Market participants’ excess of optimism with the trade agreement between the United States and China is clearly exaggerated, once we have the details.

Both the United States and China’s economy have suffered a mild impact from trade disputes. The United States saw a mild slowdown in growth but did not suffer inflationary pressures from the tariffs, while its trade deficit shrunk reduced to the lowest level in 17 months and unemployment is at a minimum of 50 years. In the case of China, the growth of the economy (even adjusted for inflated data) was less affected by the trade war than many feared. Although its exports grew much less than expected, it has been able to increase them somewhat, 0.5% in 2019.

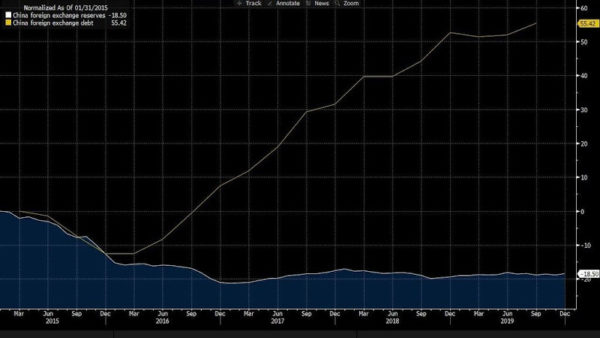

In the trade dispute, it is clear that China has been comparatively worse off. The country had to make an urgent devaluation of the yuan, bail out dozens of domestic entities and their total foreign currency reserves remained flat, barely covering their credit commitments … But, at the same time, China’s trade surplus increased by 25% even if it was mainly due to lower imports.

China has shown an acceptable relative strength but its Achilles heel remains its shortage of dollars. Its apparent huge reserves of 3 billion are not operational due to its growing foreign currency debt.

China FX debt

The so-called trade war has had a relative impact on the two giants, showing that tariffs were only a tactic to negotiate, that is why they have lasted so little. Almost no one doubts that the effects could have been much greater if these tariffs were maintained.

Of course, the trade war has been widely used as an excuse to justify the effects of global debt saturation and overcapacity. Now it will no longer be valid as a wild card.

This entire negotiation process has led to a “phase one” agreement which raises many questions. Is it enough? Are the details clear enough to put it into practice? How will it be accomplished without rising idle inventories? Can China increase its US imports so much with its growing shortage of dollars? What is the impact on the rest of the world?

That is the key.

The agreement between China and the United States is actually more similar to a global zero-sum game.

China has committed to buying an additional $200 billion in US goods between 2020 and 2021 … a figure will come from lower purchases from others. The figure is not small since China’s total trade surplus is 421.5 billion. That is, it accounts for almost 23% of the annual trade surplus divided into two years.

Why is it probably a zero-sum game? China will acquire more United States goods with the following breakdown: $32.9 billion in the manufacturing and industrial sector, $18.5 in energy, $12.8 billion in services and $12.5 billion in agricultural goods in 2020, rising to $44.8, $33.9, $25.1 and $19.5 billion respectively in 2021.

All that increase benefits the United States but there is no evidence that China is currently importing less than it needs, quite the opposite, as shown by its inventory levels. Therefore, China will likely import more from the United States and less from other countries.

How does it affect the European Union?

The European Union is the first or second in market share of total Chinese imports in various sectors. According to Morgan Stanley, the most affected sectors would be agriculture (11% of the total China imports, only surpassed by Brazil, which will also be negatively affected by the agreement), chemicals (25%), precision instruments (19%), transport equipment (50%), machinery and electrical equipment (11%, behind Taiwan, Korea, and Japan).

It is important to warn of the low impact on global growth of this agreement and on the negative collateral damage to other countries. There are risks for countries that are very dependent on energy exports. Brazil, Qatar, and Australia are the most affected by the agreement on energy imports, but also on other sectors. The impact on world GDP could be null. What is penalizing global growth and trade is more debt saturation and excess capacity than the so-called trade war which is also negative but not as important as structural problems in the global economy.

The second phase of the agreement will be the most complex. The first phase is basically a set of minimum agreements that include few real commitments regarding China’s capital controls, legal security, and respect for intellectual property. The second phase will focus on the most relevant aspects of the trade relationship between the US and China, including industry relocation, capital movements, and cross-subsidies. However, bringing China’s trade surplus with the US to zero is virtually impossible and, in my opinion, unnecessary.

So far, the evidence shows that the weakest link in the China-US deal negotiations was the European Union. China and the Us will probably benefit from the deal at the expense of lower trade with a European Union that has been unable to defend its position.

The US is already in negotiations with the European Union on the projected “digital tax” which hides an undercover tariff on US- tech giants, and barriers to traded agricultural products and the auto sector remain. The US-China deal may unveil the numerous barriers to free trade disguised under the thousands of pages of EU regulations.

Let us not forget that we are facing a negotiation with the EU as the largest client with its suppliers. The process will be slow, perhaps complicated, but a negotiation nonetheless. The so-called trade war with China has only lasted a few months. The next stop is in the European Union.

US workers can’t compete with Chinese slave labor. The Roman empire had the same problem. Their elites also insisted it wasn’t an issue and that the little people should just shut up about it while they made a mint.

The EU, as a rule is the main loser in everything.

Beacuse the so called ‘EU’ is not Europe, nor does it represent anyone but a mere minority of corrupted bureacrats and oligarch who are pushing the globalist agenda against the will of the majority of Europeans.

The so called EU should rather be called the EUSSR as it is exactly what it has become.

On its way to destruction, one way or another, peacefully or not.