One of the most repeated sentences in the financial media is: “do not fight central banks”, making the argument that you have to be invested in equities and especially in the most cyclical part because central banks increase money supply and support risky assets.

Reality shows us otherwise. Following the central bank only works in the United States and particularly in technology companies. In Europe, following the central bank is not only a bad idea. It is counterproductive.

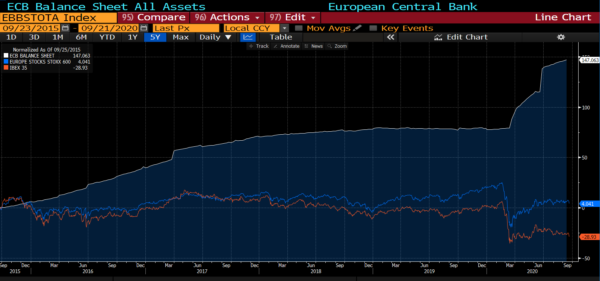

The balance sheet of the European Central Bank has expanded more than 147% since 2014 and the Stoxx 600 index, which includes the 600 most important companies in Europe, has appreciated just over a paltry 4%. There is a similar story in emerging markets. Global money supply has soared to all-time highs and the Emerging Market MSCI Index has barely appreciated by 5%. In fact, investors are taking significantly more risk only to follow monetary policy for weaker results.

“Don’t fight the Fed” may be correct in the United States where the identity between companies and minority shareholders is greater, but of course “Don’t fight the ECB” is completely false for equities. in fact, you can fight the ECB whenever you want and it works. The ECB’s policy has supported sovereign bonds, leaving the yields of insolvent states at negligible levels, thus generating a huge bubble in bonds, but in the case of equities? Nothing.

It is important to remember this when we decide to invest. Fundamentals do matter. US companies buy back shares, around 198 billion dollars in the first quarter of 2020, and by reducing the number of shares in circulation the effect on the stock price is positive. Be careful, because not canceling the shares as some European companies do in their ridiculous and insignificant buyback plans does not work.

Another essential factor is earnings estimate reviews. In the United States the reviews are more realistic. Companies do not “guide” consensus with gradual reductions in estimates as is the case in Europe, where it is common practice to reduce analysts’ expectations and then publish results “in line with consensus” when “expectations” have been heavily massaged and reviewed several times. If we analyze the revisions to earnings estimates of European companies, many are surprised that those that appear to be cheaper are the ones that suffer the greatest cuts… And then they are not so cheap. The average of estimates cuts by sector in European companies compared to North American companies ranges between 20% and 30% larger. That is to say, at the beginning of the year, companies in any particular sector in Europe seem optically cheaper than those in the United States, but throughout the year, the earnings expectations of the European companies are revised much lower than the equivalent revised estimates of the US. stocks. We always hear that “Europe is cheaper than the US” without paying attention to the composition of profits, the weight of the sectors with high added value in the index, and the shareholder remuneration policy.

An index with more high-margin, high-growth companies is not more expensive than an index where the greatest weights are traditional sectors without organic growth.

Looking ahead to the next few months, we will have to analyze in great detail the evolution of fundamentals, at the macro level, profits, cash, and margins. The recent rebound has caused many companies today to trade at unjustified multiples in most countries. This is why we must be especially cautious about believing in the magical placebo effect of central banks. The European investor should have already learned that the ECB does not give away returns in the stock market.

Daniel Lacalle

Chief Economist