Beware. The European Union, Germany and the UK have implemented some of the most harmful energy measures both for their economies and, ironically, for the objectives they strive to achieve.Let us review the measures and their consequences:

. 20-20-20 Roadmap : The goal that forces to impose a 20% of renewable energy in the electricity mix hides behind its seemingly ambitious and unanimous goals the danger of percentages. As absolute targets are not specified, the cost of the measure is higher for smaller countries. 20% of renewables in a generation park like the German, 120GW (giga watts) is not the same in cost (subsidies, tariffs, investment in new transmission networks) than for a country like Portugal, Spain or Greece. Even more if we compare it relative to GDP.

Achieving that goal will cost Germany (if they implement it) that is an economy 2.8 times larger than the Spanish, the same as for Spain in subsidies and extra-cost of networks, but only 0.3% of GDP, while in Spain it’s almost 1%. This restricts the competitiveness of small countries compared to its EU partners, but even worse compared to the rest of the world. It removes the ability to recover the economy and therefore create jobs. In energy, costs are everything.

Studies of the Universidad Juan Carlos I (“Study of the Effects on Employment of Public Aid to Renewable Energy sources”), and six other universities at European level have quantified the loss of jobs by the introduction of the so-called green economy (badly called green, because it does nothing but increase the consumption of coal, which had been deemed obsolete) in 1.8 jobs lost for each created.

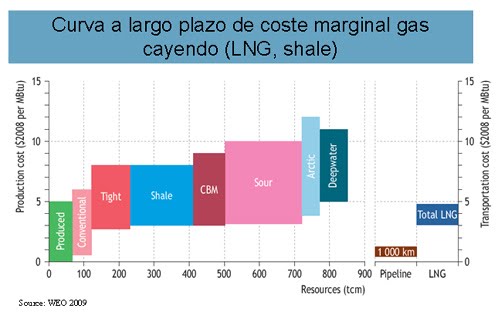

. Decommissioning or closure of nuclear plants : If 7GW of closed nuclear plants in Germany do not return to work, this means increasing by 8 million additional tons of coal imports to Germany. If they stop all new nuclear projects globally, coal consumption will increase by 80,000 tonnes between 2010 and 2020. And nuclear generation is “base-load” (ie, works almost without a break), so can not be replaced by renewables in its entirety. And this leads us to gas. The importance of natural gas as back-up in the energy mix will make energy dependence (a term I find ridiculous) increase. An Ostrich type of anti-nuclear policy, because in the middle of the EU we have France with 58 nuclear reactors, but some seem to think that if there is a radiation accident it will stop short at the border.

. Minimum price for CO2. The UK does things as badly as anyone, and has shown it this week. Intervening in the market and imposing a minimum price of CO2 while raising taxes on gas production in the North Sea has managed to increase consumption of gas by 15% at a higher price. In addition, the UK has increased dependence on foreign energy by forcing the closure of several projects, over $10 billion, in exploration and production in the North Sea. And a loss of 120 jobs in the first day. Success!.

The European Union plans as if the world was limited to our 27 countries. The EU is 13% of world coal consumption and 16% of natural gas. But supports 100% of the cost of CO2 and 70% of the cost of premiums for renewables worldwide. Thus the effect of their actions is amplified by the loss of global competitiveness in a group of highly indebted countries.

. Remove petrol and diesel transport by 2050. Again, without calculating the cost or impact on the economy. We are “only” talking about a cost close to twenty-six billion euros only in costs of network infrastructures. But most importantly, these do not reduce energy dependence or improve costs. Electrifying the park could reduce oil consumption (paradox, to be more competitive again), but will increase coal and natural gas prices, and adding to the renewable premiums, taxes lost from petrol and diesel, over 56% final price, will be transferred to the consumer of electric cars in the power bill.

We must not forget the impact of these measures and their cost of implementation, the impact on budget deficits and on the battered state of European countries’ debt. To add a cost to the system involving another 1-1.5% of GDP on debt with “supposed” benefits in 2050 has an enormous impact on employment and working conditions. At the end of the day in most companies the four major costs include energy, taxes, debt costs and wages. If the first three parts rise disproportionately, the third invariably suffers.

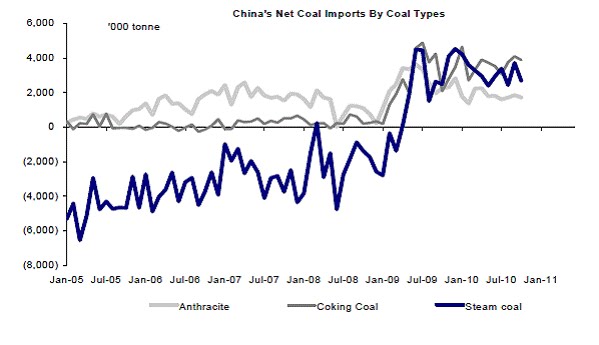

Besides, these measures have a minimal effect at European level, let alone globally. Only the planned investments in coal plants in China offsets all efforts of the EU to meet the Kyoto targets. Thus, the weight of coal as global primary energy source increased by 1.3% in 2010 to 52.3%.

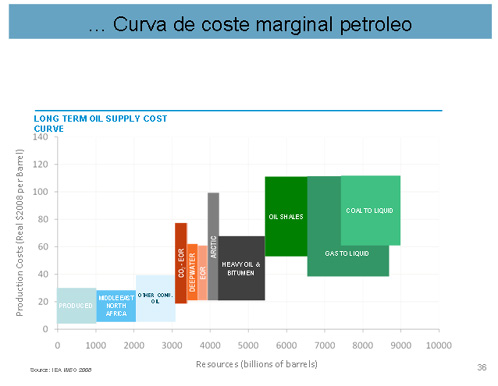

And do not forget that apart from xenophobic arguments about good and bad countries, which are embarrassing, the cost of the “ostrich policy” of energy self-sufficiency that they want to impose far exceeds (all costs included) the equivalent of $700/barrel (source: CERA, Utilities Weekly). And who do we expect to sell the haemorrhage of debt we will issue to achieve the above objectives? … the oil-producing countries, China and the U.S… Amazing.

It is rather sad that the “success” of Europe in its emissions reduction target is due mainly to the displacement of its energy intensive industries to the Far East, with the consequent loss of European jobs, and the effect of reducing industrial demand runaway that the debt orgy has generated. A success. And to close the circle, it has increased the energy dependence from Russia, Qatar (gas) or Australia and South Africa (coal).

What about pollution? We forget that the rare earths required to manufacture solar panels and batteries pollute hundreds of thousands of tons of water per year. But it pollutes in China (97% market share), so no problem.

These measures give off a smell of stale paternalism, or as Professor Dieter Helm would say, “the addiction of politicians to” roadmaps “that set the future direction of energy with Soviet precision”. And with the same disastrous results as the ridiculous five-year plans.

Until governments stop trying to plan and intervene in the energy market like the rest of the world did not exist, they will be doomed to failure. And we have spent many years with dreadful results. The green economy, which seems phenomenal, as long as it doesn’t have to be paid by my grandchildren, will only succeed if it is competitive. Governments should only create a reasonable and stable regulatory framework for technology and let the market offer solutions. Competing.

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).

Here is a summary of my views on the Egypt crisis, stocks involved and how to play it.In terms of oil, none of the countries presently affected is a major producer in a global context of oil (1.1mb/d). Yemen and Egypt are important for gas markets as significant producers of LNG for international supply (20mtpa/ 8% global capacity). However, they are very important for low cost deliveries to Europe and for South Europe refiners (Repsol gets part of its crude for Cartagena and ENI for Toscana from Egypt).