20/9/2014 El confidencial

“Industry will gradually lose its competitiveness if this course of increasing subsidies is not reversed soon”, Kurt Bock, CEO BASF

Europe needs to exit the crisis through competitiveness and security of supply.

Europe must change an energy policy that has forgotten companies and households with the objective of being “the greenest of the class” without paying attention to costs and competitiveness.

European companies and families cannot continue to bear the costs of planning mistakes and subsidy generosity, because the situation is dramatic.

Europe’s energy policy has forgotten companies and households with the goal of being the greenest of the class.

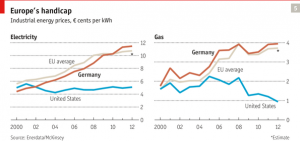

In Europe, electricity costs are on average 50% higher than in the USA and in industrial gas, almost 75%. Between 2005 and 2012, thanks to the shale gas revolution, gas prices in the US fell by 66%, while in Europe they were up 35%. In turn, power prices in the United States fell by 4% while soaring 38% in Europe. It’s the difference between an energy policy that promotes efficiency and replacement through low costs, and Europe’s policy of promoting forced substitution through subsidies.

European companies are among the ones paying the highest prices for electricity and gas in the OECD. A German medium-sized industrial company pays twice the electricity tariff than a counterpart in Texas, according to Ecofys. The average of the Spanish industrial sector pays more than twice what the comparable US one.

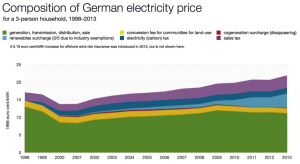

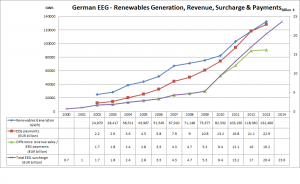

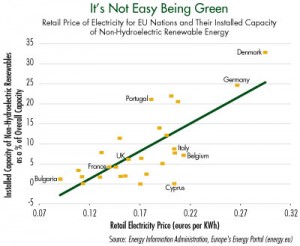

The “green” policies and the development of renewables have allowed wholesale electricity prices to fall; while at the same time, adding fixed costs and subsidies, consumer prices have skyrocketed . For example, in Germany wholesale generation prices have fallen nearly 38% since 2005 and the average electric bill has gone up 60%. A mistake that destroys jobs and businesses that needs to be tackled. In countries like Spain we must differentiate wind power, which represents 20% of the energy generated in 2013 and 19% of the cost, from solar, which represents only 5% of energy produced and 20% the total cost of generation.

Green policies and the development of renewables have allowed the price of wholesale electricity down; but adding CO2 costs, fixed costs and subsidies, consumer prices have soared

The European Union is less than 14% of CO2 emissions in the world, but 100% of the cost. Interestingly, despite the green policies of the EU, the United States has reduced CO2 emissions since 2005 by 12% to 1994 levels, a more significant reduction than Europe’s.

All these problems result in lower industrial production, increased offshoring of companies, difficulties to compete and, of course, less employment.

For these reasons, the energy policy of the European Union must comply with the principles of safety, diversification and competitiveness.

Keep betting on renewables without passing the bill to businesses and families. Subsidies must be changed to tax incentives, as in the US. This prevents planning mistakes when estimating demand, subsidies and costs as the tax incentives are only provided when demand is real through agreements with consumers (PPAs, power purchase agreements). Every year I hear that solar will be competitive next year. And every time I hear it, the electricity bill goes up. After nearly a decade of subsidies, solar and wind technologies promoted by many leading European companies are competitive and at grid parity in some countries, without subsidies. To continue to demand subsidies in mainland Europe is at least suspect.

Addressing the problem of overcapacity . Europe cannot be “green” yet subsidize inefficient coal technologies, pay unnecessary capacity payments, or maintain excess capacity, with reserve margins above 17%. And all paid by consumers.

Replacement, not accumulation. Europe cannot allow new generating capacity when consumers pay the accumulated excesses. The new generation capacity has to come from replacement, and the change should be done at lower costs.

Addressing the problem of overcapacity. Europe may not want to be the greenest yet subsidize inefficient coal technologies hold unnecessary capacity payments, payments for unjustified subsidies interruptibility or maintain excess capacity … And all paid by consumers

Solving the problem of security of supply,developing local energy sources -shale gas, oil, renewables-, as well as improving interconnection between European countries to use “hubs” to reduce dependence from Russia and other countries, using the various -almost idle- storage facilities and regasification terminals.

Do not demonize technology in a regional and ideological way . Citizens should know that replacing nuclear and gas power with renewables would increase electric bills by three or four times. Remember that the average best price of renewable generation is today 68 euro/ MWh, “only” twice the wholesale price in Germany, and 30% higher than in Italy.

Electricity prices in Europe in 2003 were among the lowest in the OECD and today they are some of the highest. Why? Because the final consumer bill was loaded with all kinds of fixed concepts. In Spain more than 62% of the bill are regulated costs, taxes and subsidies. The European average is 54%.

Europe’s energy policy can not be about “not in my garden”. Pretending to eliminate nuclear power plants when most countries have a few miles, in France, dozens of nuclear reactors, is ridiculous. France has the lowest power prices in Europe and a safe, reliable and competitive nuclear fleet is one of the reasons why tariff prices have not soared. The other is that France did not jump to subsidize tens of thousands of Gigawatts of expensive renewables in early stages of technological development. As long as nuclear power is competitive, efficient and safe, Europe must continue taking advantage of it.

The challenges faced by Europe in its energy policy are enormous. But the opportunity is exciting, and the foundation to make Europe a competitive, self-sufficient world power is already in place.

Technology replacement should be achieved through lower cost, the same way as crude oil ended with whale oil . Not because it was decided by a committee, but because the cost was lower.

The mistakes of 2007 began with optimistic estimates of demand growth, with errors of up to 35%, and so it came to be the first time in history since the industrial revolution in which governments incentivised the most expensive technologies. Europe’s decision to substitute cheap energies for expensive ones have cost many lost jobs and industries.

Security of supply must be achieved, also, from a flexible and diversified energy mix which must be cheap and efficient. Not via subsidies, but through the tax incentives that prevent “fake demand signals” and prevent overcapacity.

Energy is the cornerstone of the future of Europe. Sinking competitiveness would likely worsen the crisis. Europe has the tools, using all technologies, to ensure an abundant and cheap energy supply. Anything else would bring it to repeat the mistakes of 2007.

Important Disclaimer: All of Daniel Lacalle’s views expressed in this blog are strictly personal and should not be taken as buy or sell recommendations.