(Published in Cotizalia on 24th December 2011)

First of all, i wish you all a fantastic 2012, full of peace.

Like every year, I venture to give you my ideas for the year that is approaching.

My bet for 2012 is a combination of corporate bonds, anti-recession stocks and a very neutral strategy in commodities, covering with short positions in semi-state-owned companies and indexes in France, China and Brazil.

All my bets are relative, ie I do not expect the stock market to rise, in fact I see a fall potential of almost 20% in the Eurostoxx , so I expect a neutral strategy to deliver positive returns through the outperformance of longs versus shorts.

The reason why I look for long positions in Southern Europe, and particularly in Spain in 2012 is as follows. On the one hand, efforts to keep the corpse of the Euro will probably lead to the Germany and Eurozone countries to accept successive injections of liquidity by the ECB. That, as in 2011, creates the best short opportunities in the Eurostoxx as it is a transfer of wealth from Germany, Finland and the Netherlands to the south of Europe of nearly €150 billion, which added to the effect of a more aggressive policy to reduce debt by Monti in Italy and Rajoy in Spain could lead to the stocks in southern Europe to perform better than European indices. It is a gift from Northern Europe to the risk premium of Southern Europe stocks, and therefore lowers cost of capital.

Consensus of analysts still expects a growth in Europe of earnings per share of +10% a year 2012-2013 . This is falling gradually, and once adjusted for more realistic growth, the PE of the Eurostoxx, according to Kepler, is actually 11.2x 2012, not cheap. In a report with which I agree fully, and I’ve said before in this column, this investment bank believes that corporate earnings still have to be revised downward by 50% to reflect a realistic drop of 5-10% for 2012-2013.

Those who follow me regularly know that nobody can accuse me of being optimistic in my estimates, but Spain can be a surprise in the European market, but investors should be very selective because without subsidies or the debt expansion party, constructors, concessions, renewables, banks and other subsidized firms will continue to suffer a prolonged stock market Via Crucis . I would stick to the companies with strong LatAm and Emerging Market exposure and low gearing.

Dividend cuts in the rest of Europe are still to come. I expect a fall in the dividend yield of 4.6% of the Eurostoxx to a more reasonable 2.8%. Beware of German industrial companies, and the companies with unusually high expected dividend, which is likely to be cut.

I look for long positions also in the UK, where businesses are openly for sale, and mergers and acquisitions will likely accelerate in 2012. The benefit of the UK is to be an open market with its own currency, which has its own stimulus plan, and added to inflation makes it more attractive. British energy companies, except BP, remain at the top of my bets.

Avoid debt-dependent sectors and subsidies because the deleveraging process will continue in 2012 and will probably be much harder than in 2011. As an example, we have seen four solar companies go bankrupt in 2011, two consecutive profit warnings from Vestas in wind, and the list will continue. Putting money in these companies is not an investment, is a donation.

European banks have to seek capital for at least €115,000 million, and is not going to be easy. The risks of capital increases and dividend cuts are obvious.

Beware of “cheap for a reason” mega-caps and conglomerates. Do not bet on expansion of multiples when there has been none in 2009-2010 and 2011, years of expansion and growth thanks to the post-stimulus effect.

More Debt. More Debt.

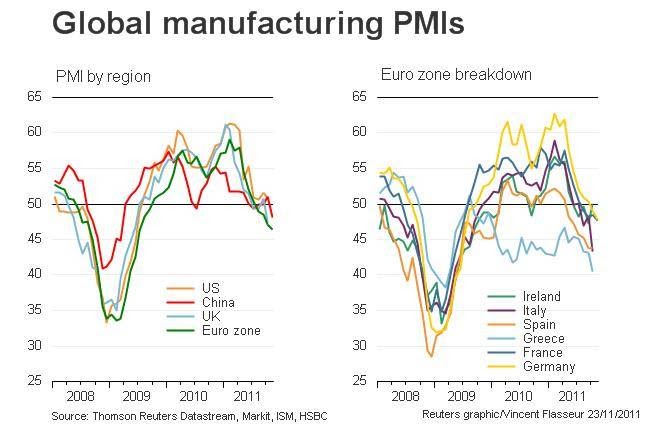

No, unfortunately in 2012 I do not expect Europe to reduce debt as it should. Packaging more debt into the ECB balance sheet is simply masking reality. And the war of the conscious destruction of currencies by governments will continue … Let’s see who will be printing more and worse.France is the biggest problem, since it will probably have to rescue two of its banks with public money while industrial production falls by 0.5% and public debt reaches 110% of GDP. Countrywise, France, along with China, which is a huge bubble of debt, build up my bearish bets in 2012.

The bad news will continue to come from the OECD. The estimates of GDP growth in Europe and USA still seems too optimistic. With over $2 trillion cuts in public spending, $5.9 trillion debt to refinance only in Europe and elections in key countries like the United States and France, it will be hard to see the economy take off . I expect a GDP contraction of 0.5% in Europe and in Spain of 0.6%. In the U.S., estimates have been revised upwards after the latest macroeconomic data, regardless of the enormous amount of downward revisions of data from previous exercises we have seen. Very Orwellian, to review the past really helps to give good data today. Seeing all increase in jobs last week coming from couriers is not exactly exciting. I estimate real GDP growth of 1.5% in the U.S., entering a recession in the second half in a year of elections and sequestration of budget (almost the effect of a “negative QE”).

The problem of stimulus plans and injections of ECB debt in Europe is that it would strengthen the euro, and this makes it harder to recover the competitiveness of companies and European countries. This massive increase of ECB balance sheet to artificially lower CDS and help banks creates a real economy problem. The financial system and public debt eat all the financial resources available to the European economy, creating a “crowding out” effect on real economic growth, jobs and industries. When trying to resolve a problem of liquidity and solvency the true effect is that the European Union is squeezing the real economy out and not helping confidence or credibility in the system. I believe that the euro should go to $1.15 or even back to parity with the dollar.I do not think interventionists will allow it.

Emerging Markets

China is likely to remain the “Big Short” in 2012. Growth will continue to be manipulated, driven by a housing bubble that has already reached 12% of GDP and non-financial debt already exceeding 200% of GDP, and therefore destructive of value. With growth slowing, the country will pursue an expansionary monetary policy, accelerating debt to sustain a GDP growth above 6%. But this “growth” takes place through the further destruction of value seen in the economic environment, as returns collapse. In my analysis, 70% of Chinese listed companies generate returns below their cost of capital. It should be no surprise. Semi-state companies are usually large destructors of value, and in the MSCI China Index, 48% are semi-government owned. Conclusion: Short. Brazil and Russia will continue the same path, in which inflation and growth is expected to move in the same direction, generating very little value for investors, especially because of its excessive dependence on oil.

Avoid at all costs semi-state-owned entities in an environment of economic slowdown. They end up being the subsidisers of the economy and minority investors in them are simple charitable donors. That is why China, France and to a smaller extent Russia , where the percentage of semi-state companies is higher, is where the minority shareholder is most vulnerable when states seek to reduce inflation and contain costs.

Commodities

Unfortunately, consecutive years of printing money, lowering rates and injecting liquidity into the system means expensive commodities despite the expected fall in demand and increased supply.

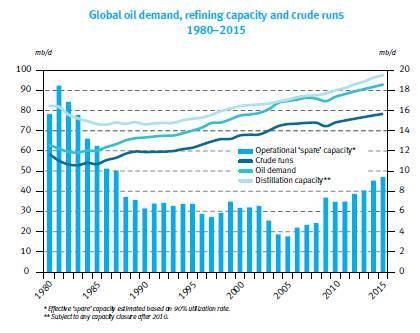

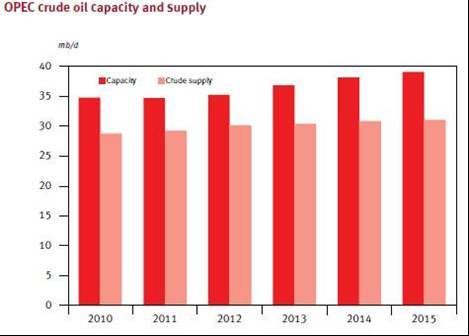

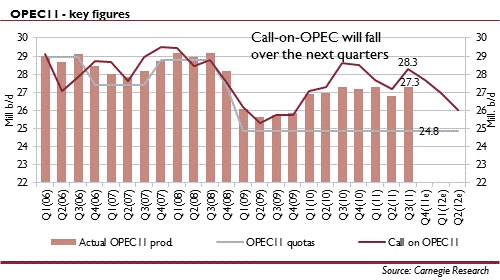

I estimate growth in global oil demand of 0.7 million barrels a day compared with +1.2 million expected by consensus and a small increase in production, generating a spare capacity of 5 million barrels/ day, leading to an estimated average of $90/barrel Brent excluding geopolitical pressures. The price premium for geopolitical risk if we see an increased pressure on Iran would move, as usual, between $8-10/barrel.

All indicators I have lead to estimate a stagnant demand for gas and electricity in the OECD, especially in Europe, which will highlight again the installed overcapacity environment.

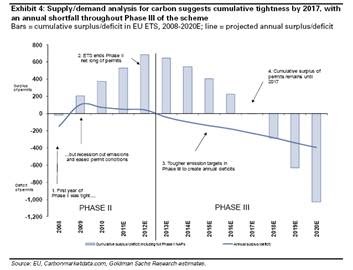

In a “La Nina” year, poor harvests and weather challenges would make a great opportunity to see increases in the price of corn and wheat of spectacular magnitude. My bets on commodities are kept in corn, wheat, oil and declining gas (Henry Hub), electricity (Germany and Nordpool) and especially CO2, where the path of death of this fake commodity, and manipulated as well, continues due to the massive selling pressure of debt filled countries, stagnant demand, refining shutdowns and emission free allowances needed to be sold. I see an unattractive environment for coal in 2012 , as China’s demand may not, in my opinion, offset the decline in India, which is spectacular. But my big bearish bet of 2012 is aluminium, where overcapacity is estimated to reach 30% while Chinese smelters continue to produce at lower costs.

Fixed Income

In a year in which states will be looking to refinance 5.9 billion in Europe and all companies have their sights on the bond market , the fixed income opportunities are not be missed because European companies have to refinance almost 1.1 billion in 2012 . No need to go to junk bonds, Single A corporate bonds, (NOT banks) as in 2008, will be very attractive. Forget Sovereigns as oversupply will likely hurt any performance. As Bridgewater Founder, Ray Dalio said on Europe: “You’ve got insolvent banks supporting insolvent sovereigns and insolvent sovereigns supporting insolvent banks”

Remember in November 2008 flagship single A rated companies with good cash flows had to refinance at 250-350 basis points above the average (benchmark)? This generated one of the most attractive environments for investment in bonds. I think 2012 may again be a similar environment. The credit market will be monopolized by billions of sovereign debt issues and 1.1 billion of corporate debt to refinance, so it will likely be an attractive environment to buy single A corporate bonds at unusually attractive rates.

In Summary

I see a year to gain much in the short term but very volatile, with a clear negative trend. I hope I’m wrong and in June I will write that all is well.

Volatility is good but does not hide a bearish environment, so I keep buying stocks ahead of Euro summits and stimulus packages and selling once announced. A market neutral strategy seems the most appropriate and of course, long only bets on “everything is already discounted” are the most dangerous.

May I remind you of my traditional sentences. The market does not attack, it defends itself. And in 2012 the market will be attacked again and again by waves of intervention.

I always say this market is a good bet and a bad investment , make good use of that and there is much money to gain. And when you read strategic reports of banks, remember the three phrases to identify a good short position: a) fundamentals have not changed, b) it’s a good company and c) the dividend is still attractive.