In this era of monetary fiction, one tends to read all types of undocumented and misguided views on monetary policy. However, if there is one that really is infuriating is the MMT science fiction.

One of its main principles is based on a fallacy.

“A country with monetary sovereignty can issue all the debt it needs without default risk”

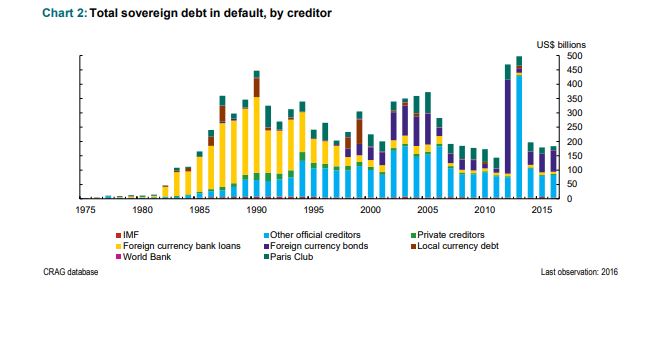

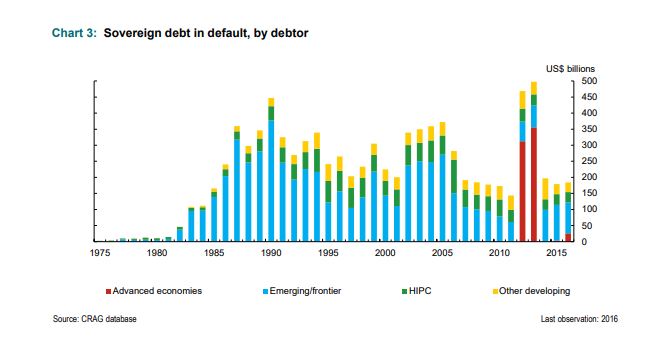

First, it is untrue. A report by David Beers at the Bank Of Canada has identified 27 sovereigns involved in local currency defaults between 1960 and 2016 (database here).

(source: Bank of Canada, David Beers)

David Beers explains: “A long-held view by some investors is that governments rarely default on local or domestic currency sovereign debt. After all, they say, governments can service these obligations by printing money, which in turn can reduce the real burden of debt through inflation and dramatically so in cases like Germany in the 1923 and Yugoslavia in 1993-94. Of course, it’s true that high inflation can be a form of de facto default on local currency debt. Still, contractual defaults and restructurings occur and are more common than is often supposed”.

(source: Bank of Canada, David Beers)

No, a country with monetary sovereignty cannot issue all the debt it needs without default risk. It needs to issue in foreign currency precisely because few trust their monetary policies. Most local citizens are the first ones to avoid domestic currency exposure and buy US dollars, gold or cryptocurrencies (now), fearing the inevitable:

Most governments will try to cover their fiscal and trade imbalances by devaluing and making all savers poorer.

“A country with monetary sovereignty can issue all the currency it needs” is also a fallacy.

Monetary sovereignty is not something the government decides. Confidence and use of fiat currency are not dictated by the government nor does it give said government the power to do what it wants with monetary policies. Citizens all over the world have stopped accepting the government-issued and denominated currency when confidence in its purchasing power has been destroyed after increasing the money supply well above its real demand.

That is why the Sucre in Ecuador or the Colon in El Salvador collapsed or why the Argentine peso and the Venezuela bolivar or the Iran Rial are widely rejected by local and international citizens. There are numerous fiat currencies that have failed or disappeared. As Michael Sanibel writes, “a nation’s currency is not exempt from the laws of supply and demand, so the more that is printed, the less it is worth“. Currency collapses and failures are frequent, but, more importantly, even if some survive, its domestic and international demand is irreparably damaged.

Given that the world of currencies is a relative one, the average citizen of the world will prefer gold, cryptocurrencies, US dollars or Euros and Yen despite their own imbalances rather than their own currencies.

Why is this? When governments and central banks worldwide try to implement the same mistaken monetary policy of the US and Europe or Japan but without their investment security, institutions and capital freedom, then they fall into their own trap. They weaken their own citizens’ trust in the purchasing power of the currency.

The MMT answer would be that all that is needed then is stable and trustworthy institutions. Well, it does not work either. The first crack in that trust is precisely currency manipulation to finance bloated government spending. The average citizen may not understand monetary debasement but certainly understands that their currency is not a valid reserve of value or payment system. Because the value of the currency is not dictated by the government, but by the latest purchase agreements made with such means of payment.

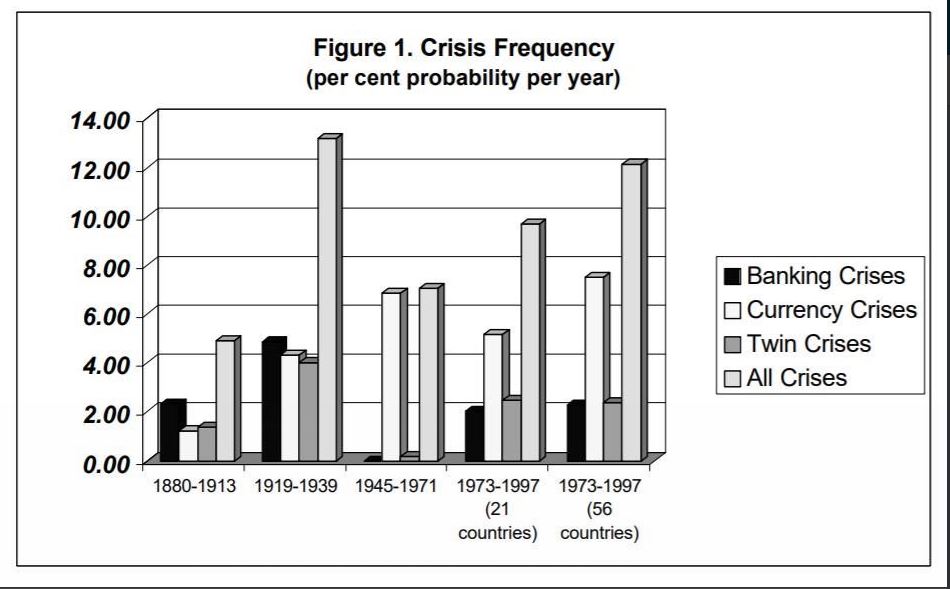

Governments always see economic cycles as a problem of lack of demand that they need to “stimulate”. They see debt and asset bubbles as small “collateral damages” worth assuming in the quest for inflation. And crises become more frequent while debt soars & recoveries weaker.

(source World Bank, Deutsche Bank)

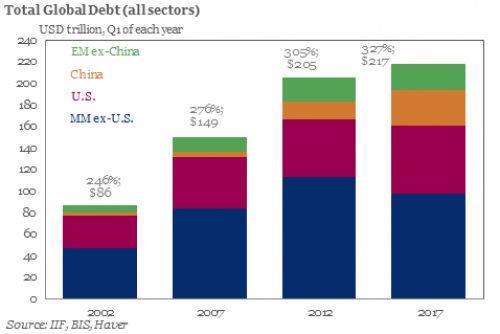

The imbalances of the US, Eurozone or Japan are also evident in the weak productivity growth, high debt and diminishing effectiveness of policies (read “Monetary Stimulus Does Not Work, The Evidence Is In“).

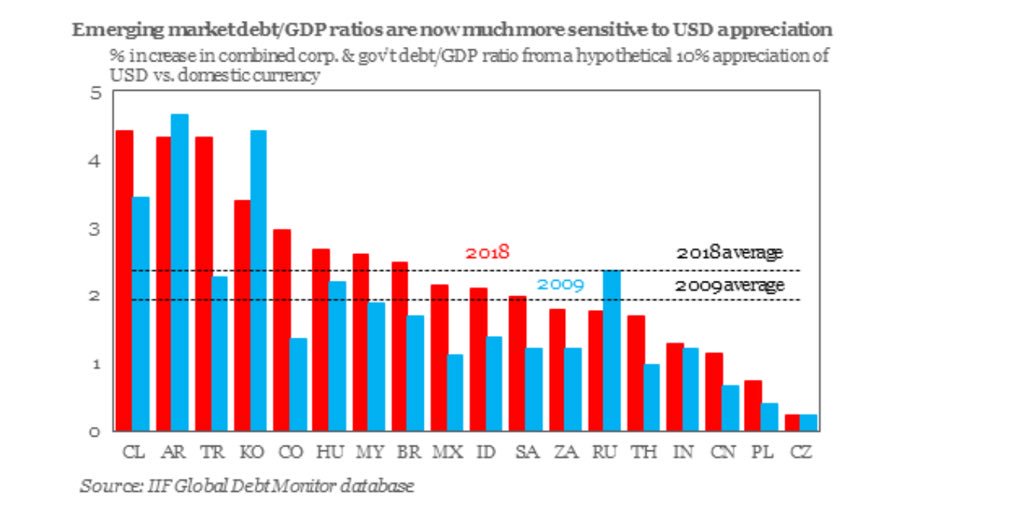

(source IIF, BIS)

Countries don’t borrow in foreign currency because they are dumb or ignore MMT science fiction, but because savers don’t want government currency debasement risk, no matter what yield. The first ones that avoid domestic currency debt tend to be domestic savers and investors, precisely because they understand the history of purchasing power destruction of their governments’ monetary policies.

Some 48% of the world’s $30T in cross-border loans are priced in US dollars, up from 40% a decade ago, according to the Bank of International Settlement. Again, not because countries are stupid and don’t want to issue in local currency. Because there is little real demand.

(source IIF)

As such, governments cannot unilaterally decide to issue “all the debt they need in local currency” precisely because of the widespread lack of confidence in the central bank or the governments’ perverse incentive to devalue at will.

As reserves dry up, and citizens see that their government is destroying purchasing power of the currency, the local savers read minsters talk about “economic war” and “foreign interference”, but they know what really happens. Monetary imbalances are soaring. And they run away.

(source: Capital Economics)

Inflation is not solved with (more) taxation.

Many MMT proponents solve this equation of inflation caused by monetary excess denying that inflation is always a monetary phenomenon, and saying that inflation would be solved by taxation. Is it not fantastic?

The government benefits the first from new money creation, massively increases its imbalances and blames inflation on the last recipients of the new money created, savers and the private sector, so it “solves” the inflation created by the government by taxing citizens again. Inflation is taxation without legislation, as Milton Friedman said.

First, the government policy makes a transfer of wealth from savers to the political sector, and then it increases taxes to the “solve” inflation it created. Double taxation.

How did that work in Argentina? That is exactly what governments implemented, only to destroy the currency, create more inflation and send the economy to stagflation (read).

These two factors, inflation, and high taxation, negatively impact competitiveness and ease to attract capital, invest and create jobs, relegating a nation of enormous potential, such as Argentina, to the final positions of the World Economic Forum index, when it should be at the top.

Excessive inflation and high taxes are two almost identical factors that hide an excessive public expenditure that has acted as a brake on economic activity since it is not considered as a service to facilitate economic activity, but as an end in itself. The consolidated public expenditure reached 47.9% of GDP in 2016, a figure that is clearly disproportionate. Even if we consider primary public expenditure, that is, excluding the cost of debt, it doubled between 2002 and 2017.

The idea that a country’s debt is not a liability but simply an asset that will be absorbed by savers no matter what is incorrect as it does not consider three factors.

- No debt is an asset because the government says so, but because there is a real demand for it. The government does not decide the demand for that bond or credit instrument, the savers do. And savings are not unlimited, hence deficit spending is not endless either.

- No debt instrument is an attractive asset if it is imposed onto savers through repression. Even if the government imposes the confiscation of savings to cover its imbalances, the capital flight intensifies. it is literally like making a human body stop breathing in order to conserve oxygen.

- That debt is simply impossible to assume when the investor and saver know that the government will destroy purchasing power at any cost to benefit from “inflating its way out of debt”. The reaction is immediate.

The Socialist idea that governments artificially creating money will not cause inflation, because the supply of money will rise in tandem with supply and demand for goods and services, is simply science fiction.

The government does not have a better or more accurate understanding of the needs and demand for goods and services or the productive capacity of the economy. In fact, it has all the incentives to overspend and transfer its inefficiencies to everyone else.

As such, like any perverse incentive under the so-called “stimulate internal demand” fallacy, the government simply creates larger monetary imbalances to disguise the fiscal deficit created by spending and lending without real economic return. Creating massive inflation, economic stagnation as productivity collapses and impoverishing everyone.

The reality is that currency strength and real long-term demand for bonds are the ultimate signs of the health of a monetary system. When everyone tries to play the Fed without the US economic freedom and institutions, they only play the fool. Monetary illusion may delay the inevitable, a crisis, but it happens faster and harder if imbalances are ignored.

However, when it fails, the MMT crowd will tell you that it was not done properly. And that it is YOU, not them, who do not understand what money is.

Further read: https://publications.banque-france.fr/en/meaning-mmt

QE 1 and 2 and 3 and 4 and QE infinity is nothing but MMT in practice.

.

With $21 trillion in missing money from HUD and DOD, with QE infinity of handouts to the financial institutions and any other business that is too big to fail (like fracking) or too big to jail (any of the banksters), the US essentially runs on effective MMT terms.

.

Although only MMT for the privileged few.

.

It (the ones at the spigots of the money creation) can afford whatever it dreams of, and it can issue subsidies for Big Business at will … anytime.

.

Unfortunately this ‘exorbitant privilege’ is not being put in the service of the wider citizenry of the USA, not for the aliviation of homegrown poverty, not to lessen the epidemic of despair, nor for the betterment of the global ecological predicament.

.

• Pam Martens and Russ Martens, ‘ The Fed Has Pumped $9 Trillion into Wall Street Over the Past Six Months, But Mnuchin Says “This Isn’t Like the Financial Crisis” , 14 March 2020:

.

https://wallstreetonparade.com/2020/03/the-fed-has-pumped-9-trillion-into-wall-street-over-the-past-six-months-but-mnuchin-says-this-isnt-like-the-financial-crisis/

Your arguments remind me of those Richard Dawkins makes against Christianity. Those being arguments against a Christianity in which no mature, intelligent thinker familiar with Christian theological scholarship believes. Likewise here, you are attacking the straw man erected by political actors who use MMT jargon in an attempt to hide their malfeasance amid ostensibly theoretical differences.

The basics of MMT teach that money must be “printed”/spent into productive sectors of the economy in order to avoid inflation & that a balanced economy is achieved not via a balanced “budget” but, rather, via ensuring growth, controlling inflation, and reducing unemployment. That is why a “jobs guarantee” is central to its precepts.

http://moslereconomics.com/2011/08/04/mmt-history-and-overview/

It is important to expose the facile use of MMT terminology in defense of the indefensible. However, many of its ideas are important to liberating our post-gold-standard minds from gold-standard rules. The USD in the modern era is more correctly understood as a utility and its uses as governed by policy choices made by political actors.

Thanks for your time.

The MMT view is not so much that debts can be serviced by printing money, but rather that the debt itself *is already* money. Swapping a $5 bill for 5 $1 bill is non-inflationary, it creates no new inflation pressure.

So what is the issue with swapping a treasury bond with a face value of $100, for a fed note with a face value of $100?

Excessive debts can definitely cause inflation, which many may consider “a de facto default”

The MMT proposal of a permanent zirp, is in essence to “monetize the entire national debt”. Undoubtedly, markets would respond to this, based on optics, but not reality. No new net financial assets are created when the fed buys debt.

MMT is easiest understood by thinking of fiat currency and fiat debts as equity shares. Inflation is obviously the constraint on total spending. You could say the same of a private company “share price is the budget constraint of a private company”. So long as a company’s share price remains high, it can do further and further capital raises.

Some people seem to be under the impression that MMT wants giant deficits and huge spending programs. Nothing could be further from the truth. The basic MMT proposal is to fix the bid the government’s offers for goods and services, but let the deficit float based on how much the private sector can meet those bids.

Under such a “price anchoring” scheme, the first whiff of inflation would lead the public budget to drop dramatically, as these fixed bid levels would no longer be competitive, so no one would take the other side of the contract. But the point was always full employment at a stable price.

Technically, MMT is not a specific set of proposals, but this kind of price anchoring, such as a job guarantee at $9/hr(mosler’s original proposal), is an example of something MMT considers a robust policy combination for achieving full employment and price stability. Most others would struggle to reason about the effect of a job guarantee or any other price anchoring on budget and price. But it is self limiting. As soon as you get inflation, then people demand higher wages, and thus the job guarantee pool shrinks, and those workers transfer to the private sector.

Thanks for taking the time to write a thoughtful and engaging article, and while I disagree, this at least creates an opportunity for discourse