where most analysts expected recession, slowdown or weakening, the US economy has added 1.6 million jobs.

Almost every month has seen gains above trend and better than the previous year before the tax cuts.

(Bureau of Labor Statistics)

Average hourly earnings of all private sector employees increased by 10 cents in

August 2018. Hourly earnings have risen by 2.9 percent in 2018.

Manufacturing created 159,000 jobs YTD (August) in 2018.

Interventionists will say the deficit is high. The deficit is high because expenses are and were too high. The US deficit is not solved by raising taxes as the Obama administration showed, where deficits averaged 5% of GDP during his tenure. Deficits are solved growing more, creating more jobs and spending less.

Tax cuts work.