The idea that governments can’t lower taxes because there is a deficit, but are free to raise all expenses even if there is a deficit can be found in many political manifestos these days. Central planners always see the economic challenges as a problem of demand, and as such cringe at the idea of prudent investment and saving. When GDP growth, gross capital formation, and consumption are lower than what Keynesians would want, they always blame the alleged problem on “too much saving”, a ridiculous premise based on the perception that economic cycles and excess capacity do not matter and if companies and citizens don’t spend as much as the government wants, then the public sector should spend a lot more.

The idea that governments can’t lower taxes because there is a deficit, but are free to raise all expenses even if there is a deficit can be found in many political manifestos these days. Central planners always see the economic challenges as a problem of demand, and as such cringe at the idea of prudent investment and saving. When GDP growth, gross capital formation, and consumption are lower than what Keynesians would want, they always blame the alleged problem on “too much saving”, a ridiculous premise based on the perception that economic cycles and excess capacity do not matter and if companies and citizens don’t spend as much as the government wants, then the public sector should spend a lot more.

That is why tax cuts are hated and government spending plans are hailed. Because tax cuts empower citizens while government spending empowers politicians. An extractive view of the economy in which politicians and some economists always consider that you earn too much and they spend too little.

However, we have empirical evidence showing that massive government spending plans and tax hikes generate the opposite effect: Weaker economic growth, higher debt and larger imbalances. The probability of attacking potential growth, worsening public accounts and breaching optimistic estimates is more than high.

The empirical evidence of the last fifteen years shows a range of fiscal multipliers of public spending that, when positive, is very poor (below 1) and in most countries, especially with open and indebted economies, the fiscal multiplier of higher government spending has been negative.

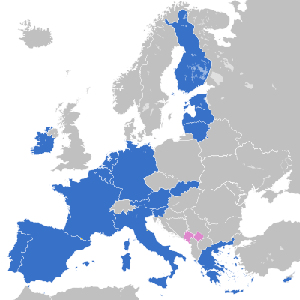

Fiscal multipliers are particularly negative in times of weakness in public finances, and nobody can deny that the eurozone has exhausted its fiscal space after more than three trillion euro of expansive budgets in a decade.

More government spending will not spur growth in economies where the public sector already absorbs more than 40% of the GDP, and where the previous large stimulus plans have generated more debt and stagnation.

Adding tax hikes to the formula is even more damaging. The IMF analyzes 170 cases of fiscal consolidation in 15 advanced economies from 1980 to 2010 and finds a negative impact of a 1% increase in taxes of 1.3% in growth two years later.

Additionally, the vast majority of empirical studies going until 1983 and especially in the last fifteen years, show a negative impact of tax increases on economic growth and a neutral or negative impact of increases in spending on growth. Moreover, studies on the effect of bigger tax hikes on tax revenues reveal a negative impact on receipts. In fact, a 1% increase in the marginal tax rate may reduce the taxable income base by up to 3.6%.

The risk for the eurozone is huge because one of the main reasons for its stagnation is precisely the chain of massive fiscal stimulus plans implemented in the past two decades. To say that Germany should copy the fiscal strategy of France, a country that has been in stagnation for three decades defies any economic logic. There is no evidence that Germany is spending or investing ñless than what it needs, rather the opposite.

The problem of the eurozone is not lack of government spending or taxes, but the excess in both.

The string of spending increases announced daily in Europe disguise an extremely dangerous bet: that the ECB will bail out the eurozone forever, especially because the diminishing effects of monetary and fiscal policy are evident.

Tax cuts will not work either if those are not matched with efficiency improvements and red tape cuts precisely to ensure that public services continue to exist within thirty years.

Burdening the private sector with more taxes and increasing an already bloated government spending may lead the eurozone to the Argentine paradox. By ignoring the sources of wealth generation as well as job creation and expelling them with confiscatory and extractive policies all that is achieved is unemployment and stagnation.

The eurozone cannot expect to achieve the growth it has not delivered repeating the same mistakes, further weakening an economy that needs to bet on attracting investment, reinforcing growth and improving technology and the competitiveness of companies.

When politicians charge an economy with large and growing fixed costs, without prioritizing investment attractiveness, productivity and economic freedom, they jeopardize the welfare they pretend to defend.

The problem of productivity, growth, and employment is not solved by putting obstacles to investment and increasing extractive measures.

Growth and the welfare state are not strengthened by putting political spending and debt as pillars of an economy.

Additional reading:

Ethan Ilzetzki, Enrique Mendoza y Carlos Vegh. How Big (Small?) are Fiscal Mutlipliers?

Giancarlo Corsetti, Andre Meier, y Gernot J. Müller. What Determines Government Spending Multipliers?

Karel Mertens y Morten Ravn. The dynamic effects of personal and corporate income tax changes in the United States.

Norman Gemmell, Richard Kneller e Ismael Sanz. The Timing and Persistence of Fiscal Policy Impacts on Growth: Evidence from OECD Countries.

Jens Arnold, Bert Brys etc. Tax Policy For Economic Recovery and Growth.

Robert Barro y C.J. Redlick. Macroeconomic Effects of Government Purchases and Taxes.

Alberto Alesina y Silvia Ardagna. Large changes in fiscal policy: taxes versus spending, in Tax Policy and the Economy.

FMI, Will it hurt? Macroeconomic effects of fiscal consolidation.

Young Lee y Roger Gordon. Tax Structure and Economic Growth.

José Felix Sanz. Reported gross income and marginal tax rates: estimation of the behavioural reactions of Spanish taxpayers.

Carlos Díaz-Caro y Jorge Onrubia. How do taxable income responses to marginal tax rates differ by sex, marital status and age? Evidence from Spanish dual income tax.

Has the IMF proved multipliers are really large? (wonkish)”. Financial Times, 12 October, 2012.

Teresa Leal, Javier J. Pérez, Mika Tujula y Jean-Pierre Vidal. Fiscal Forecasting: Lessons from the Literature and Challenges.

I’m not a good trader, never have been. I heard about binary options trading from my friend and tried it but never got results I wanted and didn’t have enough time to get better at it. So when I came across the oil and gas invest managed account, I thought that it was perfect for me: I don’t need to do anything, pros will do everything for me. Sure, it’s a big investment, but that also means big profits, right? It turned out to be the best thing that’s ever happened to me, cause in just 2 months I made more money than in my entire career! It’s incredible how free I felt once I got my profit. All this happened after i got introduced to total company,where you invest in oil and gas..you can reach him at E-mail: totalinvestmentcompany@gmail.com