(This article was published in Cotizalia.com on August 19th 2010)

I said it three weeks ago. Sell turbine manufacturers and buy wind developers. Turbine prices are plummeting, margins fall inexorably and the demand bubble, artificially created by the debt and subsidies of the OECD countries, has burst. And the only beneficiaries of this are the wind developers that centre on returns and not empire-building growth. They buy more turbines, cheaper and of better quality.

The turbine manufacturing industry is a great industry with great professionals and great engineers. But as an investment it is a disaster. It committed the sin of greed and the industry has been bloated with excess capacity for some time. Since 2006, the market has not seen anything but cuts to their own estimates for orders and margins. The industry positioned itself for excessive growth, undifferentiated returns and the hope that competition would never appear and are now paying the excess.

And it’s not a cheap sector in any shape or form. My readers who have access to Bloomberg can see that the stock market debacle has been entirely justified by falling estimates. And the sector is trading at 20x 2011 PER and average EV/EBITDA 7.5x. Not cheap at all for a sector that has proven to be more mature and cyclical than its managements and analysts would like to admit.

On Wednesday, Vestas, the largest turbine manufacturer in the world, fell 22% after they announced a downward revision of revenue estimates (for 2010!!) from €7bn to €6bn. The analyst consensus, who claimed that their average estimates were “conservative” (€6.7 bn), again had to slash estimates. This has happened six times in three years. The EBIT margin has been reduced by 50%, no less. Let us not forget that Vestas, like all turbine manufacturers, had given estimates for 2010 only a few months ago. And now they cut their estimates for this year … 50%. Then they say that it’s a temporary issue and that 2011 is fine. Again, something they said in 2007, 2008 and 2009. And some say that the market is speculative and short-term. Come on.

When a global leader is unable to estimate properly a year, THE CURRENT YEAR, how can they demand from us to make long-term valuations and investments? Come on. But what’s more important is that we are also seeing the cash flow fall and what is worse, a deterioration of the ratio of working capital/sales, which is what indicates the strength of the sector. Many firms take 20% WC/sales, which it is too risky,and shows that the industry is so desperate that they could be financing their own clients, in a downward spiral of financial weakness.

Gamesa, only a few weeks ago, further reduced, as it is almost a recurrent episode, its estimate of 2,700-3,000 MW of installations to 2,400-2,500, and their expectations for EBIT margin to 4.5-5.5%, compared with 6 -7% in January’s previous estimate. A very difficult process of adjustment to reality after the aggressive expansion plans and ludicrous expectations to compensate the falling Spanish business with Chinese and US growth.

As I told the CEO of one of these companies, who was asking what to do to mak the shares go up: “for once, please beat your own estimates. Simple.”

The turbine manufacturing sector faces three problems:

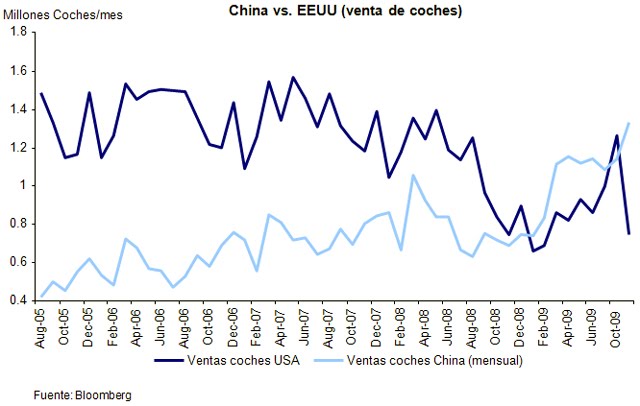

– The drop in demand, obviously. As I mentioned three weeks ago, the American green dream has faded. Expectations are for about 4 Gigawatt installed in the U.S. in 2010, less than half that of 2009. The European Union has very high electricity reserve margins. And the growth in renewables in other countries of the world is poor at best, and not enough to justify the “high growth sector” multiples. The bubble has burst.

– Production capacity is excessive. Turbine manufacturers themselves confirm that its plants operate at 50-55% capacity. This makes the need to reduce average prices to their remaining customers (10-12% decline in 2010, after a 12% in 2009) and compete aggressively with low margins. And what is worse, not only there have been no cuts in capacity, but it continues to increase both in European and America as well as Asia.

– Competition in the target market of China, which had been ignored with almost xenophobic arguments. “Not enough quality”, “customers do not trust them”, “European turbine prices can not fall and the Chinese have to accept it.” Well, Goldwind and Sinovel continue grabbing the Chinese market with prices 20% lower than European manufacturers, and what’s more improtant, better margins (12%).

The solution for the sector exists. “Shrink to greatness.” ROCE and margins. Easy. Reduce capacity, focus on margins, be less “engineers”, less empire-builders and more managers… And provide the market with realistic expectations. If we return to the bull market for renewable installations, and believe me, do not expect it, they will generate higher margins, better cash and have sustainable and profitable businesses. If the bull market does not come back, and it isn’t, they will be able to generate solid returns and correct the gradual and painful decline that we have seen since 2007. And do not cling to offshore as a salvation, as it’s more costly, less efficient and riskier… But, what’s most important, as replicable and technologically undifferentiated as onshore.

In an industry where the cost of replacement is reduced in absolute and relative terms every year as the technology is affordable and easy to replicate, basing a business on volume growth is crazy.

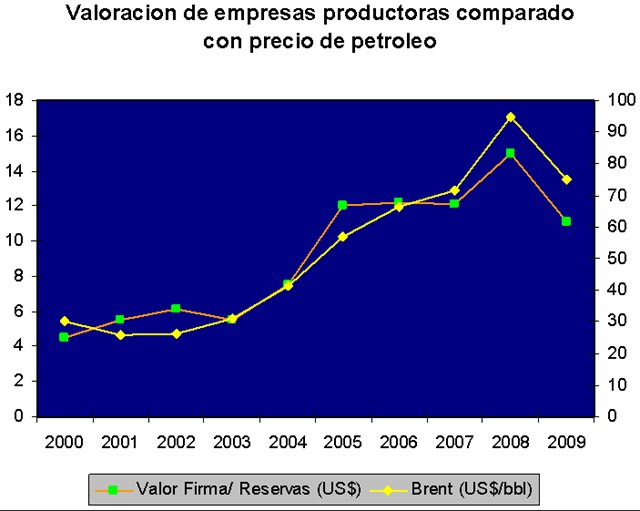

Turbine manufacturers should learn from the oil services sector, who suffered the lesson in the 80s when the same “GROWTH FOR GROWTH” and overcapacity issues occurred. Acciona, for instance, has seen this happening for some time. Its turbine manufacturing division is now a mere chain in their renewable business, which allows it to be integrated and manage the total cost in the projects it builds. Indeed, it does not provide the company any higher valuation, but at least they manage the business based on real internal demand, not on unachievable global growth expectations. Gamesa and Vestas have a tough road ahead. But a fascinating one nonetheless. As stocks, still a space to avoid except for very (VERY) short term beta trades. And to me, beta is better found elsewhere.