Estimates of United States growth have improved but remain massively below the Federal Reserve projections.

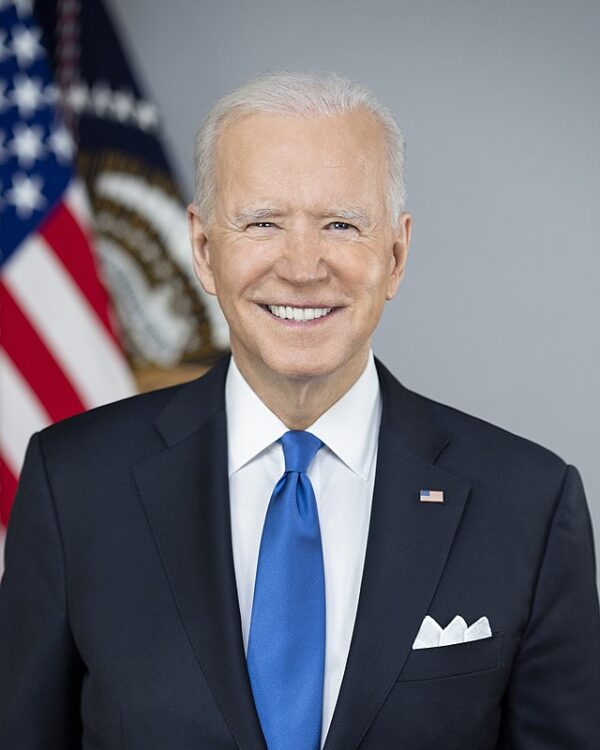

After the largest monetary and fiscal stimulus in recent years, growth remains well below trend and debt is significantly higher. It is interesting to hear Janet Yellen say that “trickle-down economics did not work” when this is the failed trickle down: massive government deficit spending leads to negative real wage growth and weaker GDP.

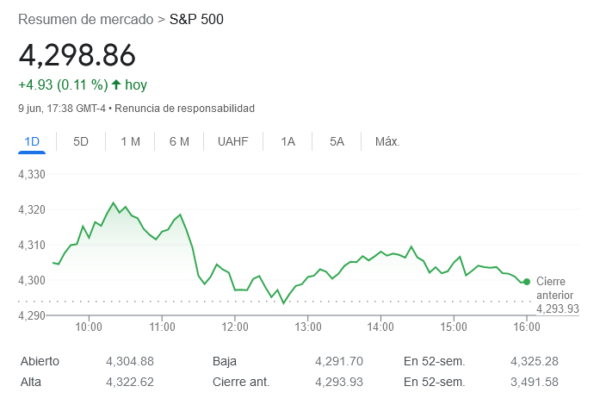

Current consensus real GDP growth for 4Q23 stands at 0.2%, significantly lower than the median projection of 1% in the FOMC’s June Summary of Economic Projections.

The latest figure, for example, shows the evidence of headline strength hiding weakness in the details. New durable-goods orders surged in May, but this headline growth disguised that core capital-goods orders were revised down again.

Continue reading How Bidenomics generates more debt and inflation