This article was published in El Confidencial on August 20

“The phenomenon of economic ignorance is so widespread and its consequences so frightening that the objective to reduce that ignorance becomes a personal goal”, Israel Kirzner.

I spent eight years of my career in the area of Investor Relations and despite suffering the Latin American crisis and others, I never saw the Spanish media insulting investors and spreading conspiracy theories of British attacks on Spain as I am seeing today.

In those days we didn’t approach everything from a sense of entitlement. We had to earn the interest of a market with limited capital. We learned especially from those who criticized us. Today, the global deleveraging process is making capital even more scarce, but our country seems to invoke a right to receive “unlimited capital” unconditionally.

Blaming the waiter for the bad food of the restaurant

Today, the national sport of blaming everyone except ourselves for our problems has reached delirious levels, peaking with articles in the mainstream media accusing the United Kingdom and the markets of “financial terrorism.” It is a handy scapegoat, to use a diffuse entity, the market, as a sort of “evil Dr No” behind our troubles.

This “market” is nothing but our savings, operators which are a secondary consequence of the real causes of a crisis created by ourselves, the states with reckless spending and their central banks. An economic policy based on monetary expansion that generates structural inflation, artificially low interest rates that create bubbles and masses of debt, which ultimately becomes unaffordable, leads to defaults and devaluations that impoverish the entire population.

These media commentators demand every day that the European Union prints, devalues, and raises taxes. However, afterwards the same journalists wonder why inflation rises, and food and raw materials rocket. And their conclusion is obvious: It is the fault of some “evil conspirator” in Westminster or ‘traders’ in London that envy Spain and want to make it fail. Easy. Of course, the hedge funds all together handle a fraction of the funds that the EU manages, but in our ostrich policy of “pretend and extend” the media repeats over and over that hedge funds attack us. Reminds me of my parents’ village, where every time there is a robbery, the people blame the tourists.

Now Spain needs investors like oxygen.

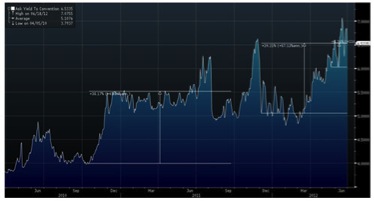

It’s funny that we complain of our unfair bond yields “when the UK is in much worse condition”, the “Perfidious Albion attacking us because of envy”, as the press said of Britain in the Franco times.

When Spain multiplied its debt in four years from €390bn to €734bn and all its regions increased their debt from €60bn to €140bn no one in Spain branded the reckless spending as ‘financial terrorism’, despite squandering money that the country didn’t have. Spending is always justified, and citizens presume good intentions behind it, while now the mainstream media and many politicians attribute dark evil motives and invent conspiracy theories to explain why investors do not trust the country and decide not to buy bonds. Not purchasing, by the way, is not attacking. The country cannot force anyone to “buy.”

In terms of sovereign debt management, Spain should learn from the UK

Let me clarify one thing first. No one is more critical of the UK economic policies than me, I live in London and have been vocal about the very erroneous policy of the previous government of excessive spending and believe the current QE and monetary expansion policy is no solution for recession. But the British ten-year bond is perceived as a solid investment, and there are fundamental reasons for it.

Let me summarize the ongoing debate all over Spain’s economic media. It says: “Spanish bond yields are unreasonably high and the UK’s are unreasonably low despite the fact that the UK is in worse financial shape because the London financial institutions and media attack and exploit our weakness”. Right?, No.

Let’s start with what creates mistrust in the Spanish debt, which needs to be tackled urgently:

-The concerns when accounts do not match. Spreads started to widen aggressively despite ECB interventions with the increase in government spend (the failed 35bn “Plan E” stimulus, the 125bn injected in the savings banks) and the well-known unpaid bills, debts not accounted, while deficit figures had to be revised twice. If Spain does not give credible and consistent economic data, bond investors, by definition the most conservative and long-term driven, will simply avoid the risk. The UK on the other hand has been detailed and clear not only about swift cuts but stimulus and about budget limitations.

-Institutional credibility and credit responsibility. Everyone knows who to blame for the deficit in the UK, and there is one body and one chancellor who can act on it. There are no debates between parties of “who is less corrupt” than the other, and institutions and their responsibilities are clear and enforced rigorously. Another problem is lack of credit responsibility. In Spain, between savings banks and 17 regional communities with 17 decision centres, each with its vested right to default and be rescued, there is no real political responsibility for the consequences. Regions miss debt targets and then “rebel” against the state. How do they rebel? Not paying their suppliers.

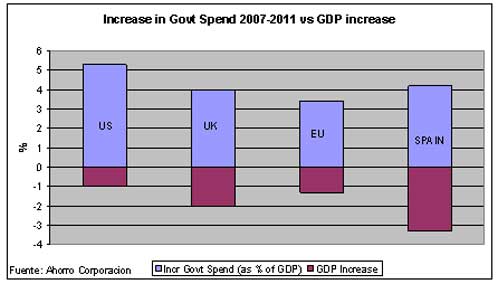

–The perception that reforms are cosmetic. Spending cuts in Spain so far have been reductions in expected increases, not real cuts, while the UK has made very deep cuts. Therefore, ahead of uncertainty in the economy, Spain can only count on improving revenues to achieve its targets and that’s a huge risk.

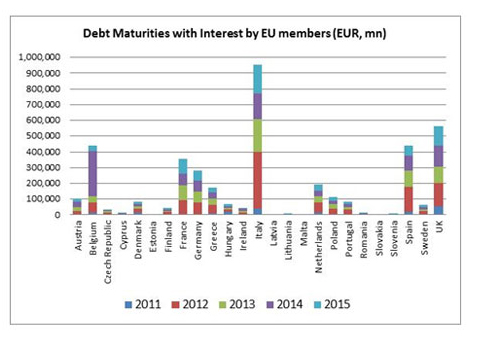

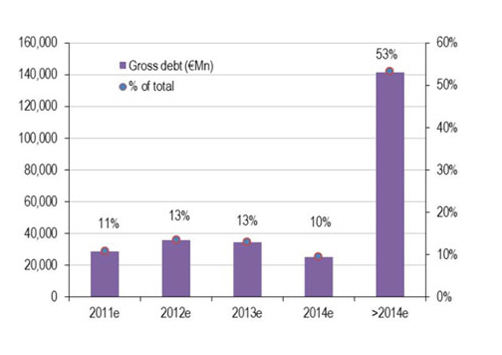

–The acceleration of spending. In Spain spending has doubled while revenues stagnated. This acceleration is very relevant. What creates more distrust among investors is the evolution of dynamic solvency ratios (increased costs versus revenue growth), not static (debt / GDP) and also future refinancing needs over the global supply of debt. In the UK, for example, issues tend to be made with very long maturities, and always seeking to avoid saturation of supply. Spain has to refinance, between 2013 and 2015, 259 billion euro, almost the same amount as the UK, 320 billion, but with less than half of GDP and much lower revenues.

–The unhelpful messages on default and exit from the euro. If an opposition leader says “if Spain was out of the euro our risk premium would be 300 basis points,” a leader of a majority party says “debt must be declared odious and stop payments” and a minister says “the German banks also benefited from our bubble”, they are unconsciously highlighting in public the risk of default. And investors do read those statements.

Of course, the UK is a country that attracts capital, maintaining investor’s interests as the State’s primary policy, the economy is extremely flexible, and with 8.6% unemployment. The challenges in Spain remain in a regulation that makes investment and job creation extremely bureaucratic, onerous and slow, and an unusually restrictive and cautious approach to foreign investment.

To think that the UK bond yields are low only because the state devalues the currency and monetizes debt is another mistake.

If the panacea to lower bond yields is to print money and have an active central bank easing, Zimbabwe or Argentina would be the countries with the lowest bond yields of the world. Without institutional credibility and credit responsibility, legal certainty and a suitable investment environment, the impact of interventions are temporary and ultimately irrelevant.

The BoE has bought less than half of the debt issued by the UK between 2009 and 2010, the other half was bought by institutions and banks, including, surprise, surprise, a few big Spanish banks.

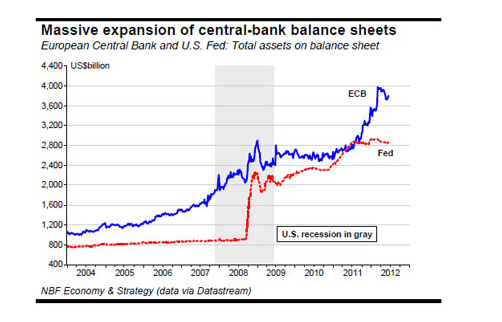

In Spain the ECB has injected over 400 billion euro to banks, used mainly to buy sovereign debt, more than the Gilt purchases of the Bank of England in 12 months. If the monetization of debt is the reason given by the media to explain low bond yields, Spain has seen a much larger EU-funded program of bond purchases –through its domestic banks- relative to its GDP and its refinancing needs.

Without institutional trust and credit responsibility that prevents default risk on Britain’s debt, the country’s yields would also soar despite BoE purchases.

Bond yields are a reflection of the secondary bond market, ie the investor appetite for the country’s debt. Nobody profits or attacks the country by not buying bonds.

I read that the Spanish government will make a diplomatic offensive to attract investors and I think it’s a wonderful idea.

Three ways to improve:

–Stop issuing short-term debt to finance long-term spending, it will take bond yields to stratospheric levels, with or without ECB purchases. It would be positive to see lengthening maturities and a national agreement to attempt the conversion of debt held by domestic entities-nearly 70% of total-to long-term debt.

–Attracting capital, as the City of London does. Issue debt to investors who can also have access to assets. One reason for the distrust of investors is because in Southern Europe they are allowed to buy debt but not companies or assets. A national regulation that encourages investment and stops trying to keep out foreign capital would be very productive.

-Enforce compliance and responsibility to those regions and banks with problems. Irrevocable, immediate and demonstrable. If investors see that the money is given out but not controlled, they will not invest.

–Strengthen laws to defend creditors and debt repayment. It is not worth changing the Constitution as last year and then a few months later deny of such agreement.

The problem of wasteful spend disguised as ‘real’ economy

I’m getting used to read in the mainstream media that useless investments, duplicate administrations and cronyism are not so bad because they “maintain GDP and employment” and, after all, unnecessary investments in infrastructure “at least are spent in something tangible –real”. Furthermore, these “wasteful activities also generate growth”. This belief is part of a monstrous mistake that began to take shape in the mid 90s when Spain started to see money pouring in from Europe. It had to be spent to get more afterwards. It’s the widespread belief that money is free and that the right side of the balance sheet does not matter or does not exist. “Public money belongs to no one”

This is not true because it assumes that the “money” spent is capital and not debt. If it was capital, I would partially agree. That is, if I’m rich and I spend a significant part of my salary in drinks it is my decision, but it does not have a direct negative impact on my finances. But when it is debt, bad economic decisions cost a lot. That is, if I’m poor and I have two mortgages and I spend a significant part of my salary in drinks I create a double negative effect, the cost of debt and the futility of my expense. The money squandered is not only wasted but it costs, because debt and interest have to be paid by a declining percentage of the profitable and productive part of the economy.

The popular perception in Spain is that if a bridge, a phantom airport or a ghost city that is not needed is built, at least there is something real and valuable. Like China but without its economic power and wealth. The idea that the economic use of those “things” is irrelevant just because some jobs were temporarily created, when in fact there is not only an asset, but an associated liability, and the cost must be covered with the productive returns of another activity or through taxes, or more debt. Therefore, unnecessary infrastructure is not only wasted borrowed money that does not create “real activity”, but it crowds out and eventually erodes the real productive activities, enlarging the debt balloon. The useless bridge-airport-city would only have zero cost to the economy if it were funded with surplus wealth or a donation. And Spain has neither one nor the other.

In summary, Spain must attract capital, learn from its more financially mature peers and forget to support GDP with hot air. No one is attacking Spain, if anything we attack ourselves by scaring investors. The day that the country learns that inflating GDP based on useless spending generates debt that cannot be paid with air; we will start to end our problems.