The European Central Bank continues to disproportionately inflate the debt bubble of the Eurozone, while the economic slowdown of the main European economies worsens. What was designed as a tool for governments to buy time in order to carry out structural reforms and reduce imbalances, has become a dangerous incentive to perpetuate the excessive spending and increase debt under two very harmful and wrong excuses: That there is no problem as long as debt is cheap and that there’s no inflation.

- Cheap borrowing is not an excuse to increase debt. Japan has a very low cost of debt and the cost of servicing Japan’s public debt is almost half of the state’s tax revenues. Japan’s debt is 15 times higher than the tax revenue collected by the government in 2018.

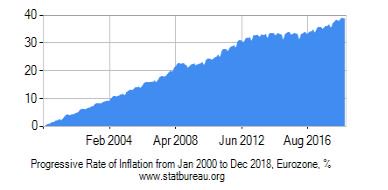

- The Eurozone official inflation since 2000 shows an increase of 40% in CPI while productivity growth has been negligible and salaries and employment remain depressed.

Monetary policy has gone from being a tool to support reforms to an excuse for not implementing them.

Monetary policy has gone from being a tool to support reforms to an excuse for not implementing them.

We must remember that the euro is not a global reserve currency. The euro is only used in 31% of global transactions, while the US dollar is used in 88%, according to the Bank Of International Settlements (the total sum of transactions, as the BIS explains in its report, is 200% because each transaction involves two currencies).

Bond yields in the Eurozone are artificially depressed and give a false sense of security that is completely clouded by extremely low interest rates and excess liquidity.

- The balance sheet of the European Central Bank has been inflated to be 40% of the GDP of the Eurozone, while at the peak of quantitative easing the Federal Reserve’s balance sheet did not reach 26% of the US GDP.

- The Federal Reserve Treasury purchases never exceeded net issuances. The ECB continues to buy back bonds once they mature despite having multiplied the repurchases and having reached seven times the figure of net issuances .

- Sixteen 10-year sovereign bonds in the Eurozone show negative real yields. Greece and Italy, the other two, are amazing examples, as their yields (adjusted for currency and inflation) show a negligible differential over the US ten-year bond.

- Excess liquidity in the Eurozone exceeds 1.8 trillion euros.

Everything is justified because “there is no inflation” and yet there is, and a lot. Not only in financial assets (huge bubble in the aforementioned sovereign bonds), prices in the Eurozone have increased by 40% since 2000 while productivity has barely increased.

Cheap debt must never be an excuse to increase it, but an opportunity to reduce it.

All this generates excessive complacency and accumulation of long-term risk.

The ECB ignores tail risk and accumulation of imbalances and expects liquidity to generate the levels of growth and inflation that have not been achieved after two trillion euro of expansion. Meanwhile, the risks of debt saturation rise.

Governments all over the eurozone identify low yields as some kind of market validation of their policies, when markets are artificially inflated by the central banks’ policies. This placebo effect has led many countries in Europe to abandon the reform impulse, and many believe that the solution to low growth is to return to the wrong policies of 2008.

Low yields are not a sign of credibility and low risk, but of financial repression and fear of a weaker macroeconomic environment in other assets.

The problem of the Eurozone is that it has relied entirely on the placebo effect of monetary policy to strengthen the recovery, focusing on a single objective, to make public spending cheap to finance, whatever the cost. This perpetuates structural imbalances, the perception of risk is clouded and the economy becomes less dynamic while long-term risks rise.

The ECB finds itself in a monetary trap. if it normalizes policy, the mirage of low yields will disappear and governments will react against it. However, if it keeps the policy, there is an increasing risk of repeating a Eurozone crisis without any tools to address it. That is why it must raise rates now and stop repurchasing maturities while markets remain optimistic.

Unfortunately, instead of proposing supply-side measures and curbing the excessive taxation and stagnating effect of government spending, many analysts will recommend more spending and more liquidity as solutions that will make the economy even weaker. The main problem with the accumulation of debt at low rates is that it has the same effect as a real estate bubble. It disguises real liquidity and solvency risk, because borrowing costs are too good to be true. And they are not true.

There is none so blind as those who will not see. It will all end in tears once again, only this time it will be ten times worse than 2007/8