Energy, Markets and Money: The Debacle of Solar and ‘Tariff Support’ Models: “Solar stocks are the worst performers again, despite the Fukushima hype and extremely generous tariff support. The solar sector (January to …”

Tag Archives: Energy

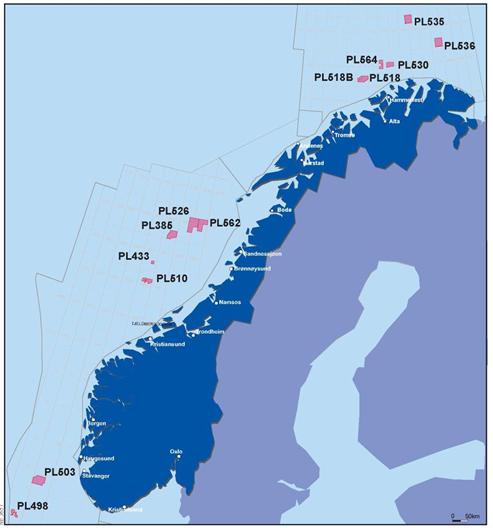

Can Norway Really Offset Oil Production Decline?

The Norwegian oil production decline is staggering. The figures are simply incredible. Total liquids production in April came at 2.10mbpd, flat from March, but down 7.1% year-on-year. Production has fallen by more than 20% (440kbpd) from 1991 levels, Problems have come in all shapes and forms. Corrosion of old infrastructures, lack of proper investments prior to the merger of Statoil and Norsk Hydro, lack of in-depth analysis of reservoir and the optimal recovery techniques, added to a less than stellar appraisal and development process.

Let’s start with a fact: There is a technical and cost challenge that is evident, but given the success in exploration and the experience of similar geological structures, it is not clear that the decline is impossible to offset due to an irreversible geological problem.

Statoil has set itself to correct this issue and has in the pipeline more than 100 projects targeting 1.2mbpd. Will they be able to offset decline?. Well, the track-record so far does not lead me to be optimistic. Since 2004 Statoil has been a story of consensus downgrades (it was supposed to deliver 16% production growth in 2006 and it ended being flat), cost overruns and delays. True, the merger with Norsk Hydro did not make things easy, but the under-delivery was simply jaw-dropping. Now things are set to change.

Statoil, at its Capital markets Day in New York, set itself with the ambitious target of growing production by 3%pa to 2020. The problem is that the road will be bumpy. 2012 growth will be strong, only to be flat in 2013 again, and project delivery gets trickier as we move into the back-end of their target period.

Capital intensity to deliver this offset of decline and subsequent growth will not be small. $16bn per annum and $90/bbl break-even (remember taxes are very high in Norway) until 2015, when the growth projects finally kick in and costs could, if delivered, start to fall.

From an investor perspective, and from a global-supply demand standpoint, the most relevant point is that Statoil intends to keep production flat as a base case from 2011-2020 implying an absolutely categorical view that decline will be offset. Skrugard, which could add 60-90kbd (gross) by 2020, or a Train 2 at Snoehvit could be the main surprises. Also, new “fast-tracked” projects beyond the existing 10 fast-tracked projects – could add another c.70kbd by 2020.

What can go wrong? First, such a large number of relevant but complex projects can be delayed easily. Skarv has already been delayed, resulting in a 20kbd impact at the project level in 2011.

Although average breakeven for Norwegian Continental Shelf projects stands at c$50/bbl, there are also significantly higher cost projects. Costs per barrel have escalated with the production decline, but once the main technical challenges have been well understood, the infrastructure has already been in place and can be used for multiple projects, costs can rapidly fall. Now it’s time to deliver. It will not be easy.

Further read:

http://energyandmoney.blogspot.com/2011/01/some-energy-thoughts-for-2011.html

http://energyandmoney.blogspot.com/2009/11/2010-warning-risk-for-non-opec-supply.html

Shale Gas, Poland… The Energy Treasure That Most Of Europe Rejects

(This is a merger of two articles I published in Spanish in Cotizalia)Nine hundred billion euros.This is what Europe could save in its goal of reducing CO2 emissions by 80% in 2050 if, in addition to further renewable energy, the continent would develop its shale gas reserves according to this sector study. And what will Europe do? If it follows the example of France, threaten to ban hydraulic fracking.

(This is a merger of two articles I published in Spanish in Cotizalia)Nine hundred billion euros.This is what Europe could save in its goal of reducing CO2 emissions by 80% in 2050 if, in addition to further renewable energy, the continent would develop its shale gas reserves according to this sector study. And what will Europe do? If it follows the example of France, threaten to ban hydraulic fracking.

The funniest thing is that the coal, conventional gas and solar lobbies have all joined forces in the war against shale gas. There must be something truly threatening and interesting to see such an unholy alliance.

None of the three are interested in cheap gas prices, because they have seen with horror how gas prices in the U.S. have plummeted due to the shale gas revolution, and therefore obliterated the use of coal for power generation and the grants of succulent subsidies as abundant energy reduced power prices (see my previous post about this). And for a continent obsessed on energy independence, it seems funny for Europe to deny the chance of developing domestic gas, not Russian or Nigerian or Qatari. European. And 50% cheaper if production grows as it has in the United States. What a horror. Ban It!

Europe has no fewer than 156 tcm (trillion cubic metres) of estimated shale gas reserves. That means c90 years of demand covered and saving up to €24bn p.a of subsidies for alternative technologies. Ban it!.

Fracking technology, thanks to the revolution of shale gas in the United States is tried, tested and of negligible ecological impact. However, we have seen many alarmist reports, even a movie, Gasland, which was immediately refuted by the industry, scientists and the Department of State U.S. Energy as inaccurate… But best of all in these alarmist reports is that in every one you read that “we could not confirm accurately any of (these) claims “(Cornell study, for example). When I wrote this post about the shale gas revolution many just ignored it as uneconomical.

Point by point, it is worth noting:

Hydraulic fracturing technology is proven, is used in thousands of wells in the U.S. annually safely, and there have only been one or two cases of minor accidents. The fluids used in the fracking of the rock are composed by more than 99.98% of water (94.62%) and sand (5.24%), with a minimal amount of chemicals, highly diluted, easily stored and handled safely.

Of these chemicals, the majority (hydrochloric acid, ethanol, methanol, ethylene and sodium hydroxide) are recovered perfectly in the extraction process.No state or local department in the U.S. has found evidence of water pollution of aquifers. The industry is also using more than 5,000 tons of steel and cement to protect the groundwater, and the fracking process occurs at least a mile deep, well away from the aquifers.

This reality, Europe’s available natural resources is what none of the politicians and lobbyists mentioned, fans of subsidies, want you to see. They prefer inculcating fear with tales of energy dependence and expensive subsidised technologies. Before looking for a solution to develop the continent’s natural resources efficiently, in a clean and competitive manner, they prefer to ban. And then complain about the energy dependence.

Europe wants cheap energy, but does not want nuclear, and now seems unwilling to develop shale gas. Meanwhile, in the 1st quarter of 2011 energy costs, paid by businesses and consumers, are again the highest in the OECD. The EU will continue to be 100% of the cost of CO2, 70% of energy subsidies in the OECD and will further reduce its ability to compete.

While gas production in the U.S. has pushed prices for gas and electricity at highly attractive levels for industrial productivity, the policy of “not in my backyard” of the EU continues. It’s easy to complain about the evil energy exporting countries when at the same time domestic production is curtailed. Instead of collaborating with the industry and with proper regulation to monitor that gas is extracted in the safest and most ecological way, they prefer to ban, with the risk of sinking the competitiveness of our economies with expensive energy as we demand that the rest of the world changes.

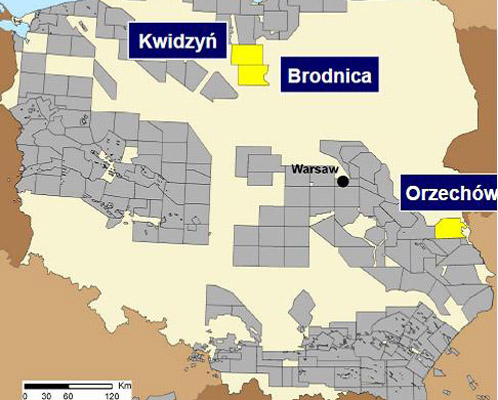

But Poland is different. Wood MacKenzie estimates that Poland could hold 3 trillion cubic feet of gas reserves in unconventional (tight gas and shale) spread between the North and the Midwest,which, if confirmed, would mean an increase in European gas reserves of 47%.

Poland depends on Russian imports by more than 75% (11.6 BCM / year) and the unconventional gas reserves can be a very important factor to improve its ratio of domestic production.

Given an opportunity to access new reserves in countries with no geopolitical risk, European companies are starting to wake up and rushing to the challenge. Total has just moved in. However, in Poland the main companies betting on the resource base are Chevron, ExxonMobil, Marathon, Talisman and Conoco.

The Polish government has awarded over 85 exploration licenses lately with the goal of achieving results in three to four years. Conoco (with 3 Legs) has been the first to drill near Gdansk, and the results are very solid although it is early to know the cost structure or plan development.

Besides the major U.S. oil companies in Poland there are several independent exploration companies present, 3 Legs, San Leon or Aurelian, for example.

Poland’s shale gas opportunity shows the following key points, according to Tudor Pickering:

- Geologically thick, organic, brittle, with multiple targets at <10,000 ft.

- EIA ranks the Baltic Basin as 80% play success factor.

- Thermal maturity indicates abundant gas generally, but oil windows are possible.

- Lifting costs in Poland may be a quarter of the US.

- Political and public support is very high.

- Seismic is being acquired and 30+vertical wells are being planned for 2011-12.

- Low royalty and corporate tax at 19%.

- Poland gas price is more attractive than US Henry hub as it is oil linked, and priced at $8-8.5/MMbtu (versus US at $5/MMBtu).

The recent IPO by 3legs values the Baltic Basin shale acreage at ~$450/acre.

It is worth alerting the risks of being overly optimistic.That’s why it seems very exaggerated what seeking Alpha said that Poland shale gas may be the end of Gazprom.

Poland has signed an agreement with Gazprom to increase its supplies by 30% in 2011 and Ukraine has increased its commitment to buy Russian gas by 11% this year …And Ukraine has its own potential in shale gas exploration, as Chevron knows. that is why the US giant is reviewing prospects in the Polish border with Ukraine, in Zamosc.

And in the rest of Europe? It is still very difficult to see real possibilities due to lack of political support. Statoil and Chesapeake are analysing more than 15 new areas in Germany, France and the North Sea, among others. The last time I saw the CEO of Chesapeake in March he was confident of the geology but not optimistic about political support.

In my opinion, the shale gas in Europe is an excellent opportunity but also carries an operating cost of not less than $2/mmbtu given the enormous cost of water in Europe, representing nearly 60% of the cost of drilling. and water is essential to fracture the rock.

Poland is now beyond the stage of “promise” and is a country we will follow closely in this blog, because when you see such concentration of oil companies in one area, there is a reason.

Further read:

http://www.thegwpf.org/press-releases/2938-new-report-shale-gas-shock-challenges-climate-and-energy-policies.html

http://www.aei.org/article/103815

http://energyandmoney.blogspot.com/2010/01/revolution-of-shale-gas.html

http://energyandmoney.blogspot.com/2010/11/shale-oil-600-years-of-supply.html

http://energyandmoney.blogspot.com/2009/11/china-exxon-and-war-for-resources.html

Peak Oil Defenders’ Most Overlooked Myth: EROEI

“So long as oil is used as a source of energy, when the energy cost of recovering a barrel of oil becomes greater than the energy content of the oil, production will cease no matter what the monetary price may be.”– M. King Hubbert

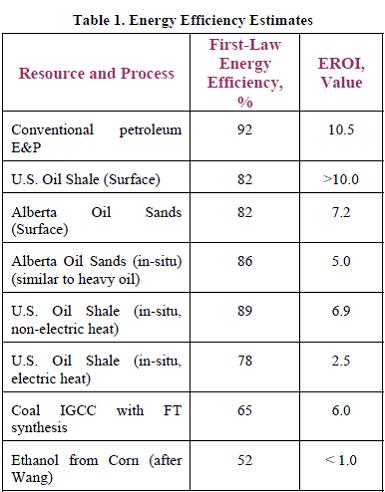

Peak Oil defenders continue to make new claims. While inventories reach the highest levels of the past five years, OPEC fights to keep quotas and for a third consecutive year reserve replacement remains strong, in a world that has not seen a single day of disruption in oil supply, the defenders claim that the problem is EROEI (energy returned on energy invested) and that therefore, it doesn’t matter if supply is abundant, because it is still negative.I had the pleasure of talking with industry leaders and this is their response.

a) The concept of EROEI has to be clearly attached to profitability. Peak oil crash defenders scream at 4:1 levels as unsustainable. This is funny. An “alleged” low EROEI is not necessarily a negative in itself, given that low cost of capital and high technology developments have helped to have readily available and abundant energy all over the energy complex (not only in non-conventional, but in conventional resources), and there has been no issue with supply in any environment despite a few geopolitical bumps. Furthermore, that EROEI rises as efficiency and productivity help reduce power use and increase output.

a) The concept of EROEI has to be clearly attached to profitability. Peak oil crash defenders scream at 4:1 levels as unsustainable. This is funny. An “alleged” low EROEI is not necessarily a negative in itself, given that low cost of capital and high technology developments have helped to have readily available and abundant energy all over the energy complex (not only in non-conventional, but in conventional resources), and there has been no issue with supply in any environment despite a few geopolitical bumps. Furthermore, that EROEI rises as efficiency and productivity help reduce power use and increase output.

b) The concept of EROEI is static, it uses an estimate of energy consumption that starts at an intensive point and that just stays or rises afterwards, and this has proven to be wrong (energy used per unit produced falls dramatically in virtually all industry projects, see Shell’s analysis of oil sands extraction).

c) If EROEI estimates published by peak oil defenders were correct, given the gigantic increase in E&P and non-conventional spending we have had, power usage, and electricity prices and gas prices would have rocketed… But they have fallen. Co-generation is barely considered by EROEI doomsters either.

More importantly, in projects as energy intensive as PNG LNG, cost of energy used has fallen by 34%.

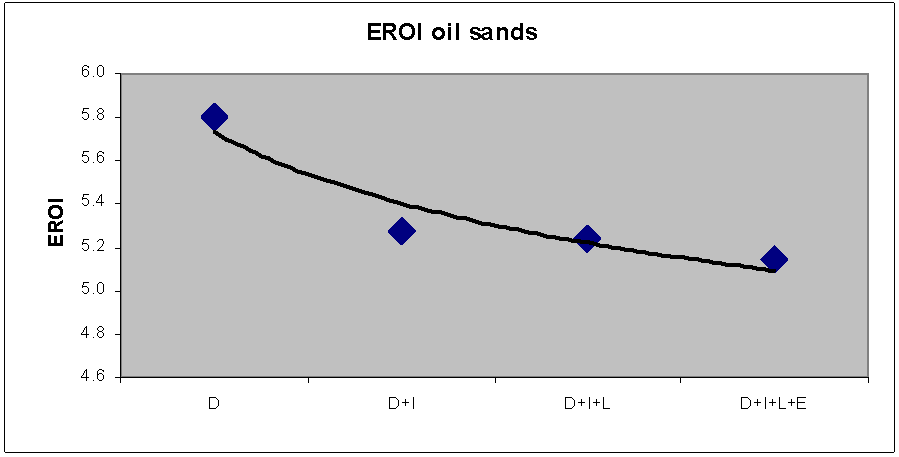

In Oil sands we have seen drops of 25% per unit of production. In shale oil as dramatic as 34%. The graph below shows the EROEI estimates of the Department of Energy in 2006 (link here). This was in 2006. Since then the efficiency and lower use of power and energy in hydraulic fracking and oil sands extraction has significantly increased the EROEI.

d) EROEI is an excuse of peak oil defenders to justify that they have been wrong about supply, turning the debate to the alleged unsustainability of that same supply as a justification.

Finally, any of the peak oil defenders needs to explain how the development cost of the industry has fallen, the energy intensity of the industry has gone down dramatically (they don’t read companies sustainability reports?) yet reserves and production have improved 2006-2010, fundamentally in unconventional.

The EROEI theory takes an individual projection (and this is typical for peak oil), leaves the negative elements untouched and stable (as if techonology and resource development did not improve) and then expands it to the entire base.

This, obviously, leads to a massive generalization and a leap of faith that can be easily denied just looking at 20-F filings, detailed analysis per project, which are available to all shareholders in strategy presentations and Fact Books, and in the brutal fact that oil sector’s electricity and gas consumption has been falling while productivity, particularly in non-conventionals, has soared.

Never bet against human ingenuity.

Further read. The Oil Drum (link here):

On EROEI of oil sands

“EROI depends mostly upon the direct energy used and which alone suggests an EROI of about 5.8. Including indirect energy decreases the EROI to about 5.2”, “adding in labor and environmental costs have little effect”. “Nevertheless it appears that tar sands mining yields a significantly positive EROI”.

On shale oil “Reported EROIs (energy return on investments) are generally in the range of 1.5:1 to 4:1, with a few extreme values between 7:1 and 13:1”. “Tar sands and oil shales seem to be in the same EROI ballpark”.

Note from Daniel Lacalle: Worth noting that the assumption of energy consumption in the article for shale oil is now widely seen as excessive, so real EROEI is currently close to the latter part of the analysis (7x to 13x)

Note from Daniel Lacalle: Worth noting that the assumption of energy consumption in the article for shale oil is now widely seen as excessive, so real EROEI is currently close to the latter part of the analysis (7x to 13x)

Further read:

http://energyandmoney.blogspot.com/2009/11/peak-oil-realities-myth-and-risk.html