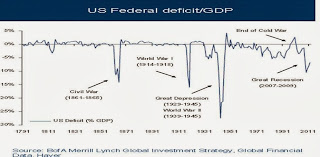

Our country is headed toward a ‘fiscal cliff.’ The bad news: We elected a guy whose campaign slogan was ‘Forward’ – Jay LenoSee my intervention on CNBC about the matter here: http://video.cnbc.com/gallery/?play=1&video=3000205718 and http://video.cnbc.com/gallery/?play=1&video=3000205434 and on the BBC here. One of the perverse government incentives that we have always discussed in this column is the policy of kicking the can forward. Governments relax the objectives of debt and deficits, introduce monetary expansion measures, cut interest rates and what happens?. They exceed all limits and debt grows faster. As a magic formula to resolve a balance sheet crisis it is simply not working. Government spends more, debt continues to soar and the citizen gets buried in taxes. Thank you for your money. Look at the United Kingdom, Japan and the United States. Financial repression has only encouraged more excessive borrowing.

One of the perverse government incentives that we have always discussed in this column is the policy of kicking the can forward. Governments relax the objectives of debt and deficits, introduce monetary expansion measures, cut interest rates and what happens?. They exceed all limits and debt grows faster. As a magic formula to resolve a balance sheet crisis it is simply not working. Government spends more, debt continues to soar and the citizen gets buried in taxes. Thank you for your money. Look at the United Kingdom, Japan and the United States. Financial repression has only encouraged more excessive borrowing.

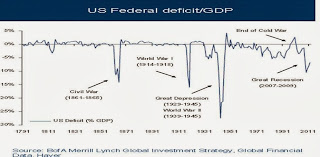

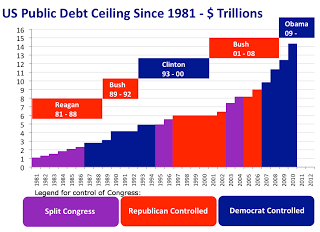

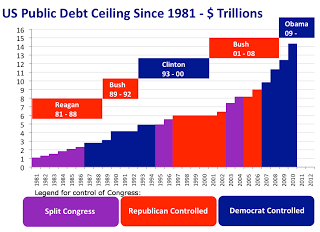

The mantra that is repeated again and again, “now is not the time”, “we have to borrow more”, “the important thing is to grow” simply does not work. It is not a matter of growth. As we commented two weeks ago, in the past five years, the G-7 ‘spent’ $ 18 to generate $1 of GDP.As I expected throughout the negotiations of the fiscal cliff in late 2012, it was only a matter of time until the US exceeded the debt ceiling. Indeed, this might happen in October. The situation is so perverse that the government spending machine accelerated ahead of the deadline like the car in the final scene of Thelma and Louise. In less than four months in 2013, the Obama administration has added 300 billion debt to the system. That, after raising taxes and introducing budget cuts. And now, as the deadline approaches, President Obama has the audacity to declare that the government “will not allow to be blackmailed” . It is a superb tactic. First, full throttle spending, exceed all limits, despite the economy growing and tax revenues helping, and then ask for more spending. Like a child that says “if I don’t get more sweets I will stop breathing”.Amazingly, in 2006 Obama, then senator, voted against raising the debt ceiling. Seven trillion dollars of debt afterwards, he seems to see no problem in lifting it. Since 2001, the debt ceiling in the United States has been ‘raised’ 13 times, which has led to an accumulation of additional debt of 10.4 trillion.

Since 2001, the debt ceiling in the United States has been ‘raised’ 13 times, which has led to an accumulation of additional debt of 10.4 trillion.

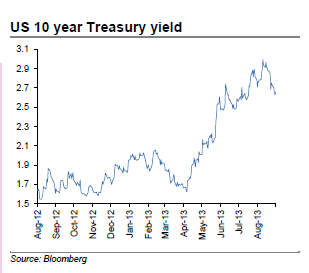

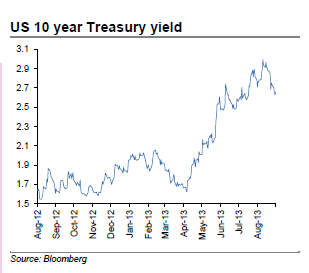

The debt ceiling problem in the United States will not be the same now that interest rates are rising, the Fed has had to revise down their growth estimate for the economy and the risk of a new fiscal cliff in a few months looms again. Even if yields are low and demand is strong, a deficit of close to 800 billion and a debt of 101% of GDP do not improve with the economy growing just 2 to 2.2%. The U.S. must tackle immediately its spending spiral .

The debt ceiling problem in the United States will not be the same now that interest rates are rising, the Fed has had to revise down their growth estimate for the economy and the risk of a new fiscal cliff in a few months looms again. Even if yields are low and demand is strong, a deficit of close to 800 billion and a debt of 101% of GDP do not improve with the economy growing just 2 to 2.2%. The U.S. must tackle immediately its spending spiral .

One of the perverse government incentives that we have always discussed in this column is the policy of kicking the can forward. Governments relax the objectives of debt and deficits, introduce monetary expansion measures, cut interest rates and what happens?. They exceed all limits and debt grows faster. As a magic formula to resolve a balance sheet crisis it is simply not working. Government spends more, debt continues to soar and the citizen gets buried in taxes. Thank you for your money. Look at the United Kingdom, Japan and the United States. Financial repression has only encouraged more excessive borrowing.

One of the perverse government incentives that we have always discussed in this column is the policy of kicking the can forward. Governments relax the objectives of debt and deficits, introduce monetary expansion measures, cut interest rates and what happens?. They exceed all limits and debt grows faster. As a magic formula to resolve a balance sheet crisis it is simply not working. Government spends more, debt continues to soar and the citizen gets buried in taxes. Thank you for your money. Look at the United Kingdom, Japan and the United States. Financial repression has only encouraged more excessive borrowing.The mantra that is repeated again and again, “now is not the time”, “we have to borrow more”, “the important thing is to grow” simply does not work. It is not a matter of growth. As we commented two weeks ago, in the past five years, the G-7 ‘spent’ $ 18 to generate $1 of GDP.As I expected throughout the negotiations of the fiscal cliff in late 2012, it was only a matter of time until the US exceeded the debt ceiling. Indeed, this might happen in October. The situation is so perverse that the government spending machine accelerated ahead of the deadline like the car in the final scene of Thelma and Louise. In less than four months in 2013, the Obama administration has added 300 billion debt to the system. That, after raising taxes and introducing budget cuts. And now, as the deadline approaches, President Obama has the audacity to declare that the government “will not allow to be blackmailed” . It is a superb tactic. First, full throttle spending, exceed all limits, despite the economy growing and tax revenues helping, and then ask for more spending. Like a child that says “if I don’t get more sweets I will stop breathing”.Amazingly, in 2006 Obama, then senator, voted against raising the debt ceiling. Seven trillion dollars of debt afterwards, he seems to see no problem in lifting it.

It’s worth watching this video from his 2008 campaign and what he said about raising the debt ceiling: http://www.youtube.com/watch?v=ydZTHPkOnvE

Since 2001, the debt ceiling in the United States has been ‘raised’ 13 times, which has led to an accumulation of additional debt of 10.4 trillion.

Since 2001, the debt ceiling in the United States has been ‘raised’ 13 times, which has led to an accumulation of additional debt of 10.4 trillion. The main mistakes we usually read about the US debt ceiling are:

- The US is not going to default because they can print all the money they want. However, in 1979 it had to delay payments on debt maturities for 122 million, and the debt ceiling negotiations of 2011 culminated on August 5th with the loss of the country’s debt top rating of ‘AAA’ by Standard & Poor’s. Of course, monetary expansion (Quantitative Easing , QE) keeps the appearance of normality, but to quote Richard Koo in his report “U.S. faces QE “trap”, “the vicious circle of rising interest rates and economic weakness has already begun”. “No country has injected so much liquidity and lived to tell”. The ‘magic bullet’ trap of expanding the monetary base is simply impossible to stop without negative consequences, because the debt has soared and the economy does not improve.

- Everything is just political posturing, the debt ceiling will be raised and all will continue normally. Since 1976 there have been seventeen shut-downs where the federal government can not carry out new spending. In 1995-96 the shut-down in the administration Clinton lasted 21 days. The Obama administration reached the debt ceiling in May 2013 following an unprecedented increase in spending from February to July. Give a cheque to the government and it will spends it, and more. In this occasion it has managed to keep within the ‘limit’ with “extraordinary measures”, but on October 17th the limit simply is unavoidable. This time it will not be easy for Republicans to accept another deal that will probably lead to another fiscal cliff in May-June 2014.

- It is an unjustified attack from Republicans. The Obama administration wants to spend $1.1 trillion in “discretionary” spending in 2014. Discretionary. The maximum allowed currently is just ten percent lower. Therefore, it is not a monstrous disaster that leaves families in the streets and the state without resources. It is simply a matter of budgetary restraint and to delay a social security plan, Obamacare , that is generating more doubt and concerns about the cost of its implementation than the existing Medicare system.

- The cost of a ‘government shut-down’ is irrelevant. The 1995-1996 one is estimated at about 2 billion dollars of today. In 2014 it could mean 35 billion.

The debt ceiling problem in the United States will not be the same now that interest rates are rising, the Fed has had to revise down their growth estimate for the economy and the risk of a new fiscal cliff in a few months looms again. Even if yields are low and demand is strong, a deficit of close to 800 billion and a debt of 101% of GDP do not improve with the economy growing just 2 to 2.2%. The U.S. must tackle immediately its spending spiral .

The debt ceiling problem in the United States will not be the same now that interest rates are rising, the Fed has had to revise down their growth estimate for the economy and the risk of a new fiscal cliff in a few months looms again. Even if yields are low and demand is strong, a deficit of close to 800 billion and a debt of 101% of GDP do not improve with the economy growing just 2 to 2.2%. The U.S. must tackle immediately its spending spiral .All debt ceiling increases in the past have been accompanied by more and more deficit spending. Kicking the can forward has worked as interest rates fell. Now, the risk of ignoring the accumulation of debt and keep spending is too high, as is the case in the UK or Japan, the other kings of the money printing press. Because there is only one way for interest rates to go. Up. The perverse incentive of “debt does not matter”, matters in the end. A lot.

Totally biased analysis. The deficit is going down faster than expected, but it cannot be eliminated in a swirl (or at considerable economic and social cost). Increasing the debt ceiling is appropriate so that growth does not stop abruptly (as happened in Europe), and the budget gradually edges towards balancing.

I am stunned on your analysis..i have gone through many sites which isn’t impressed me by giving exact charts..Thanks for sharing the things which is useful for all..

all about money

Thank’s for your information and i like this post