Read the entire post by Michael Snyder, on July 11th, 2013 here

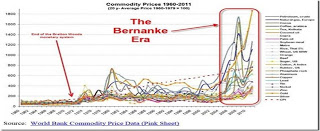

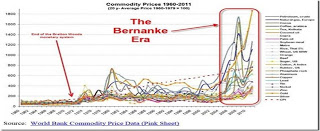

“Federal Reserve Chairman Ben Bernanke said this week that inflation in the United States needs to be higher. Yes, he actually came right out and said that. It almost seems as if Bernanke is trying to purposely hurt the middle class…

But what Bernanke will never admit is that the official inflation rate is a total sham. The way that inflation is calculated has changed more than 20 times since 1978, and each time it has been changed the goal has been to make it appear to be lower than it actually is.

If the rate of inflation was still calculated the way that it was back in 1980, it would be about 8 percent right now and everyone would be screaming about the fact that inflation is way too high.

But instead, Bernanke can get away with claiming that inflation is “too low” because the official government numbers back him up.

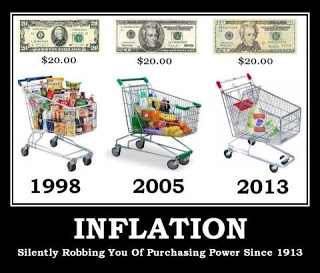

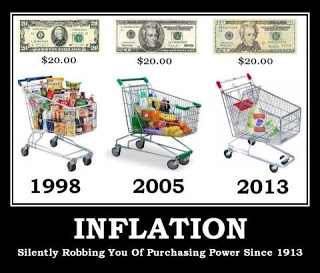

Of course many of us already know that inflation is out of control without even looking at any numbers. We are spending a lot more on the things that we buy on a regular basis than we used to.

Electricity bills in the United States have risen faster than the overall rate of inflation for five years in a row and according to USA Today water bills have actually tripled over the past 12 years in some areas…

Since 2010, employee health insurance premiums have been rising an average of between 8 and 9 percent a year. So where is this low inflation that everyone has been talking about?

It certainly cannot be found in college tuition costs. Since 1986, the cost of college tuition in the United States has risen by 498 percent.

What about at the supermarket?…An article by Benny Johnson details how the prices of many of the things that we buy on a regular basis absolutely soared between 2002 and 2012. Just check out these price increases… ”

Eggs: 73%

Eggs: 73%- Coffee: 90%

- Peanut Butter: 40%

- Milk: 26%

- A Loaf Of White Bread: 39%

- Spaghetti And Macaroni: 44%

- Orange Juice: 46%

- Red Delicious Apples: 43%

- Beer: 25%

- Wine: 60%

- Electricity: 42%

- Margarine: 143%

- Tomatoes: 22%

- Turkey: 56%

- Ground Beef: 61%

- Chocolate Chip Cookies: 39%

The middle class in the United States is shrinking with each passing day, and Bernanke seems absolutely clueless…

The middle class in the United States is shrinking with each passing day, and Bernanke seems absolutely clueless…

http://theeconomiccollapseblog.com/archives/inflation-is-too-low-are-you-kidding-us-bernanke