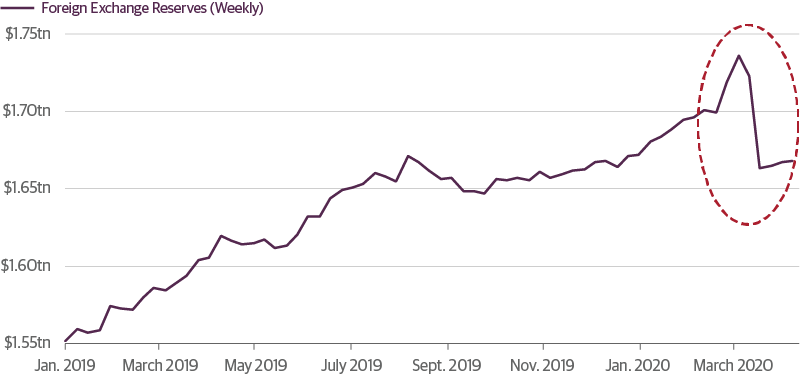

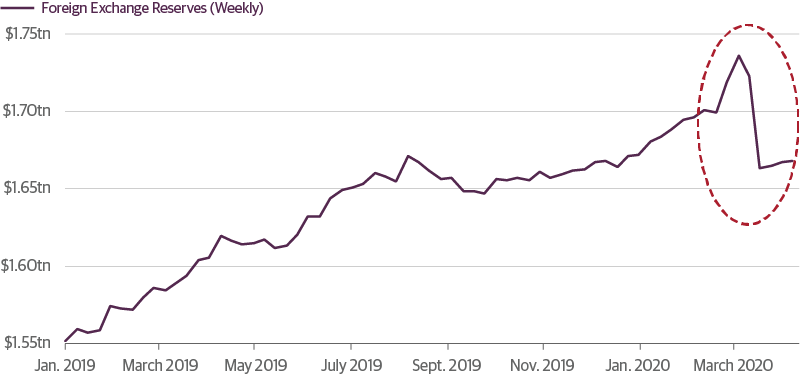

The pace at which emerging market economies are losing FX reserves is staggering. In March, emerging economies lost around $1.5 billion in foreign exchange reserves per day, according to Bloomberg.

The pace at which emerging market economies are losing FX reserves is staggering. In March, emerging economies lost around $1.5 billion in foreign exchange reserves per day, according to Bloomberg.

The Eurozone economy is expected to collapse in 2020. In countries like Spain and Italy, the decline, more than 9%, will likely be much larger then emerging market economies. However, the key is to understand how and when will the eurozone economies recover.

Continue reading Three Reasons Why The Eurozone Recovery Will Be Poor

OPEC and its partners have been cutting production since September 2016. Between September and November 2016 they cut production by more than 1.7 million barrels a day, a historical cut that was wrongly prolonged throughout the expansionary phase of the global economy. In December 2018 they cut production again.

OPEC’s most serious mistake in recent years has been forgetting its mission and principles and trying to artificially inflate the price of oil. No oil-producing country lost money at 2016 prices, the only thing they could not afford was to pay huge subsidies, civil servants and non-oil expenses that many OPEC members finance with export earnings.

Continue reading The Oil Market Is Broken

These days, we hear a lot that banks were the problem in the 2008 crisis and now they are the part of the solution.

Banking was not the main problem of the 2008 crisis, but one of the symptoms that indicated a more serious disease, the excess risk taken by public and private economic agents after massive interest rate cuts and direct incentives to take more debt coming from legislation as well as local and supranational regulation. Lehman Brothers was not a cause, it was a consequence of years of legislation and monetary policies that encouraged risk-taking.

Continue reading Banks Will Not Bail Out The Economy