This article was published in El Confidencial on Sept 24, 2012

“Spain’s meltdown is so huge that Al Gore would make a documentary about it”

Last week, I was fortunate to meet with many Spanish companies. Their transparency and prudence is what helps us to improve the country’s image with investors despite the erosion of results from tax greed, political noise and anti-foreign harangues.For investors, it is not easy to position themselves ahead of the last quarter. On one hand, we see the stock market go up and the Spanish risk premium holding the 400 basis point level, even if it is at levels that were considered intolerable a year ago. And Spanish companies have taken advantage of a window of credit that opened in September to go to markets and refinance part of their debt.

In fact the week from 10 to 17 September, according to Goldman Sachs, was the busiest week of corporate bond issuances since 2009, at almost €21bn. But unfortunately this is not enough, and companies have issued bonds for one third of their needs for the next twelve months.

What does the debt market tell us? Public or private debt?

The good news is that Spanish companies can access capital market and are doing it at spreads that are not very different from what we saw in 2008-2009, about 300 basis points above the benchmark (midswaps), with demand exceeding supply by four times.

What the bond market tells us is that there is appetite for debt of companies as long as it’s well secured by assets. That appetite should be exploited.

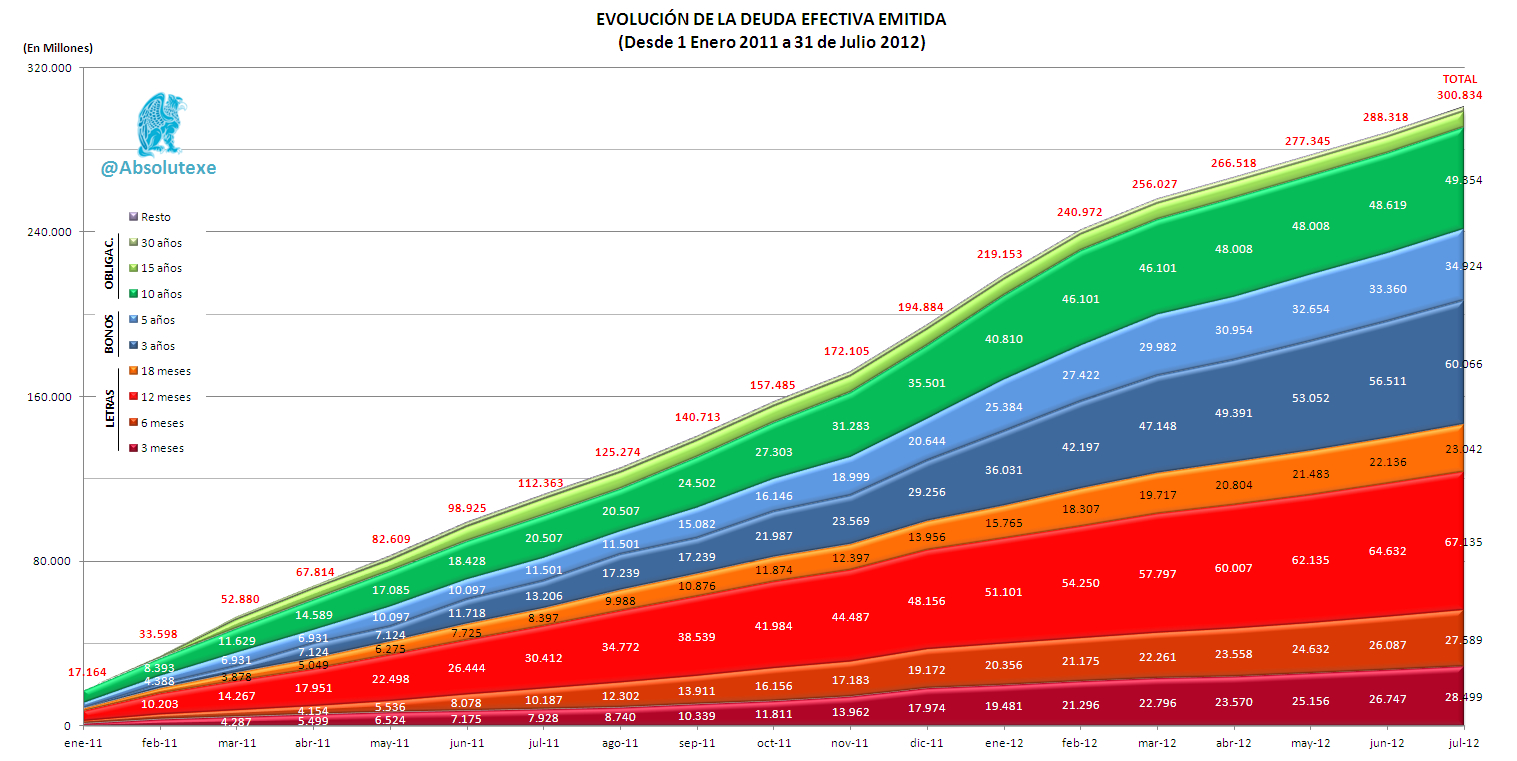

It also tells us that the debt market has no appetite for sovereign debt. When the government published the July budget execution, most economists had already written off the deficit target of 6.3 percent in 2012. In June, the deficit of public administrations was 8.56 percent. Regardless of all the taxes and cuts that they want to announce, it is virtually impossible to reach the budget target, which has already been revised upwards three times, as shown in this chart of JB Capital.

Thursday’s auction was extremely revealing. Weak foreign demand is concentrated in the short term -three years- which is where the European Central Bank would supposedly buy and therefore only a few hedge funds are betting on an imminent intervention. The long-term tranche -10 years- was disappointing, only €901m, showing the lack of international demand.

This is one of the most important things that I always explain to my readers when I read that Spain “has no public debt problem” but a private debt problem. Yeah right … Spain doesn’t have a problem because there is no demand. No demand, no problem. With public debt at historic highs, €804.4bn and 75.9 percent of gross domestic product, which is in reality 110 percent of GDP if we include all the concepts, we’re headed to have one Exxon plus one Apple in debt. There is no bigger problem than to have financing needs of tens of billions annually and have no institutional demand. Just like a store without customers.

a) Private debt, no matter how weak companies are, is secured by assets that can be sold more or less expensive, but are sellable. Public debt is just spending, it disappears, it generates no return and is used to maintain duplicate administrations, loss making public enterprises like Omnium orInvercaria, and to bail out the public saving banks… Yes, all public. To all those that demand a nationalized banking system, congratulations, this is the result.

b) Private companies can raise capital and sell assets. The state either curtails spending or raises taxes and cuts services.

c) Private debt default risk is almost 40 percent lower than that of public debt because confidence in managers is significantly higher than in politicians.

d) Half of Spain’s private debt is concentrated in 30 companies. Not one of them has losses and negative free cash flow that match the disaster of our public accounts. The state loses €45.2bn in six months. The state spends nearly double its income. Find me a single large company or SME that spends twice its revenues. Not remotely. And do not tell me stories that the state has a social duty. The first social duty is not to spend money they do not have, and not to sink future generations speculating that everything will go up.

Therefore, we have a budget implementation which does not induce optimism.

– Very few investors believe that tax revenues will grow by 17.9 percent between 2011 and 2014, because we are living the Laffer curve in all its glory. More taxes, less income. And in this item rests nothing less than 28 percent of the estimated improvement of national public accounts.

– Very few investors believe Spain will reduce spending watching the evolution of expenditures so far. In fact, many investors believe €20-30bn more will be needed to cover the hole of the savings banks in 2013, and many fear that the government’s objective is to maintain GDP at all costs, even keeping unproductive expenditures.

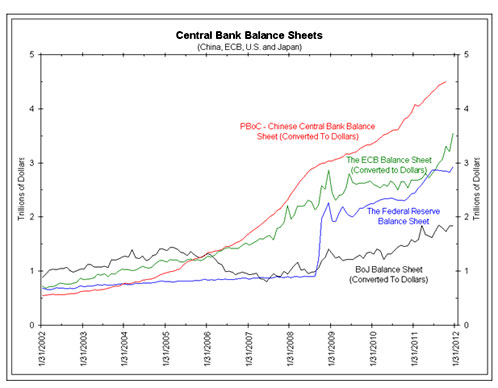

Investors resoundingly favour corporate bonds and continue to avoid a sovereign bond that is only discounting the option of a bailout. Government debt held by foreign investors has continued to fall while Spanish banks have offset this decline.

What if the bailout is delayed?

The delay makes sense, but the bailout is inevitable:

– As I mentioned in this column, once the bailout is requested, the country runs the risk of being labelled as junk status. While a rating agency says it is not going to do it, the market will likely do it. It is of paramount importance to give companies the ability to finance all they can and to raise capital before Spain is treated as junk bond.

– The conditions can be very aggressive and with the liquidity and solvency indicators of European Union countries worsening, Spain runs the risk of making a bad deal. Spain will have to make huge cuts anyway, and everyone wants to give the impression of calm and prudence.

– Perceived political problems. Elections are close and no one dares to appear in front of voters saying “ladies and gentlemen, what we have to do is to apply the red pencil.” I’m surprised, because people know and all they ask is that someday the red pencil is applied to official cars or the hundreds of politicians paid by taxpayers’ money.

What we do with the IBEX at 8230?

“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria” Sir John Templeton

We have gone from the “worst is over” to “the best is yet to come” and the risks of complacency abound.

We will end September and Spain is the only European country that bans short positions. And now the government calls for a tax on short term gains. Against speculators, they say. Of course, to them selling a stock is speculating, but building statues and unnecessary airports is “investing.”

McCoy in El Confidencial wrote an article mentioning that the IBEX could be a great investment opportunity based on CAPE (cycle adjusted price to earnings). However, I have doubts. How can we value today’s companies using the last cycle when the past meant massive debt, huge subsidies and real estate bubble growth?

My opinion is:- The IBEX is not cheap. The consensus expects earnings growth in 2013 of… 52 percent. I swear. Normalizing these estimates, the Ibex at 12xPE and 3.8 percent yield is not cheap, except for three sectors, industrial, and electrical consumption. Look at this chart by Mirabaud.

– Once we establish that the IBEX cannot give big surprises in its expected profits, the surprise can only come from the average weighted cost of capital (WACC). It has improved thanks to the cost of debt, but the cost of equity is rising and the impact on stocks will be dictated by their ability to continue refinancing themselves cheaply … and by country risk. If the market puts Spain in junk bond, the brutal positive impact generated in August can be reversed.

– The IBEX remains the most indebted index in Europe, which is why it goes higher when liquidity injections are discounted and falls more when financing is a risk. The refinancing needs of companies can lead to a situation that we call “cannibalism,” that is, the bond supply offsets the interest in shares when marginal investor appetite focuses exclusively on corporate bonds, not stocks, as we saw in 2008.

Spain will have to make real cuts, not tax increases. We cannot see the bailout as a solution and forget the risks for companies. I hope our dear politicians, who complain so much about speculators, will stop speculating with the money of others betting that in two years all will go up, because they are turning Spain into the worst hedge fund in the world.