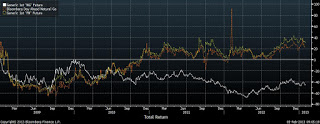

Chart: US gas price -44% since shale gas revolution, Euro gas +23%, UK gas +30% (in USD)… Ban fracking! 🙂

Chart: US gas price -44% since shale gas revolution, Euro gas +23%, UK gas +30% (in USD)… Ban fracking! 🙂We live in panic times. Horror stories abound about shale gas, the energy revolution that has taken US gas prices to the lowest level in decades, has created 2.1 million jobs, 75 billion in tax revenues, 283 billion in GDP, and raised household income up by $1200/yr (source: CERA) … More importantly creating a massive competitive advantage for the US versus Europe and the rest of the world that suffer high cost of energy due to expensive pipeline gas and LNG, polluting coal and heavily subsidized alternatives, crippling economic growth and prosperity. Instead of working alongside industry leaders and innovators, together with environmental agencies and governments to develop this clean and cheap source of energy in an environmentally friendly way, we, in Europe, decide to ignore it. Meanwhile, in the US, the eco-friendly Democrat administration is supporting its way to growth and jobs putting in place the framework to develop this enormous resource in a sustainable way.

I hereby compile the main concerns as outlined in Credit Suisse’s excellent report “The Shale Revolution” (12/17/12) and the essential articles from Robert W. Chase (Debunking the fracking myths) and other experts (see below) with my own analysis from my post “The Energy Treasure That Most Europe Rejects”

In my post I mentioned:

Nine hundred billion euros.This is what Europe could save in its goal of reducing CO2 emissions by 80% in 2050 if, in addition to further renewable energy, the continent would develop its shale gas reserves according to this sector study.

The funniest thing is that the coal, conventional gas and solar lobbies have all joined forces in the war against shale gas. There must be something truly threatening and interesting to see such an unholy alliance.

None of the three are interested in cheap gas prices, because they have seen with horror how gas prices in the U.S. have plummeted due to the shale gas revolution, and therefore obliterated the use of coal for power generation and the grants of succulent subsidies as abundant energy reduced power prices (see my previous post about this). And for a continent obsessed on energy independence, it seems funny for Europe to deny the chance of developing domestic gas, not Russian or Nigerian or Qatari. European. And 50% cheaper if production grows as it has in the United States. What a horror. Ban It!

Europe has no fewer than 156 tcm (trillion cubic metres) of estimated shale gas reserves. That means c90 years of demand covered and saving up to €24bn p.a of subsidies for alternative technologies. Ban it!.

“Even those man-made tremors large enough to be an issue are very rare, says a special report by the National Research Council. In more than 90 years of monitoring, human activity has been shown to trigger only 154 quakes, most of them moderate or small, and only 60 of them in the United States. That’s compared to a global average of about 14,450 earthquakes of magnitude 4.0 or greater every year, said the report.

Only two worldwide instances of shaking — a magnitude 2.8 tremor in Oklahoma and a 2.3 magnitude shaking in England— can be attributed to hydraulic fracturing”. “There’s a whole bunch of wells that have been drilled, let’s say for waste water and the number of events have been pretty small,” said report chairman Murray Hitzman, a professor of economic geology at the Colorado School of Mines. “Is it a huge problem? The report says basically no.”

Quoting Robert W Chase’s excellent “myths of fracking”: “William Leith, senior science adviser for earthquake and geologic hazards at the U.S. Geological Survey, told National Public Radio recently: “Fracking itself does not put enough energy into the ground to trigger an earthquake. That’s really not something that we should be concerned about.”

Oil and gas waste water disposal wells, on the other hand, do have a history of causing tremors, most recently in Youngstown, Ohio. However, by reducing the volume of water injected, the depth of wastewater injection wells, and avoiding earthquake-prone areas, the risk of inducing tremors, however small, can be reduced.”

Robert W Chase wrote “Some mistakenly say the practice can pollute water tables which lie just a few hundred feet or less below the surface. Fracking is done well below 7,000 feet, and solid rock separates the oil and gas deposits from shallow groundwater aquifers. This rock buffer makes contamination from fracking virtually impossible.

In addition, wells are built with at least four layers of steel casing and concrete and are cemented in place, creating a solid divider between gas production and any fresh-water aquifers. Energy Secretary Steven Chu recently asserted: “We believe it’s possible to extract shale gas in a way that protects the water, that protects people’s health. We can do this safely.”

http://www.ohio.com/news/local/chesapeake-unveils-system-to-recycle-waste-water-from-fracking-drill-sites-1.264011By Robert W. Chase (Debunking the fracking myths http://eetweb.com/Debunking-fracking-myths/) © 2013 Penton Media Inc.:

On the positive side: According to a study by IHS Global Insight, in 2010, U.S. shale gas production due to fracking generated $76 billion toward GDP, accounted for $33 billion in capital investments, was responsible for $18 billion in tax and federal royalty revenues, and supported 600,000 jobs. Experts estimate that nearly $2 trillion in capital investments will be created into the U.S. shale-gas industry through 2035. The benefits of such large investments will spread through communities, businesses, and governments.

Adam Sieminski, IEA:

“US energy independence is not a pie in the sky. It’s realistic”

The other surprising new argument is that anti-fracking groups say that shale gas and oil is uneconomical. I shed a tear at their concerns about other people’s money. An industry fully driven by private entrepreneurs, no subsidies, no government, financed with private capital and very little debt. The average of the E&P sector in US is 2.6x Net Debt to EBITDA -including Chesapeake, ex-CHK it falls to 2x. This compares to 3.5x in other energy sectors and 6x average in renewables, with wind and solar sometimes close to 80% debt at project level.

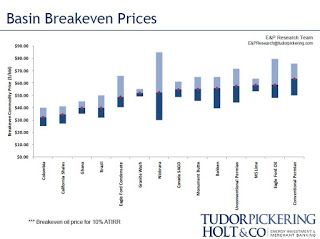

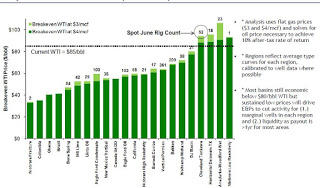

The other surprising new argument is that anti-fracking groups say that shale gas and oil is uneconomical. I shed a tear at their concerns about other people’s money. An industry fully driven by private entrepreneurs, no subsidies, no government, financed with private capital and very little debt. The average of the E&P sector in US is 2.6x Net Debt to EBITDA -including Chesapeake, ex-CHK it falls to 2x. This compares to 3.5x in other energy sectors and 6x average in renewables, with wind and solar sometimes close to 80% debt at project level. A sector where private investors risk their own money and tens of billions are put to work in shale gas, but seems everyone of those investors is wrong, and (surprisingly) the same defenders of subsidized energies and intervention in energy price mechanisms, forget the effect of shale gas in energy bills… but are the ones that are suddenly worried about investment returns!! and inform us of the poor economics of private cash invested in shale. However, average ROIC (return on invested capital) of the shale gas sector since 2010 has never been worse than 5%… with gas prices falling 21% in 2010 alone! (in 1Q 2014, ROCE of the industry averaged 17% according to UBS and Goldman Sachs) Compare that to any utility in Europe, or any renewable company ex-subsidies, or coal companies.(Charts courtesy Tudor Pickering)

A sector where private investors risk their own money and tens of billions are put to work in shale gas, but seems everyone of those investors is wrong, and (surprisingly) the same defenders of subsidized energies and intervention in energy price mechanisms, forget the effect of shale gas in energy bills… but are the ones that are suddenly worried about investment returns!! and inform us of the poor economics of private cash invested in shale. However, average ROIC (return on invested capital) of the shale gas sector since 2010 has never been worse than 5%… with gas prices falling 21% in 2010 alone! (in 1Q 2014, ROCE of the industry averaged 17% according to UBS and Goldman Sachs) Compare that to any utility in Europe, or any renewable company ex-subsidies, or coal companies.(Charts courtesy Tudor Pickering)

Finally, on EROEI:

“Hydraulic fracking has been studied with a published paper showing the energy return on investment (aka EROI) with a total input energy compared with the energy in natural gas expected to be made available to end users is similar to or better than coal…

…The analysis indicates that the EROI ratio of a typical well is likely between 64:1 and 112:1, with a mean of approximately 85:1. This range assumes an estimated ultimate recovery (EUR) of 3.0 billion cubic feet per well. This is similar but significantly higher to the EUR of coal, which falls between 50:1 and 85:1.

I made a lengthy post here (http://energyandmoney.blogspot.co.uk/2011/06/peak-oil-defenders-most-overlooked-myth.html) but the words of the IEA make a lot of sense as a finish line: “As long as consumers are willing to pay for it and resources are there, consuming some energy to produce energy is fine”.

Further read:

Fracking: Facts and Myths

http://thf_media.s3.amazonaws.com/2012/pdf/bg2714.pdf

Anti-fracking documentary challenged with facts:

http://watchdog.org/42444/oh-gaslands-claims-debunked-by-new-documentary/

(Bloomberg: Feb.11, 2013) – Record petroleum exports helped shrink the U.S. trade deficit in December to the smallest in almost three years as America moved closer to energy self- sufficiency, a goal the nation has been pursuing since the 1973 Arab oil embargo.

The gap narrowed 20.7% to $38.5 billion, the smallest since January 2010 and lower than any estimate in a Bloomberg survey of 73 economists, Commerce Department figures showed today in Washington.

Oil exports climbed $11.6 billion. In addition to trimming the trade deficit, greater fuel autonomy helps boost household incomes, jobs and government revenue and makes American companies more competitive. An improving global economy, reflected by record exports.

Further read: http://blogs.the-american-interest.com/wrm/2013/07/05/shale-gas-is-fracking-green/

Is it posible that there is a “fracking bubble” as there was a “real estate bubble”?

I don’ t think so. The real estate bubble was based on unsustainably high prices and massive leverage. There is virtually no leverage in the shale gas industry as a whole

When you think of the most indebted companies, compared to other sectors it’s asset backed and cash flow generating

Thank you very much for your explanation.

It´s necessary to take care with definitive assertions .See what has just happened in Poland regarding shale gas exploration.Technology cannot be simply transfered from USA.Regards

http://www.ft.com/intl/cms/s/0/5e883fdc-b94c-11e1-b4d6-00144feabdc0.html#axzz2LjExHG4p

Regargs

Definitive assertions? The issue in Poland was simply too many smnall cap E&Ps trying to get a quick result with low capex in the least prolific basin. Not an issue o technology. When the large players started investing, solutions have been seen.