Estimates of United States growth have improved but remain massively below the Federal Reserve projections.

After the largest monetary and fiscal stimulus in recent years, growth remains well below trend and debt is significantly higher. It is interesting to hear Janet Yellen say that “trickle-down economics did not work” when this is the failed trickle down: massive government deficit spending leads to negative real wage growth and weaker GDP.

Current consensus real GDP growth for 4Q23 stands at 0.2%, significantly lower than the median projection of 1% in the FOMC’s June Summary of Economic Projections.

The latest figure, for example, shows the evidence of headline strength hiding weakness in the details. New durable-goods orders surged in May, but this headline growth disguised that core capital-goods orders were revised down again.

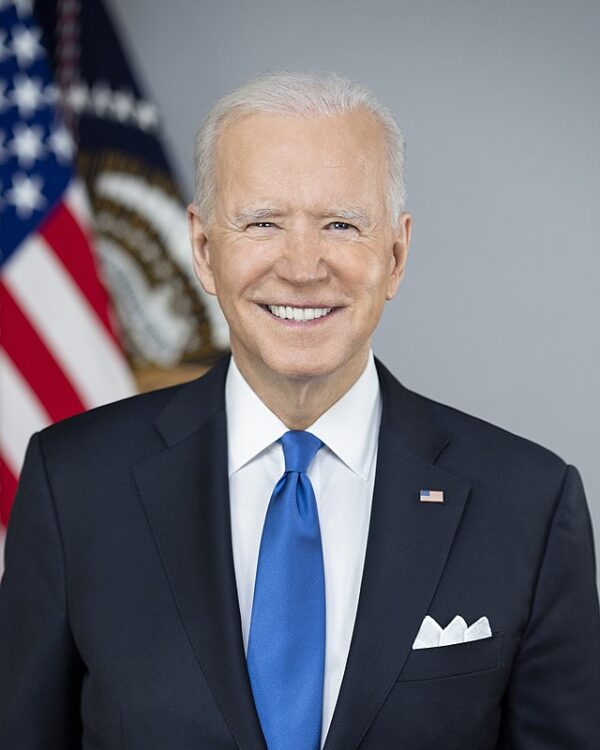

Even if we consider the optimistic assumptions of the Biden administration, which assume a 2% per annum GDP growth until 2032 and 3.8% unemployment, the United States federal government deficit would not fall below 5% of GDP even in 2032. That is a deficit that rises from $1.1 trillion in 2023 to $2.01 trillion in 2032, an accumulated deficit between 2023 and 2032 of $15.46 trillion. That is a 106% debt to GDP according to the Biden administration calculations even with very bullish estimates of growth that consider no recession or stagnation in the entire forecast period.

One of the biggest problems of this neo-Keynesian approach to government budgets is that it leaves households with less money in real terms and the “anti-inflation” measures increase debt and inflation.

Take the American Rescue Plan. It was supposed to be the helicopter money solution to the crisis, giving families cash and supporting consumption through the pandemic. Adjusted for inflation, Bloomberg Economics estimates the average household in the bottom 40% of the income distribution now has liquid assets worth $1,200 less than they did before Covid. You wanted the stimulus cheque with printed money? You paid for it multiple times over in higher inflation.

The other key policy items of the Biden administration, the Inflation Reduction Act, the CHIPS and Science Act, and the Bipartisan Infrastructure Law were created to incentivize aggregate demand and boost investment in areas where the private sector seemed to be underinvesting. However, it was not the case. The problem is that the government does not have more or better information about the requirements of the real economy, assumes erroneously that the private sector did not invest because of some flaw in the market, and these massive federal expenditure programs generate more inflation as they add artificial demand created with newly printed units of currency to an economy that is already working at full capacity and full employment. Thus, it puts more fuel to the fire of inflation.

Bloomberg Economics warn that “If successful, the benefits of these projects will play out in the long term – and other deliverables, like reduced dependence on China and lower carbon emissions, won’t show up directly in the GDP data. In the near term, our view is that the costs in terms of higher inflation and recession risks offset the benefits and may even outweigh them”. Even if we assume a benign view of multiplier effects, the result is that these plans accelerate the risk of a recession by artificially tightening an already strong labor market and putting more pressure on supply chains.

The Inflation Reduction Act assumes a total of $500 billion in federal expenditure and tax breaks to accelerate investment in clean energy. This was utterly unnecessary when the United States was already a global leader in renewable energy investments, and the program so far has created more inflationary pressures as artificial government spending added to an already hot industry. Furthermore, if there was an industry that required no further support from the government it was the clean energy sector, which had no impact from the pandemic on investor demand and ample financing capacity.

The same happens with the Bipartisan Infrastructure Law, $550 billion in new spending over five years, included a clearly unnecessary artificial boost to an already booming sector, driving prices much higher.

Even considering revenue-generating measures, and assuming they would work, the net effect “will be to add on average about 0.1% of GDP per year to the primary fiscal deficit during that period” according to Bloomberg Economics.

Launching multi-billion spending programs financed with newly created money and debt into an economy that was already running at full capacity has added to inflation and further debilitated the public finances. Meanwhile, the measures taken by the Federal Reserve to reduce the inflationary pressures -that were worsened by the government anti-inflation spending programs- make a recession more likely. The Federal Reserve must act to reduce the inflation that the government generates with its anti-inflation spending programs and by doing so, may create a recession as the rate hikes and monetary contraction hinder families and businesses. Brilliant.

When all this fails and revenues fall below estimates, growth deteriorates or leads to a recession, and debt soars, neo-Keynesians will say that another massive government spending program is required.