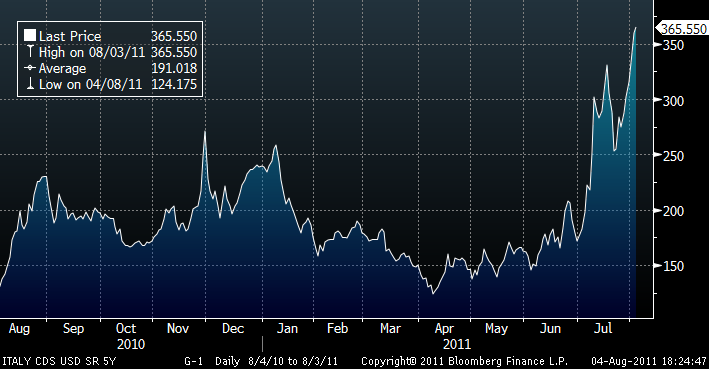

(Published in Cotizalia on 5th Nov 2011)The peripheral European sovereign risk premium and the role of CDS (credit default swaps) have focused the debate this week with my Twitter followers. Despite the enormous stimulus measures and bailout packages, the CDS of the peripheral countries remains at historic highs. It falls one day and rises quickly the next. That is because, despite all the stimulus plans, the risk increases.

On the issue of credit default swaps there are many myths that often hide the desire of governments to mask reality. We’re used to hear that every time the premium rises they say that it is because of Greece, the Fed, or any other excuse.

The CDS market is about $ 24.1 billion gross. Insignificant compared with the impact of the ECB and public institutions. The European Union itself in 2010 analyzed the potential impact of CDS positions on the cost of debt and concluded that there was no effect. Nevertheless, the EU has banned CDS without collateral, a cosmetic measure as not even 0.3% of the CDS market transactions are negotiated without coverage.

The main positions in CDS are in Italy ($ 22.8 billion), Germany ($ 13.1), Spain ($ 13.1), Brazil ($10.6) and Greece ($ 8.7), but for those who support the the theory of an “attack from Anglo-Saxon institutions” against Europe, the figures don’t even compare remotely with the U.S. CDS positions, or, more tellingly, General Electric, Bank of America, JPMorgan and Goldman Sachs that, combined, surpass the CDS exposure to Italy and Spain together. The biggest exposure to corporate CDS is … Berkshire Hathaway with $ 4.8 billion, far more than Deutsche Telekom, Telefonica, and France Telecom, all below $ 4.0 billion.

. Those buying CDS do not expect that countries or companies go bankrupt because in that case the “credit event” would make these CDS worthless. What they expect is to cushion the impact of default risk. In fact, when one buys a CDS, one seeks to mitigate the probability of bankruptcy when it is between 20 and 65% (Spain is now at 29%, Italy 35%). From 65% chance of default, the CDS does not protect.

. While Euro governments persist in the mirage metric of debt to GDP, false because what matters is free cash flow generation, bond investors looks at the percentage of income to interest expense, the acceleration of debt and deterioration of the accounts, calculating the difference between the actual cost of it, artificially manipulated by the ECB buying, and the real one if it was traded in the open market, given the fundamentals of the economy and the type of interest that institutions would demand.

. 96% of the sovereign CDS market is absorbed by the financial institutions (many semi-state owned) that accumulate billions of European sovereign debt (€275bn) and know they have to “pitch-in” and buy more when countries need to refinance € 5.9 billion from 2011-2015.

. Many of the new CDS are “quant CDS”, a simple long-short strategy in which the investor buys protection against sovereign risk using CDS, buying in dollars and selling in euros, which “insulates” the sovereign risk and covers the two parts with no “speculative” impact to the country risk premium.To understand the rise of risk premium spreads we must analyze the lack of institutional demand, as the demand-supply analysis explains perfectly why the CDS up despite aid packages to Greece, bailouts and injections of debt.

The first major problem for peripheral debt is institutional investors do not demand it because the price and interest does not match the risk .

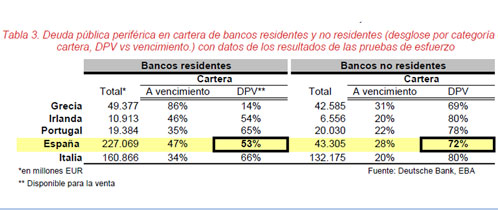

If we look at official figures, Spanish debt seems well placed between residents and non-residents (62% -38%). The Treasury boasts that 38% of sovereign debt is placed “between non-resident investors”, however this figure conceals the fact that the vast majority are European central banks, which support each other in the orgy of public debt, EU institutions and underwriters. In Italy it’s the same. Institutional demand is all but nonexistent. Very active buyers are the European central banks, government agencies and the Social Security, which can go to the primary market and is filling its reserve fund, up to 80%, with sovereign bonds . In other words, almost 45% of the debt is bought by the issuing country and the rest by the EU entities.

On Thursday’s Spanish auction there was not a single final customer order, I have been told by several banks. The same since July 2011. And in 2012, Spain has €150 billion more to refinance. Italy has €361 billion maturities in 2012. Therefore it is essential to attract capital and to stop placing the debt in a false cocoon market buddied between the ECB, public entities, social security and underwriters. Countries have to show that this investment is attractive for foreign capital. And that can only be achieved regaining confidence in public accounting, commitment to re-pay, providing transparency and allowing the investor to receive an interest on that debt that is right, not manipulated.

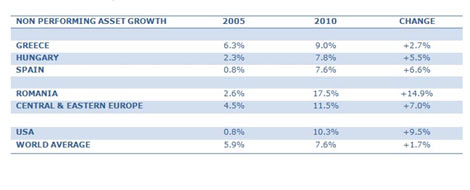

The fundamental reason for the rise of the CDS is not the absolute debt level, religiously repeated by politicians, but the acceleration of expenses and the deterioration of cash flow.

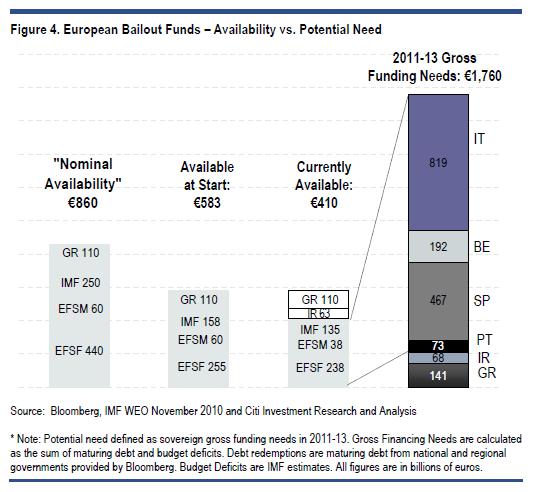

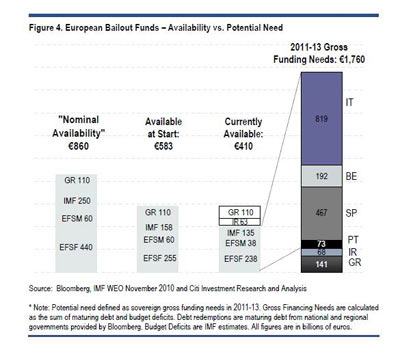

The other reason why CDS are not down is the huge refinancing needs. Between 2011 and 2015, European governments must refinance € 5.9 billion and European companies another €1.1 billion, all while GDP and stagnates and spending does not drop substantially. Italy, especially the Czech Republic and Spain are the biggest risks.

It seems normal that bond investors will continue to demand a premium over the German bund of at least 150 basis points rising to 400 if the deterioration of the income statement of Europe SA continues. The sovereign debt risk premium of peripheral countries is at risk of rising in a scenario in which the supply of debt in the market far exceeds the possibilities of investors to buy it. Spain can not expect to reduce their risk premium when their refinancing needs account for 8% of European supply in 2012, because it is simply impossible to bear weight by investors. The same with Italy, which accounts for a staggering 20% of European refinancing requirements in 2012.

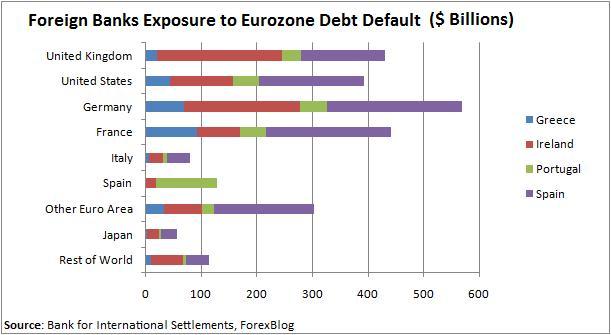

If 100% of Societe Generale’s “core capital” is sovereign debt and for any reason there was a new State problem of liquidity, it would have an immediate impact on the real economy (“shrink lending”) and the financing of French companies. In Italy, UniCredit has 121%, in Intesa 121% in Spain between 76% and 120% … and that’s assuming that all urgent refinancing needs are covered. European states have in excess of €250 billion short to medium term maturities.

If 100% of Societe Generale’s “core capital” is sovereign debt and for any reason there was a new State problem of liquidity, it would have an immediate impact on the real economy (“shrink lending”) and the financing of French companies. In Italy, UniCredit has 121%, in Intesa 121% in Spain between 76% and 120% … and that’s assuming that all urgent refinancing needs are covered. European states have in excess of €250 billion short to medium term maturities.