(This article was published in Cotizalia on Thursday, 16th June 2011)

The Oil & Gas sector, the world’s most profitable and less indebted one, will invest in 2011 for the first time in its history more than $500 billion in exploration and production alone. The level of value creation and development that these investments generate can not be compared to any other industry or sector in the world, and if we include gas and refining they will reach a total of $790 billion.

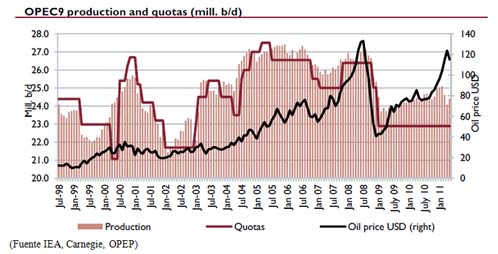

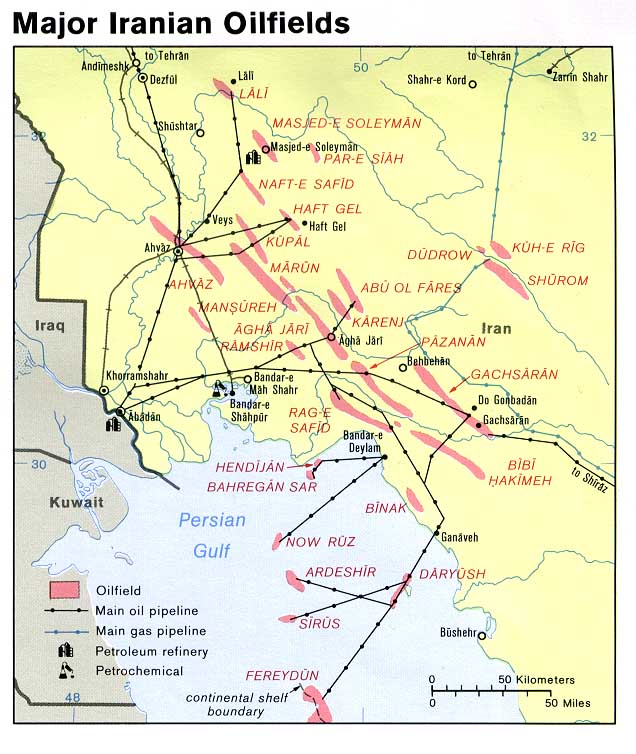

Saudi Arabia announced this week an increase in production, showing the frustration they have after being one of the few OPEC countries to comply with the quotas. Imagine, if they presented themselves later this year at the next meeting and see that OPEC produces 26.2 million barrels/day (when the quota is 24.9) and found that the output gap between them and others had widened. Iran, for example, has increased production by 45,000 barrels/day (to 4.24 million barrels a day) despite a 35% drop in oil investments since the beginning of the embargo.

Saudi Arabia will not appear at the next OPEC meeting as the only good boy in the class with homework done. Because if quotas are revised up, then everyone has to start from the same base, and there is no evidence that the other OPEC countries will decide to reduce their current output.

Anyway, it’s a good decision which, together with increases in other countries over the quota, partially mitigates the effect of the lost Libyan barrels. Partially because Libyan barrels are of exceptional quality and the oil that is to replace them is heavier, making it difficult to replace, for example, in the Italian refineries.

In the last three weeks I have seen over twenty-five executives from oil companies, including all the big oil companies and if there’s a comment that is repeated each time over and over it’s this: Almost no one believes the sustainability of demand in China. And watch out for the estimates of the IEA, EIA etc., which use “diplomatic” data, especially in their demand models, where the estimates depend on GDP projections which are generated by the governments, which have a nasty habit of being wrong (as a fun exercise, look at the growth estimates published in 2006 for 2009).

As John Watson, CEO of Chevron, says, if the industry had listened to these agencies in the past twenty years, or whomever recommended them to “improve” their cost of capital by re-gearing, the sector would all be in bankruptcy.

a) Sales of cars do not match with demand for gasoline and diesel. Apparent consumption of gasoline remains at 6.1 million tonnes and 13.86 million tons of diesel. These figures are much lower than the sales of cars and trucks would indicate (with 1,382,770 vehicles sold in May).To give you an idea, using the model of China’s own state expected evolution of consumption by type of vehicle, demand for diesel and diesel is suspiciously 12% less than it should be. The theory advocated by many investors that many of these vehicles remain parked without use is at least plausible.

b) The apparent oil demand in China remains around the 39 million ton figure for months. With seasonal changes, of course, but total demand has not exceeded 40 million tons since September. If we add that industrial production began to show signs of weakness (falling from 14.2% in 2010 to 13.3%), growth was generated primarily by fixed capital expenditures… just as the Chinese government begins to take measures to cool the economy .

c) This demand has been maintained but inflation has continued to grow (mainly because of food, +11.7% in May) despite the government’s containment measures. If the government sets as a priority to curb inflation (+5% now compared to target of 4%), the impact on oil demand can be significant.

d) The estimates of per capita consumption growth are inflated . China consumes 6.2 barrels per day of oil per thousand people (EU consumes 27). That number seems small, but we must not forget that Hong Kong consumes more than 43 already, and the largest cities of China consume up to 24.6 barrels per day of oil per thousand people. So the upside is exaggerated.

The risk for analysts who think China will grow exponentially is that they assume that demand will be the same as in the cities in rural areas, and look at Russia and Brazil. Patterns are very different. In addition, China already consumes almost 10% of the oil in the world with a GDP of $6 trillion (versus $14 trn in EU), as we mentioned last week .

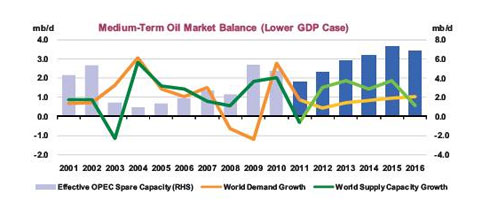

I still think that the short-term risk of a significant correction is not small. As in 2008, the ingredients are there: massive increase in investment in oil, excess crude inventories that are still too high (at highs of five year levels), increased OPEC production, which still has 4.5 million barrels/day spare capacity … just as demand slows in China, and a general environment in which estimates of OECD GDP appear too high, at least by 0.2-0.3%.

I can be wrong, but at least I think it is good to see that the oil sector takes the data from China with caution. That is why it’s the world’s most profitable sector. If the data are true, the group ROCE will exceed the historical 23%, and if they are wrong the sector will remain comfortably safe thanks to a very low debt (aggregate and individually).