Front Row represents the personal view of Rodrigo Rodriguez, European Head of developed cash trading for Credit Suisse.

I know some of you might be disappointed that FR is back and that this week Back Row team will take some deserved rest, however to give credit to everyone both are always a combined effort.

Unfortunately for me I think the team made a terrific effort last week, and standard is quite high now. (All that said half of the ideas were mineJ)

On a more serious tone, not much will change on this week note, we are bullish Europe and Japan and I do not expect that changing any time soon, we believe on QE and even hawkish statements by the ECB will reverse as soon as EUR breaks over the 1.40 level as exporters will get properly damaged and in words of my friend Juan, we will keep optimistic about Spain by seeing that European debt market starts to transition from a market clearly dominated by banks to a proper corporate market ( Ferrovial has issued a 5Y bond at MS+260 and the books are aggressively oversubscribed)

Buy the dips, any consolidation will just be an opportunity to buy.

This Tuesday I talked to a HF manager I have in high consideration and who in Nov/ Dec kept telling me “I am long but it feels wrong “ and now states “I am long because I want to be long” . For first time they prefer Europe vs. US, well I do not think they are alone on this bet . Us flows are definitely coming back, insurers are massively underweighted equities, even super bear Chief Global strategies for Soc Gen is calling the European market a “once in a lifetime opportunity”

As Marina told me recently “It is true that inflows into global equity funds have risen to a 2-year high (on the EPFR data). But if we plot inflows versus the equity market, global equities do not look extended. Taking a longer-term view, for me it is just the beginning of the Great Rotation trade: since 2008 bond funds have seen $1,190bn of inflows, while equity funds have experienced about $360bn of outflows”.

As Neville Hill says, “The “flight to safety” during the euro area debt crisis now means many financial institutions hold portfolios with a high weighting of “safe” assets, such as US, UK or German government bonds, which now offer very little in the way of return (“return free risk?”). Up to, and including, last year that “flight to safety” meant a significant capital appreciation of those “safe” assets.

However, they have now appreciated to such a level that their yields are very low, get ready as that bubble is going to burst . Credit is at the tightest levels of the last 5 years , and credit risk appetite is at euphoria level, something has to give and this time Equities will be the safe heaven . Sentiment has clearly improved on Equities but we are far from Euphoria , so again fasten your belts, they might be a minor consolidation as technically we look a bit toppy but the final direction is up, especially for Europe and Japan.

See comments from David Sneddon on them some confirm my fears some do not but worthy to write them :

US Credit Risk Appetite needs a momentum sell (lower panel) to confirm a turn. Not there yet, but getting closer.

Interestingly, a peak in Credit Risk Appetite does not always tie in with a peak in credit itself, although it certainly can do. Can just mark a slowing of the trend, or even a change in the relative value between IG and HY.

On balance, I think credit can get stronger yet, and still prefer European credit to US, and ITRX XOVER probably slightly more than Main.

In Europe, XOVER looks to have more room to tighten yet. Slightly concerned Main is close to what would expect to be fairly decent interim resistance at 95.50/94.50bps.

For US credit, we still haven’t managed a fresh tightening break here, hence bias to Europe.

US markets are a different story , Debt Ceiling will do damage, however has anyone thought where would the S&P be if Apple would not be 30% down from the highs?.

Best point I have ever heard on Debt Ceiling came from a hypothesis Dr. Soss mentioned this week on our securities risk meeting “What if the Republicans agree straight away so there is no negotiation for Tax increases ?” Equities would definitely rally but would Obama be able to manage a country with above a Trillion debt without Tax increases….it will definitely be fun to watch.

On a different point as Raph from Global Equities wrote this week the Bernanke speech was just a dream, as the only way equity could collapse would be a too sharp rate hike move, which he massively downplayed

Protect yourself , vol might not be cheap but it is clearly low

So all that say if you want to tactically go short, what might not be a bad short term call buy calls and over hedge them with futures.

Truth is that vol algos kept selling vol at 14 and the market realises 13.2% or lower, but equities vol is not price to perfection and that cannot last too long…

Vol might not be cheap but just low, but at these levels why do you want to buy cash either on indices or stocks…. Half of the world is still underperforming their benchmark so you have to play it through options the leverage you get at these vol levels is ridiculous.

You do not need to be a derivatives trader anymore, just buy vanilla calls and vanilla puts, decide your notional and your premium and put it to play…if vol goes down who cares, you will make it in your gamma. The cost of carry (theta) has been decimated!!!!

Where are we on the global picture. The Great rotation

My guess is I am heading for another ½ mark from my painfully honest colleague Mr Johar on this note, but one day I will explain the conditions under which we have been putting together this note lately and hopefully you will understand , that is not easy to add proper value with such shortage of time.

This week there were two pieces of extreme interest the ML survey and a piece from Andrew G on Rotation ( let me know in case you did not receive it )

The biggest take from the survey was given by Ben C on his monthly comment : The broad take-away from this month’s data is that the bear market in conviction that has been evident in recent months is alive and well, with 50% of sectors at or below a 10% underweight/overweight. . Definitely noting a growing degree of anxiety among some clients about the possibility of a more “normal” recovery in 2013, i.e. a world in which central bank policy serves to smooth the stop-start cycles that have been a recurring feature of the last few years.

People might have been buying but definitely not enough, the second reading for me, is that the comment on the street is that everyone is underweighted banks…I personally do not think that is the case, so after having been a massive bull on them the last 3 months, now I would only buy calls on the index and certain Spanish (yes Spanish!!!) mid cap banks (BKT, POP etc.)

On Andrew G I think it is interesting to mention the following effect that might be near to be over :

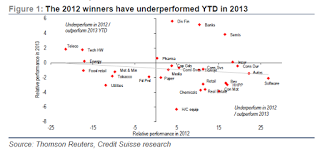

Sector performance YTD has followed a similar pattern to that of the last two years, with the market selling the previous year’s winners and buying the losers. 65% of sectors have switched from outperforming to underperforming and vice versa, compared to an average of 74% in the last two years.

Price reversal A strategy of buying the stocks that have suffered short-term losses (CSEUPRLU Index) and selling the stocks that have generated high returns over the past 6-12 months (CSEUPMLU Index) has produced average returns of 10% in January in the last three years; so far this strategy has only outperformed by 1.3%. Hence, we would buy those stocks that feature in CSEUPRLU, underperformed in 2012 and are Outperform rated: EDP, Galp, Iberdrola, Pearson and Thyssenkrupp. We would avoid last year’s winners that are Underperform rated: Inditex, Kone, Swiss Life.

The January signal is not necessarily a guide to the rest of the year: Only 52% of the time does January outperformance persist in the remainder of the year. Thus we advise using any January strength to lighten up on telecoms (we recently downgraded to benchmark) and energy (we are underweight). Only 43% of January losers typically continue to underperform. Thus we would use software’s underperformance in January as a buying opportunity.

Persistence: If a sector continues to outperform in January having outperformed in the previous year (i.e. no reversal), then 83% of the time (in the last 3 years) it outperforms for the rest of the year. This is good for banks, semis, diversified financials and pharma (banks also benefit from one of the highest correlations with ISM new orders). This is bad for utilities and tobacco (56% of the time underperformance continues). The low level of ISM compared to the previous two Januarys, declining correlations within and across markets and the low level of equity sector risk appetite (relative to global risk appetite) mean the trends of 2013 could persist.