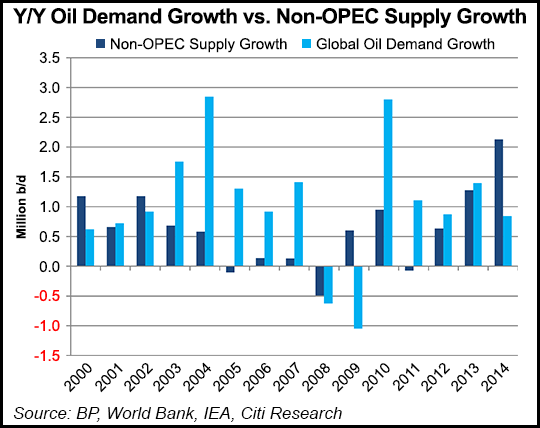

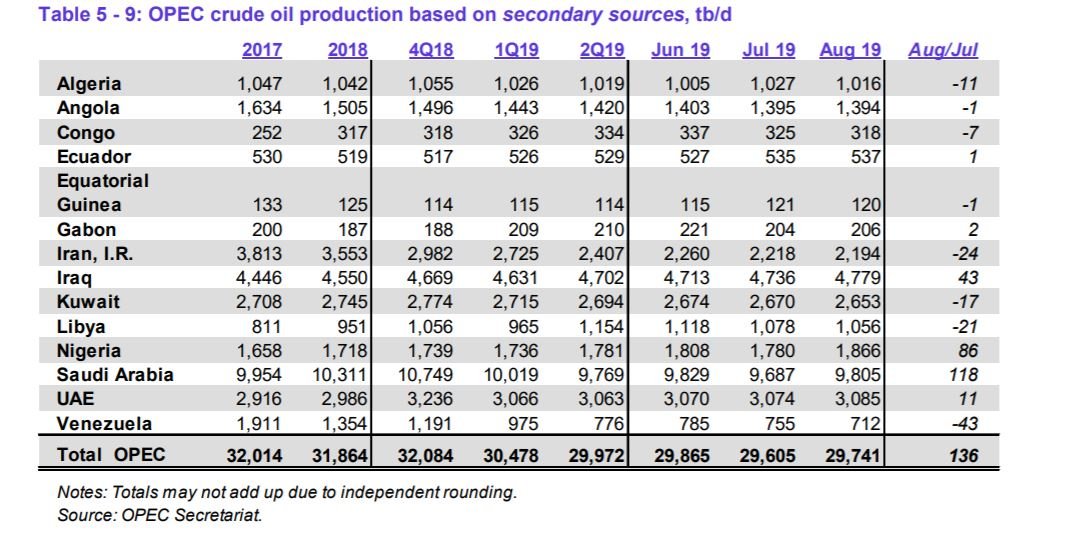

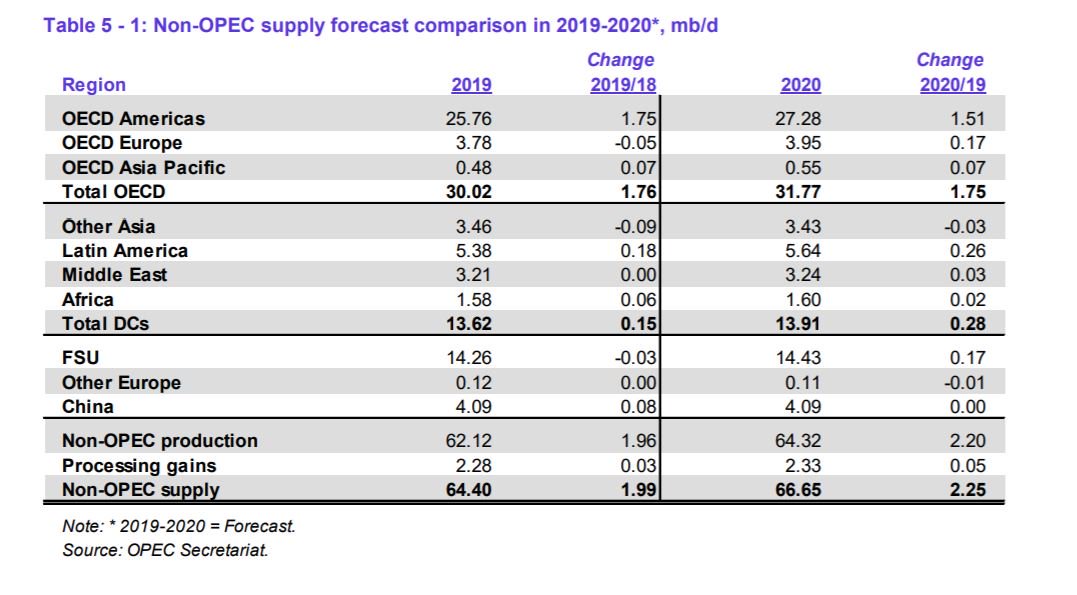

Meanwhile, U.S. crude oil production is expected to rise by 1.25 mbpd in 2019 to a record of 12.24 mbpd, according to the US EIA. The output in 2020 is forecast to rise by 990 kbpd to 13.23 mbpd, also according to the EIA

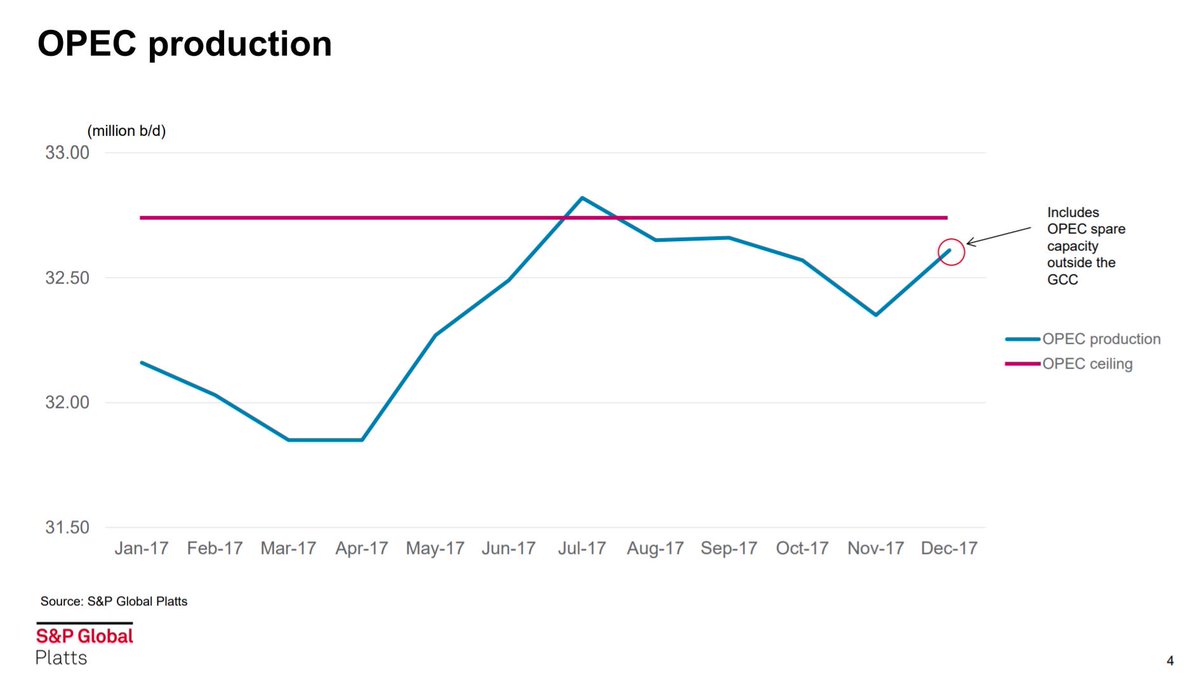

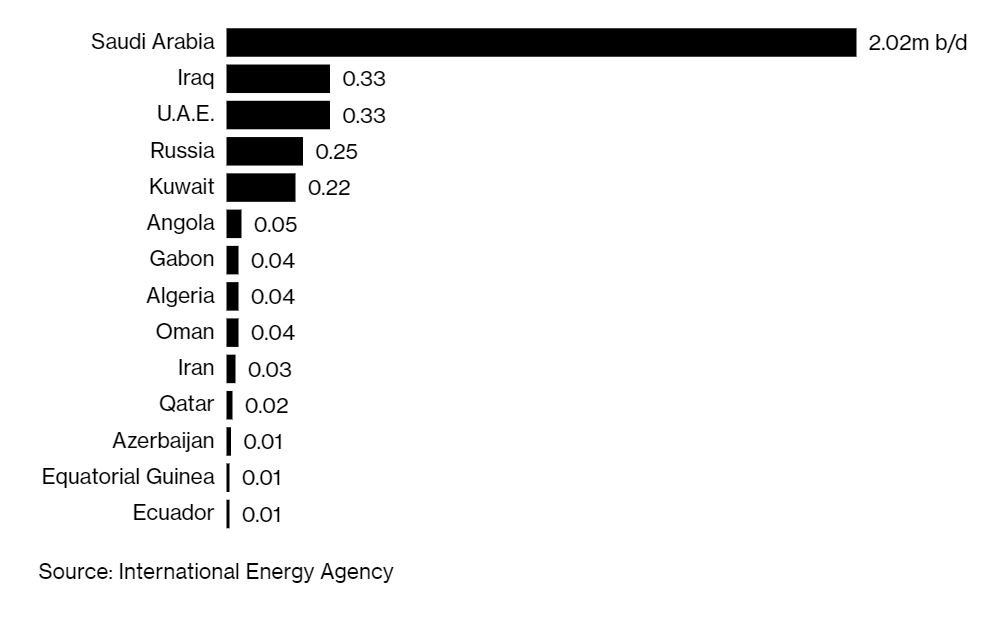

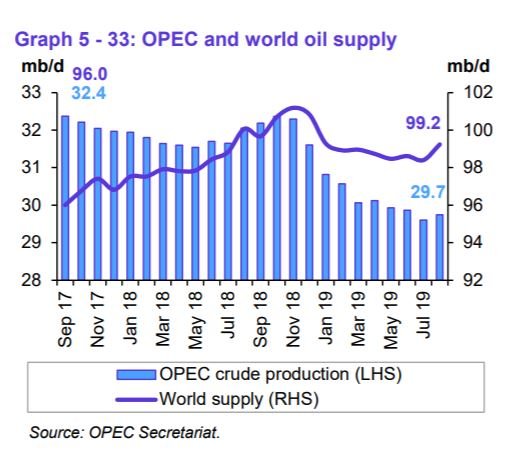

4) OPEC was already planning a production cut last week given the glut in supply, weakening demand and loss of market share.

Demand for OPEC crude in 2019 was revised down in September from the previous OPEC report to stand at 30.6 mb/d, which is 1.0 mb/d lower than the 2018 level. Demand for OPEC crude in 2020 is expected to remain unchanged from the previous report, to stand at 29.4 mb/d, around 1.2 mb/d lower than the 2019 level.

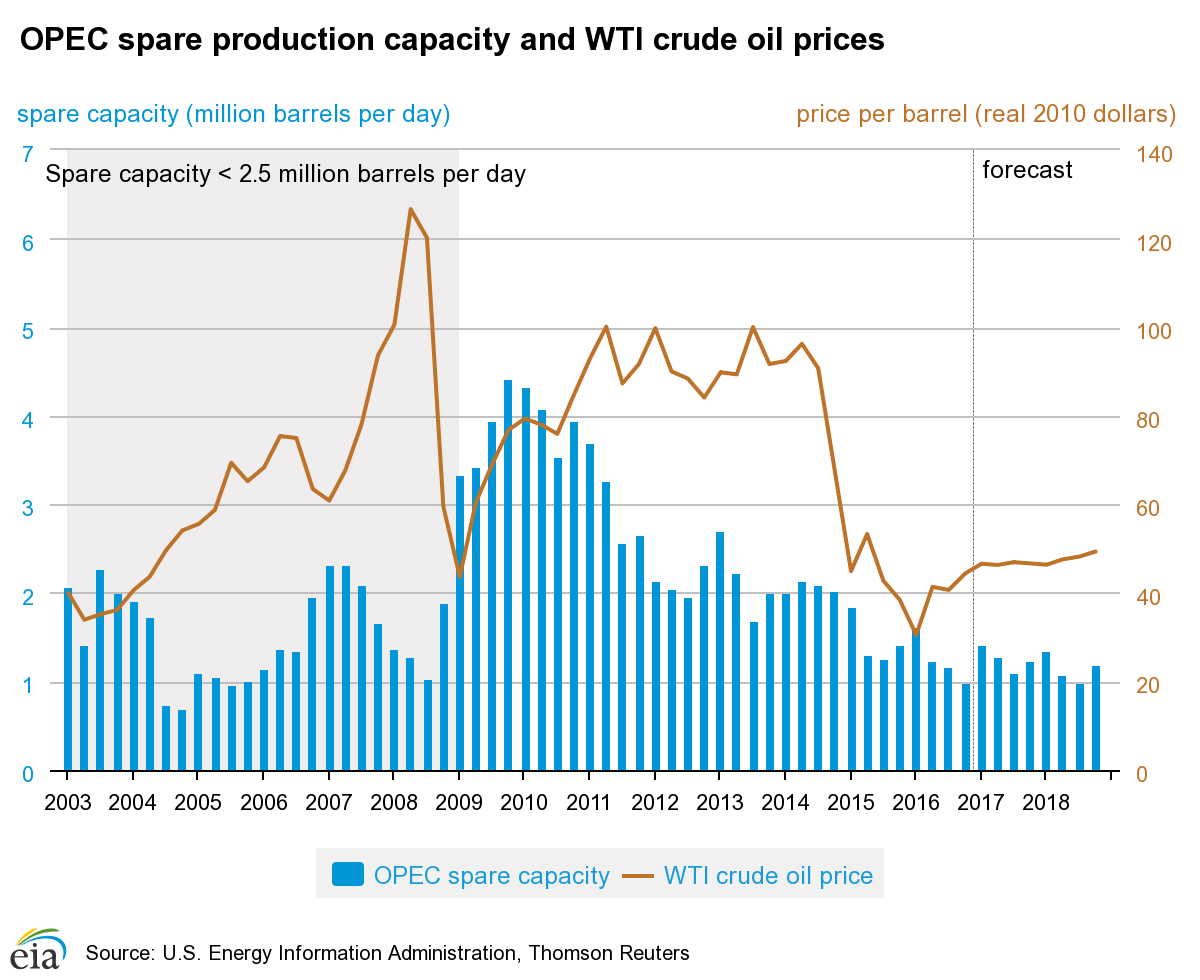

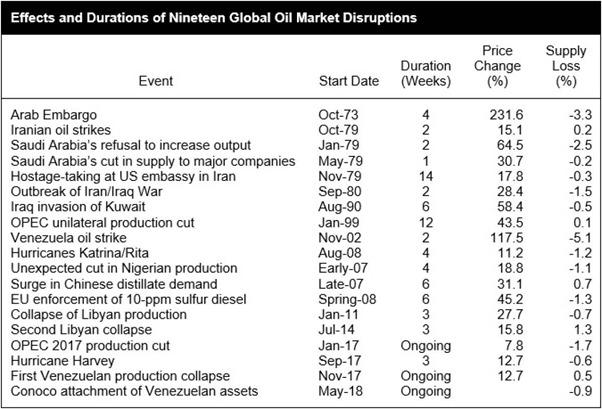

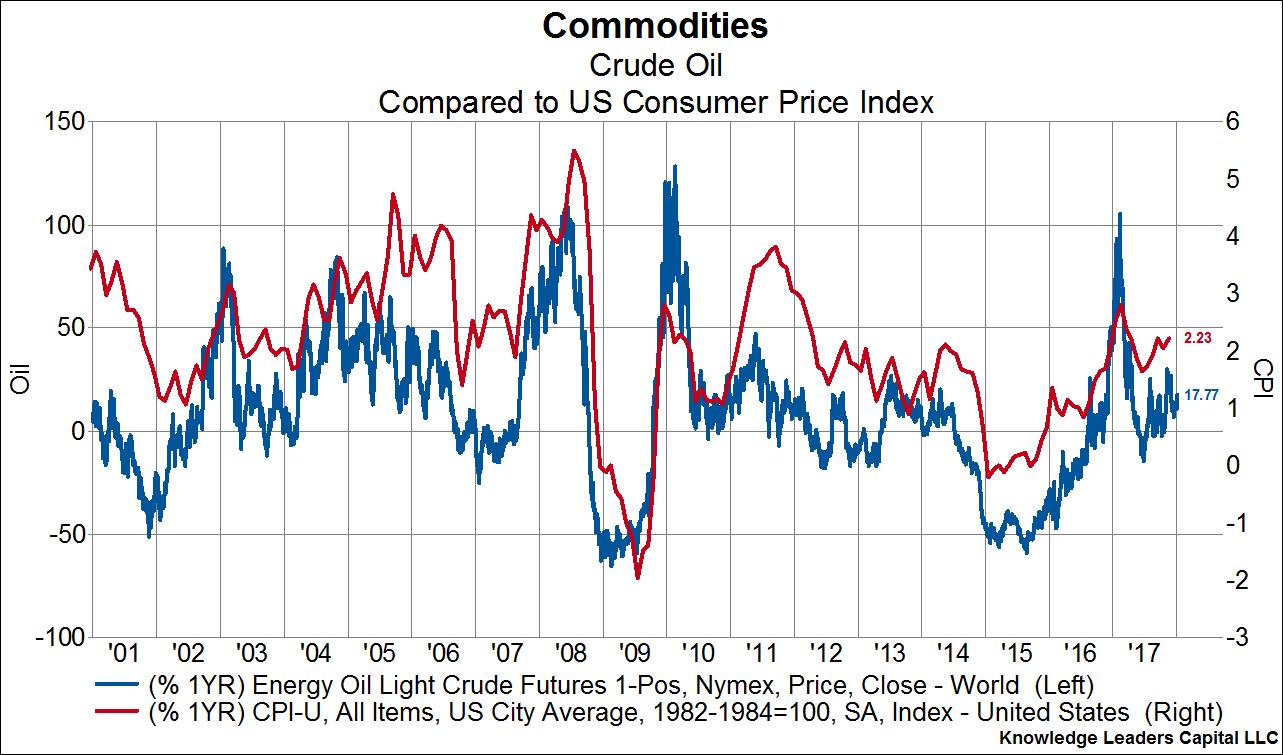

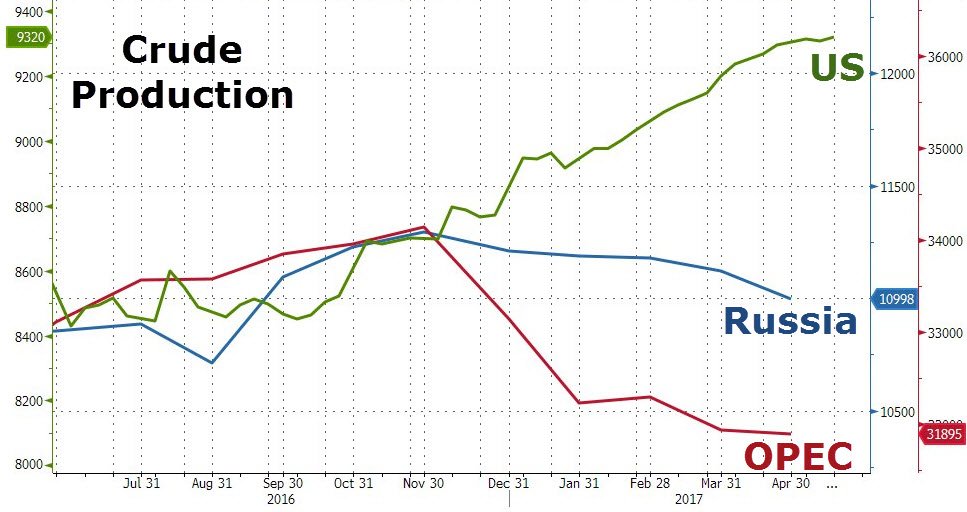

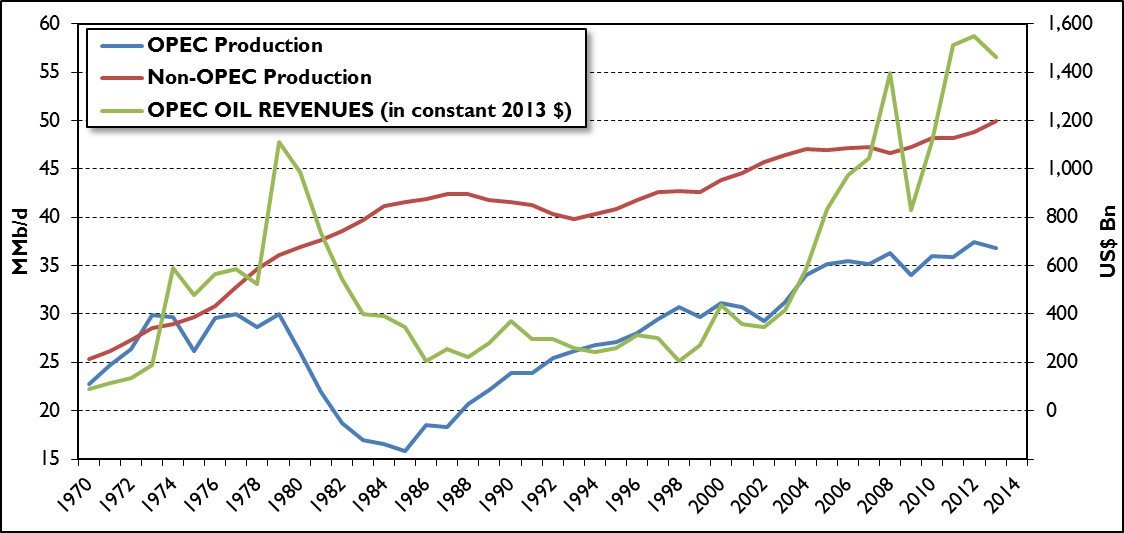

6) Other supply cuts in the past have generated very different impacts on the oil price, from exponential rises in the 1973 oil crisis to very small increases in attacks in Libya or Nigeria. It is worth highlighting the diminishing impact of unplanned production cuts on the price of oil after the US energy revolution. Since then, when there have been aggressive cuts, hurricanes or geopolitical risks including sanctions against Iran and Venezuela, those events have not raised the price of oil more than 12% for one or two months, according to MeanMarkets .The 2017 production cut, for example, generated only an 8% rise and oil has remained below $ 80 a barrel despite sanctions on Iran,

hurricanes and other geopolitical risks, in addition to the unquestionable desire of

OPEC producers to get a barrel at $ 100.

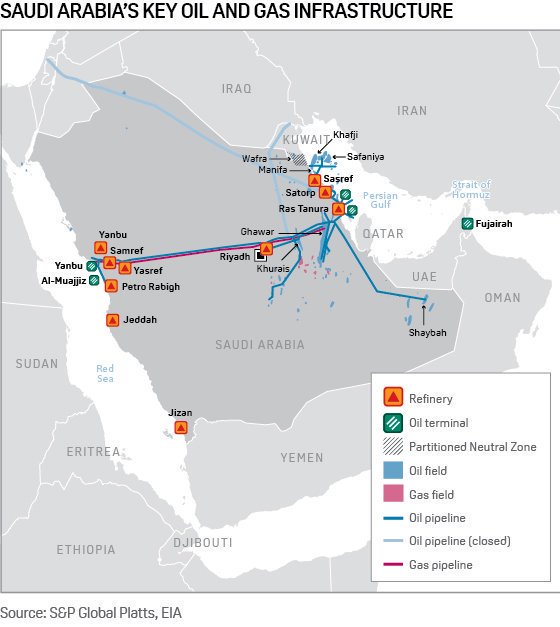

Aramco has confirmed that production will be fully restored by Tuesday, September 17th according to Bloomberg, also reaffirming it has ample inventories and alternative supply sources.

In The Energy World Is Flat, we explain how technology, substitution, and diversification are flattening the energy world and preventing aggressive inflationary pressures.

The energy broadband is back.

Although Aramco has confirmed to suppliers that there will be no disruption and that production will be fully restored by the 17th September, oil prices may spike on the uncertainty and news of different impacts. What is hilarious is that the Saudi Arabia drone attack may drive oil prices to soar, and central bankers may hail the rise in consumer inflation as a success.

Thanks for the great article. I enjoyed it sir!

Hi Daniel Lacalle, I appreciate your insider analysis of this recent drone attack event. I also felt a drone attack on Saudi Arabia wouldn’t hinder the supply for the long-term. They are an oil-rich country and have the guts and grits to recover from any shortcomings. However, I hope relevant authorities make amendments to existing UAV laws to prohibit attaching weapons or external equipment to drones without prior permission. Also, oil companies should beef up the protection with an anti-drone system because workers’ lives are also in great danger.