In this short video we explore the ideas for 2018.

The year of “no-normalization“. Means that central banks will remain significantly behind the curve, and credit conditions will continue to be extremely loose.

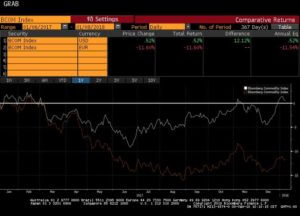

Inflation expectations and currencies. The commoditity complex has only gone up because the US dollar has fallen. This means that inflation expectations can easily change quickly if the US currency recovers.

Earnings estimates need to be monitored. Consensus expects double-digit growth in EPS in most markets. This is essential to cement current valuations, therefore we should monitor earnings surprise.

Daniel Lacalle is a PhD Economist, author of Escape from the Central Bank Trap and Life In The Financial Markets. He is Chief Economist at Tressis.