The European Central Bank announced a tapering of the repurchase program on September the 9th. One would imagine that this is a sensible idea given the recent rise in inflation in the eurozone to the highest level in a decade and the allegedly strong recovery of the economy. However, there is a big problem. The announcement is not really tapering, but simply adjusting to a lower net supply of bonds from sovereign issuers. In fact, considering the pace announced by the central bank, the ECB will continue to purchase 100% of all net issuance from sovereigns.

Category Archives: Sin categoría

Nordic Countries Do Not Mean Big Government or High Corporate Taxes

A lie is still a lie even if it is often repeated. And claiming the Nordic countries are socialist economies with high taxes for wealth and businesses is a big lie.

Nordic countries are not socialist. They rank at the top in the Heritage Foundation’s Economic Freedom Index 2020 (Denmark,10, Finland, 17, Sweden, 21, Norway, 28). They also rank at the top in the World Bank’s Ease of Doing Business Index 2020 (Denmark, 4, Norway, 9, Sweden, 10, Finland, 20), with simple and limited business regulation and strong support for entrepreneurship.

Central Banks Cannot Really Taper In This Slowdown

Recent macroeconomic data from the United States should worry us. Amid the reopening and the biggest fiscal and monetary stimulus in recent history, and with all the possible tailwinds from policy decisions, consumer confidence has plummeted to the lowest level since 2016.

Retail sales have fallen sharply again in July, and the employment or industrial production data are far more than disappointing considering the level of stimulus and that GDP has returned to pre-pandemic level.

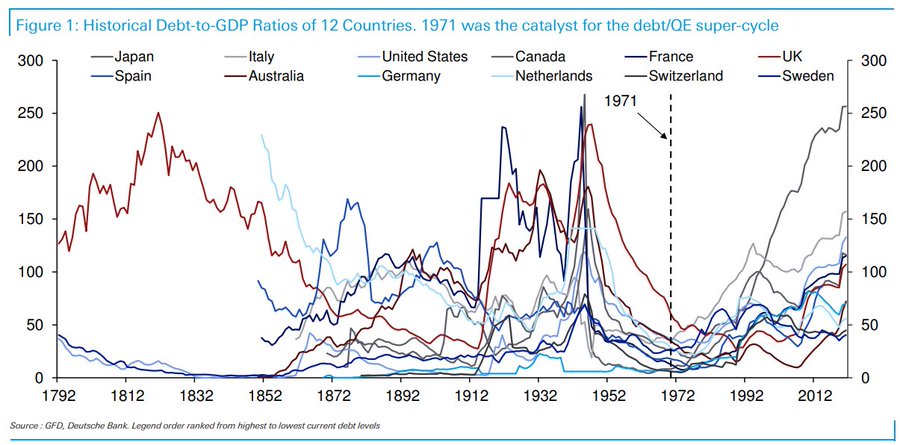

The End Of The Gold Standard. Fifty Years Of Monetary Insanity

This year marks the 50th anniversary since Nixon suspended the convertibility of the USD into Gold. This began the era of a global fiat money debt-fueled economy. Since then, crises are more frequent but also shorter and always “solved” by adding more debt and more money printing.