This article was published in El Confidencial on November 2012.

“Inflationism will not solve the problem brought by parasitical relationships. The greater the entitlements state, the lesser economic growth”

This article was published in El Confidencial on November 2012.

“Inflationism will not solve the problem brought by parasitical relationships. The greater the entitlements state, the lesser economic growth”

“Your eyes are filled with flowers, but you have your nose and mouth to ignore the pain and tears. You want saints, roses and stars” Pau Riba (Catalan rock star, 1970)

Capital outflows from Spain have reached €247.1 billion. We keep saying it’s due to “fear of the euro break-up”, but we must not forget another added reason. The logical impact of uncertainty on secession. Hence why Catalonia is leading the net destruction of businesses with more than 19,000 companies closing per year.

This week several friends of different investment funds discussed the potential “black swans” of 2013. The three possible black swans in 2013, according to my friends, are: The American fiscal cliff – which we discussed here – the bursting of the debt bubble in Japan – that we analyzed here – and the secession of regions in Spain.

After my article “Catalan bailout and credit risk of junk bond “, I still think that in Spain we minimize the risks of predatory and exclusionary policies and the race to zero that state and regional governments are pursuing.

No single investor I know sees independence as a positive. International banks, as seen in reports by UBS, JP Morgan, RBS, Nomura and others, are warning their clients of the risks and are unanimously negative. This is because:

Politicians on both sides do their analysis on independence as a zero-sum balance or worse, as an expansive result, and that’s wrong. The balance is not zero, it is negative.

No investor sits waiting if the impact of independence on GDP is 5% or 10% or 15%. Investors leave. Goodbye. The benefit of this disaster is neither for Catalonia or Madrid. It is for London or New York, among others, while our politicians talk of “green shoots” and the joys of independence.

The JP Morgan analysis Catalan challenge asks real questions of Europe says that:

“An independent Catalonia might be credible in the long term, but major fiscal and political questions remain” “Additional costs of governing an independent state would reach 5.8% of GDP”.There are larger questions: Why should Germans support poorer Spanish regions if Catalans object?”

If we go to a secessionist environment in Spain it will have very negative effects for both the separated region and the rest of the state -and for the global economy due to the level of foreign-owned public and private debt of Spain and Catalonia in particular. There was not a single case in the past in which independence has not been accompanied by a significant drop in available credit, GDP or welfare. See the study on the independence of the Baltic states of European Journal of Political Economy . An average five years of recession.

In the UK they say “hope for the best, but prepare for the worst”. Yet here separatists are selling the story that independence will generate gold for everyone and it is not true.When discussing Catalonia’s independence always remember: Public and private debt and large combined refinancing needs (€50bn in 2015) make Catalonia a unique problem. The independence of a region or a country can be defended for personal or cultural reasons –which can be discussed elsewhere- but not economic.

At least in Navarre and the Basque Country they used to say “independence will cost us 100 years of poverty, but we will be free.” Honesty. Suicidal, but honest. Separatists promise to increase life expectancy –I swear they do-, increase pensions and that unemployment (750,000 in the region alone) will disappear if Catalonia is independent. And in Madrid we hear that it is terrible for Catalonia, but the rest of Spanish will benefit if separated because Catalan companies will migrate to other regions. Capital is likely to fly away. From both.The day after independence, the following risks ensue:

* The Ireland effect: the problem of Catalonia and Spain is that the public and private debt is unsustainable and crowned by a bloated government structure. Together and apart. Not tackling this problem before entering into a debate about national aspirations is suicidal. What my separatist friends claim that “it will be fixed later, when we are free” is false. The hypertrophy of the new state, the destruction of social security, pensions and services and the rise of corruption always soars after secessionist processes. And the citizens pay.

To give you an idea, the first industrial company in Spain, which is seven times the size of the GDP of Catalonia, pays about 700 million euro a month in salaries in Spain, including senior management, and has only seven licensed official cars.

* Credit access equal to Malta, Montenegro, Cyprus, Macedonia, Estonia … Where will Catalonia find 8-9bn of annual credit? Before independence the difficulty of Catalonia to access to the capital markets has been evident as shown by the issuance of “patriotic bonds” to retail investors to pay for current expenses. With mounting “transition costs” and large refinancing needs in 2013-2015 few investors would support a country, Spain or the severed Catalonia, which uses its financial resources to cover current spending and cronyism.

* The Macedonia effect: Macedonia is an independent state that is banned in the EU by Greece. If Spain were to veto Catalonia, it would be an independent country with a currency in freefall. Revenues would plummet, Catalonia and some of its companies and banks –despite large diversification- would have to default on its debt, sweeping away the debt of the rest of Spain as well, as it includes some guarantees to Catalan organizations.* The Estonia effect: Say goodbye to the much trumpeted welfare and social rights. I am surprised reading that independence would improve pensions. All countries that have achieved independence, and among them many are rich in oil and gas, have seen their pension and Social Security systems suffer or collapse. The effect on Spanish government debt would also be devastating, sinking Social Security and pensions, which are up to 80% invested in sovereign debt.

* The Azerbaijan effect : one of my colleagues, who has seen a generation of impoverished countries of the FSU and Baltic regions lets me give you an example of what happens after independence. The political plunder and corruption soar further. “Did you complain of cronyism and corruption? They increase. All for the sake of a GDP decline for five or ten years and then “grow” from a poorer base. ”

* The Scotland risk: David Cameron has said it clearly: “take the share of the UK debt, but not the currency.” UBS in its report “Can Catalonia Leave? Hardly” estimates that the debt of Catalonia would “become 78.4% of GDP after absorbing its share of the Spanish debt”. Even if this were not the case and Catalonia decided to declare its share of state debt as “odious”, the annual deficit would exceed the current 3.7%, because the alleged “fiscal deficit” would be spent on more than covering the new-EU NATO costs, new state structures and the increased cost of debt, which would be around 10% just extrapolating the risk premium of the current Catalan bonds.

* The Wales effect: if Catalonia declared odious its share of debt of the rest of the state, it can say goodbye to transfers, endorsements, business relationships and fiscal deficit balance. When nearly half of the “exports” of Catalonia are to Spain, a very normal reduced trade between the two parties implies a fall in GDP of 10-15% in Catalonia and 2-4% in the rest of Spain, and the debt of the two would skyrocket and solvency would collapse.

. Czechia and Slovakia? Please…. That was an agreed and mutually beneficial split, not a “try to escape from debt and accuse of stealing” subterfuge. The debt (public and private) of Catalonia and Spain make the comparison simply ludicrous. Slovakia holds less than €34bn of outstanding debt. Catalonia would have €43bn even before it adds the already received transfers (€5bn), its share of Spain’s debt (c18%) and the costs of transition.

Credit Suisse in its very solid report “Catalonia’s Choice” states:Montenegro? Does Catalonia want the access to credit of Montenegro (€1.03 billion to 2024) with €140bn of maturities (private and public) in next years?.

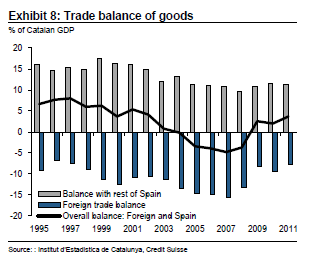

“But Catalonia is not self-sufficient, it needs Spain when it comes to trade. Although at 14% its French neighbor accounts for the largest share of Catalonian exports, ten out of its fifteen key trading partners are Spanish regions. The latter account for more than 60% of its total sales. Although Catalonia has steadily exported more goods abroad, its trade balance with the rest of the world remains negative to the tune of nearly 8% of Catalonia’s GDP. Catalonia’s total trade balance, which also includes services, has only been in surplus thanks to its trade with Spain throughout the last decade.”

Separate Spain and Catalonia. “Short and Shorter”

The numbers are absolutely atrocious for both. It is not a zero sum. Here two minus one equals less than one, because politicians do not consider the impact of capital flights, the impact of “crowding out” of the states and the loss of access to the capital markets.

The fiscal deficit that Catalonia claims –although since 2009 it was a fiscal surplus– would be spent on creating more state structures, pay to the EU and NATO and to cover the increased cost of debt.

Look at the Catalan bonds, despite recent state guarantee and bailout, and the optimistic figures given on the possible independence. They are still trading at a risk premium to the Bund of about 900 basis points and with an average of 16% discount for the 2015-2016 maturities. This does not indicate any kind of institutional credibility.

Spain after Catalonia independence would find it difficult to have a deficit of less than 8%. Short and Shorter.

Spain after Catalonia independence would find it difficult to have a deficit of less than 8%. Short and Shorter.

The problem of Spain and Catalonia is the waste of scarce resources, ‘political cronyism’. But independence does not solve that. It increases it. Think of “emergency committees” –spending- “assessment of bilateral relations” –more spending- and unions duplicated throughout –more subsidies-. A country that has today 600,000 more public workers than in 2001, that employs 400,000 politicians in different areas, with 4,000 public enterprises hiding €50bn of debt…

Spain must attack this wasteful mess before deciding what model of state it wants, and the example of England and Scotland can be a good starting point.

I leave you with the words of Marc Vidal: “We are in the hands of people who have not ever set up a company, who have never paid a payroll of their own pocket and that go to work when they want”.

We all want a more efficient management of resources, a taxation system that is closer to the paying citizen. This requires independence, together as a country, but independence from the monster that engulfs everything, the excessive public spending in a bloated political structure, subsidies and cronyism.

My previous post on the subject:

http://energyandmoney.blogspot.co.uk/2012/09/catalonia-bailout-and-junk-bond.html

And my article in The Commentator:

http://www.thecommentator.com/article/2095/an_independent_catalonia_would_be_bad_business

Read more here:

http://www.kioskoymas.com/

“The Spain bailout is the one they do not want to ask for and the one nobody really wants to give”The “Spanish Bailout”… Wrong term. No rescue for Spain, but the rescue of the Spanish state and its political spending, which is very different.

The biggest risk that investors in bonds perceive is that Spain depends on an ECB support signed by some countries whose citizens do not want more bailouts. Additionally, the market is negatively surprised by the credit ratios of our country, which is already on the verge of reviewing its 2012 deficit target again, to a 7 to 7.2%. And as much as exports improve, they do not offset the effect of four consecutive years with deficits of 7% to 10%, some 350 billion of accumulated deficit since 2008. If we add the future maturing debt, which totals 500 billion in the next four years, the over-supply of Spanish bonds compared with the investor’s ability to absorb more sovereign risk is simply unaffordable .

With the risk premium below 390 basis points and the yield on the benchmark 10-year at 5.75%, we have witnessed the euphoria … of the state. The spending bubble is guaranteed, Draghi supports it. Meanwhile, companies continue to see credit diminishing, and when they receive lending, it is with rates up to 350 basis points higher than the cronyism corporate zombies. And in this process of mummification of the real economy, it is not surprising that non-performing loans of banks reach a 10, 5% and have risen to 178.6 billion euros.

The question is not whether or not there will be a bailout. Unfortunately it is only a matter of time. The question is what will happen the next day.

When a country’s solvency, as shown in the graph below, depends entirely on the salvation of the ECB, the risk extends, it is not mitigated. And it’s amazing that, despite the promises of unlimited support, Spain’s solvency is valued at very low levels.

The risks of the next day of the bailout are:

The greater fool theory, and the German plan

Let me tell you what the market calls “greater fool theory.” It is the popular way to try to influence the price of an asset by saying that “someone”-preferably far away and unable to disprove, as “the Chinese” or “the Russians “- is coming, to try to” convince ” investors to buy. Indeed, it sometimes works. Between 2005 and 2009, half of the Ibex was a “greater fool theory ” driven by media rumours of “they tell me for a fact that Chinese will buy it. ” But it works only for a while and then investors learn not to believe the rumors. What happens now with the ECB, which has not bought a single Spanish bond, is similar. And the problem is that they expect it to work.

The German plan, is that, as they do not trust their partners, they want more or less in the middle of 2013 that the outstanding debt held by local investors of problematic countries is at least 85%, preferably 100%. When the debt of Spain and other countries is in domestic hands, the problem and the risk of default and contagion is not European or global, but local and, therefore, countries will have to take good care of breaching their commitments, because the effects of the default fall on the population – internal default-, given that Spain has its social security, pensions and private plans more than 80-90% invested in local public debt.

When they say that Spain would ask for the bailout but not use it, they assume that only the threat of Draghi actions will force international investors to buy Spanish bonds. I don’t see it. If the ECB forces the maximum risk premium relative to the Bund to 200 basis points, as they say, it will provide the hilarious situation where Italy has to contribute 1.5% of their GDP to the bailout with its own cost of debt at higher levels. Donation?. Then we will have to do the same for Italy and it becomes a pyramid scheme. To infinity and beyond.

Virtual Bailout is a myth

There is no “soft” or “virtual” bailout, limited conditionality, temporary liquidity or any adjective you want to invent.

It is a mortgage and the mortgage cost. And when the country depends on the ECB, once it buys the first bond, the state is mortgaged for life. Unless we curtail public spending that neither Hollande, nor our politicians want to cut. The cuts will come to the big items: pensions and unemployment. No. exports are not going to save us when public debt is 110% of GDP.Private debt … Very publicFor investors, the tales of “debt accounted for deficit purposes” and gimmicks to account less real indebtedness do not matter. Here what counts is all debt and all that is guaranteed by the state. It might be repeated again and again, but it’s a lie, that “private debt is the problem.” Not so. Public debt is our problem. There is no demand and that is why we have to ask for a bailout. And in no small part because a large portion of the debt misnamed as “private” are unpaid bills, guarantees and government IOUs, debt of public companies … none of them counted as “excessive deficit”. But debt nonetheless. Taking into account all financial liabilities issued by the public sector, Spain’s public debt exceeds one trillion euros. And if you add endorsements and guarantees, more … see the chart below.

Illegitimate debt. Ecuador without oil

There are parties in Spain that call for an “audit” of the public debt-default-, deem it as illegitimate -default-and restructure-default-. Calling “illegitimate debt” to those commitments that have been generated under a democracy and especially between 2008 and 2011 with the approval of each of the parties and unions is surprising to say the least. But above all, they are all living in the land of the unicorns if they think default will impact on future access to credit, on the risk premium and the “social rights of citizens.”

If Spain defaults, we will see the collapse in unison of the Social Security and Pension Funds, invested up to their 90% limit on sovereign debt. And we would see the crisis extend an average of three years, and a drop of 7% of GDP ( Cost of sovereign default, De Paoli, Hoggarth and Saporta ). But above all, when I hear the comments about other countries that have declared illegitimate their debt there is a small point they tend to forget. Almost all countries that have survived these restructurings were oil-rich countries. We want to be Ecuador, but with no oil. And, of course, without its risk premium. And of course, without the credit restrictions of Ecuador. With abundant, cheap credit that we can declare illegitimate again in 2020 and move on. A joke.

Accumulation of debt is not growth

“Spain is not Uganda, it is Enron” Christopher Mahoney

“Spain will not grow for the next five to ten years” Sean Egan

One of the most dangerous problems in Spain today is to reject the international analysis about the country’s difficulties as malicious. The market is very concerned about Spain today, but if the steps to resolve the debt crisis are not taken, Spain could quickly go from a cause of concern to being ignored.

We cannot say it was a successful week for the “Spain brand”. The country was mentioned as an example of hypertrophied government size in the Romney-Obama debate, the EU is wary of the deficit targets for 2012 and 2013, and the country gets compared with Enron. I do not like it, it hurts my pride, but we must pay attention.

The continuous fluctuations and messages about the request or a bailout are not accidental. The reality is that it is impossible to rescue Spain. It would cost a trillion euros, according to estimates by Moody’s and Egan Jones, and governments have to find ways to avoid the impact on the Eurozone.

When Sean Egan warns that Spain will not grow for five or ten years, what he analyses is the inability to generate industrial demand and investment with such a monstrous debt and a huge tax burden. If we maintain a confiscatory tax policy, legal uncertainty and the bloated weight of the government, he could be right. Considering that Spain is an ultra-cyclical economy, it could also recover quickly if the burden of taxes and government is reduced. Let’s face it, exports are improving and foreign investment rebounded slightly, although it’s nothing to get excited. Most of the deleveraging is not completed, because the reduction of public and private debt has not yet really begun aggressively.

Investors and analysts warn that the problem in Spain is the increasing burden of financial commitments without demands.

Egan Jones downgraded Spain last week. They cite as most important elements of its downgrade the pace of industrial demand destruction, and the debt overload of the regional and bank bailouts. Let’s remember that when the year started the capital needs of banks were supposed to be a maximum of €40 billion and now the official figure has risen to €60 billion, while many analysts assume capital needs of €200 billion.

Bailout after bailout

The problem is that in the vicious cycle savings banks-state-regions-spending-debt there is never a bankruptcy, no credit responsibility and, therefore, a perverse incentive for mismanagement.

I see that the bond market, taking advantage of the Draghi effect, is trying to accumulate five-year Spanish credit default swaps, although the volume is still small. Investors perceive the following problems that could cost up to 60 billion more than expected in 2013, bringing the deficit close to 6%, well above targets:

* Giving full and unconditional support to the regions. The regions have already consumed almost all of the Liquidity Fund available to them, with extremely mild conditions. The government says that the state could intervene the regions if they don’t comply with the targets. Let us see what government dares to intervene Valencia or Catalonia.

The regions have an outstanding debt €191 billion, 18% of Spain’s GDP. All guaranteed by the state. Having the state as guarantor creates perverse incentives. Regions are bailed out but no one dares to intervene them, and even if this happens, the taxpayer pays the bill any way. The autonomous communities complain that their individual deficit is very low. Remember: deficit = loss = more taxes. They account together for 33% of the total Spanish deficit.

* Unconditional support to bankrupt savings banks. The Spanish banking system balance sheet is 340% of the country’s GDP and, moreover, is extremely exposed to sovereign debt. With non-performing loans of 9%, and the drop in deposits it is likely that we will see another round of “bailouts” in 2013.

* The “bad bank” will buy real estate assets not with enough discount, at”economic value”, that is, betting that the long term everything will go up. This will require an injection of public capital to support the bank’s finances. And the longer it takes to sell, more public capital injections will be needed. All this is done to “get credit flowing” to the real economy. However, banks cannot recapitalize themselves as requested by the EU and at the same time provide credit to a “real economy” that sees increasing taxes and decreasing margins. That’s like blowing and slurping.

European CDS against Spain. Crazy

The European Union is greatly concerned. They doubt Spain will comply with the deficit targets in 2012 and 2013. The IMF believes that Spain will not reach a 3% deficit until 2017. The EU is so concerned that after criticizing Credit Default Swaps for years, and given the magnitude of the potential problem, between 700 billion and one trillion euros, the EU itself and the ECB are considering issuing European credit default swaps for the Spanish rescue, according to Bloomberg .

This is a recipe for disaster, because it shows that the EU itself is wary of the ability to repay debt of Spain and seeks to attract foreign investors to finance the bailout, insuring against a default of Spain. What happens? That CDS overshoot, which spill over to the sovereign debt but also to the debt of European Stability Mechanism (ESM).

A debt problem is not solved by more debt. If Spain stops the bailouts and establishes unquestionable credit responsibility, negative surprises are likely to be decreased greatly. A further delay in the deleveraging process from the expenditure side will mean a longer path to recovery and revenue growth. But it seems it does not matter. Someone will pay the debt. Some day.

My comments to CNBC here: “We have a lot of earnings downgrades to come and an environment where companies need to reduce their debt significantly”

http://www.elconfidencial.com/encuentros-digitales/daniel-lacalle-26