How naive we were. We thought that the riots in Egypt were going to wake up a sort of semi-hippy dream of peaceful transition to an oasis of Western-style liberal democracy.The Western world is increasingly lost, and we believe our own illusions. And the illusion is over.

On Tuesday, Colonel Gaddafi slashed all expectations and brought us back to reality . From the balcony of one of his homes, speaking to a virtual audience as the camera focused a huge golden statue of a fist crushing a military aircraft, he reminded us that the delusions of peace and democracy were just that, delusions. The picture was worth a thousand words. The Colonel is not resigned to be another Mubarak .

Until last week, the risk to the energy market appeared to be limited because the process in Egypt and Tunisia was contained with no impact on the supply of oil and gas. Tunisia and Egypt were not high-risk countries. The protests were relatively peaceful. They had weak governments. The army was close to the people. None of the two countries owes large sums to Western banks and governments, and none was a significant net exporter of oil (both net importers of 25 thousand barrels per day in 2010 due to growing demand).

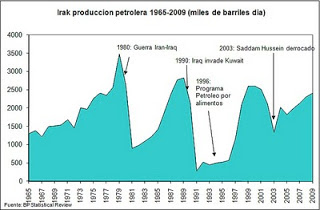

Libya is different . Because Libya is a large net exporter and the real army “is” Gaddafi’s 120 thousand soldier. Because Gaddafi arrived in 1969 when he was 27 years old in a coup that many thought would fail, and has shaped the country to his image and personality, with a mixture of Islam, iron hand, socialism, capitalism and good old totalitarianism … and there he has remained, longer than any of the international leaders, rivals or friends.

Now anarchy is about to explode along the risk of breaking up the country in tribal areas. And if that happens, billions of western investments into the country will be wiped out.

The Western press shows a country seemingly unanimous in their demands and objectives. Nothing is further from the truth. The Libyan population is extremely diverse, proud and a machine of military prowess. Both Italy and the late Ottoman Empire are aware of the risk of facing the Libyan tribes. Of the 140 tribes in the country, thirty are considered highly relevant as agglutinating powers, of which four have real influence in the circles of power. The tribe Misurata is one of them, particularly strong in two cities, Benghazi and Darneh. The tribes Beni Hilal Beni Salim have goals and interests that are perceived to be opposed to Colonel Gaddafi, but another, the Magariha tribe, is considered very close to the leader, although some observers believe it may be precisely this one which could instigate a coup. The risk of civil war and dismemberment of the state is far from negligible. And democracy or Alliance of Civilizations? No way.

Do not forget that Colonel Gaddafi has been a unique dictator, only comparable to Saddam Hussein in his mix of charisma, influence and iron fist control of a highly complex ethnic puzzle. Rumors that Gaddafi has a personal army of 120k mercenaries (compared to 50k of the official army), willing to blast wells and refineries and defend his position, make Libya a dangerous powder keg and the similarities with the Iraq of Saddam Hussein in 1991 are quite significant.

Also, do not forget that the Libyan leader has gone from being public enemy number one in the seventies and eighties to one of the most defended by politicians of all colors. While he was self-proclaimed defender of Palestine, the “anti-imperialism” of Cuba and of Islam, he also became a major trading partners for Italy, the US and UK, laying down his weapons of mass destruction in 2003 and collaborating with the West in the war on terror.

This led to a huge flow of Western investment between 2001 and 2010, particularly Italian. And Libyan oil concessions are some of the most attractive margins and returns for firms in the country. Lybia has also been one of the largest investors in Italy, with c€50bn in investments including Fiat,Unicredit and ENI.

Colonel Gaddafi from this balcony reminds us that we have much to lose. And that the examples of Egypt and Tunisia are nothing more than that, examples. That MENA (Middle East and North Africa) is not the EU. Each country is a world of ethnic, tribal, religious and military power. And the risk of further deterioration and lengthening of the crisis is not small, bringing to mind the memory of Saddam Hussein in 1991, whom also seemed trapped after the massacres of Kurds and Shiites and still remained 12 more years in power. And the information I receive from the Middle East reminds me that Bahrain, Syria and Jordan will not be comparable to Egypt and Tunisia.

Saudi Arabia, Oman, Kuwait and UAE still remain in relative calm. They should stay that way. Saudi Arabia has announced measures to increase social security protection, subsidies for housing and job creation as well as increasing the budget for charity and reduction of citizens’ bank debt. From our European paternalism we may criticize what we want, but do not forget the importance of balance in geopolitics. I recommend “The Lesser Evil” by Michael Ignatieff. Because things can get much nastier.

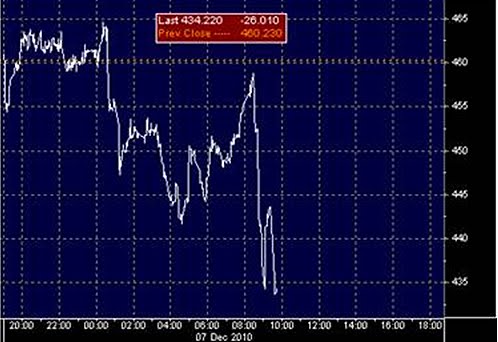

Libya produces 1,661,000 barrels per day of crude, 80% of them for export, and 16BCM of natural gas. It has about 44 billion barrels of oil reserves and 54 trillion cubic feet of natural gas reserves . And unlike in Egypt, supply shortages are a reality.

ENI, OMV, and Repsol, have the highest Lybian exposure, with 20%, 24% and 7% respectively of its net asset value in the country. They all announced on Tuesday the evacuation of nearly all staff in the country.

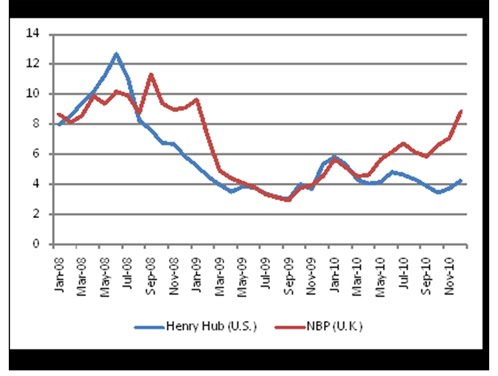

Supplies of gas to Italy through the Greenstream pipeline have been suspended. This means 8BCM of gas and nearly 80% of supplies from Libya to Italy, which accounts for 10% of the total supply of gas to the country.

The reason why the commodities market has reacted more strongly to Libya than the Egyptian crisis lies not only in the aggressiveness and forcefulness of the government’s response to the demonstrations, but the fact that the majority of Libya’s production is exported. If we consider that there is a risk of cuts in oil production because of the crisis in the MENA region, the net exported barrels (total production minus domestic demand) of Libya, Yemen and Bahrain account for 1.7 million barrels a day, almost 1.8% global production.

Today those possible “lost” barrels can easily be replaced immediately by barrels of spare capacity from Saudi Arabia (4 million barrels a day). But the contagion risk, and inaction of the West are starting to shift the market’s mind to the possibility that the spare capacity of OPEC as a whole, 5.5 million barrels a day can evaporate rapidly, and then find ourselves in a really problematic environment.

But the danger is complacency and to think that this ends here, and stay looking and waiting. Italy at least has a chance to mitigate the Libyan risk due to its access to Russian gas from Gazprom. But for Spain, although Libya is irrelevant within the total supply, the real risk lies in Algeria, followed by Qatar and Egypt. Algeria was no less than 30% of gas supplies to Spain in 2010, Qatar and Egypt 15% 8%. And Algeria, in terms of geopolitical risk, comes after Libya . Do not forget that in Algeria there were intense protests in January, but also years ago, long before the crisis erupted in Tunisia and Egypt.

Those who mention nationalization risks should not forget that that process already occurred. The vast majority of producing countries nationalized all their reserves between 1951 and 1980. But, as mentioned here two weeks ago, oil companies are going to be, as they have been for decades, the ones paying in this situation. All those investors who have been driven to buy shares of large integrated oil stocks in a Bear Market forget that they are mere concessionaires and that the PSC (Production Sharing Contracts) are at risk of further cuts, at best, or fall into the limbo of a long and tedious administrative chaos. And it should be noted that the Libyan PSCs are some of the most attractive.

In the end, Samuel Huntington was quite right in his indispensable book, “The Clash of Civilizations.” Most of the instigators of the riots don’t seek Western democracy. They seek regime change and conquest. Huntington did not predict that the detonating force would be the implosion of some Middle Eastern countries First, implosion, in which the Internet has played an undeniable detonator effect, and after explosion. And the shock wave could be coming towards the European Union.

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).