So far this year, the European energy sector (SXEP Index) is the worst performing one in the European stock market. Same with Energy vs the US all-time-high levels.

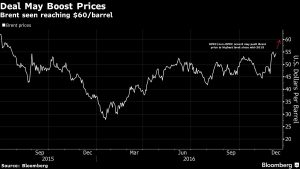

The fact that this situation happens while oil prices remain within the range of $ 50-55 a barrel, shows that the sector is very far from regaining momentum after a rather technical rebound seen in 2016.

We should not forget that the oil sector was already one of the worst performers in the stock market way before the oil price collapse. The reasons were obvious. Monstrous investment plans with very poor returns, disappointing growth, weak profitability and missing companies’ own targets, added to an unsustainable dividend yield even at $ 100 a barrel.

No, the problems of the oil sector do not come only from the price of oil or natural gas. It comes from the atrocious allocation of capital and the inexorable destruction of value of many conglomerates that hide under the “long-term strategy” excuse, and the detestable “integrated model” to mask a very low competitiveness and a poor identity of objectives with the suffering shareholder who, year after year, looks to the sky and hopes that “in the long-term” things will improve.

When prices are high, the sector embarks on questionable acquisitions and, when oil prices fall, it is the shareholder who suffers.

It all started many years ago. Already in the late 1990s, the vast majority of integrated oil companies forgot the historical principles of the sector. They forgot ROCE (return on capital employed) as a fundamental measure to analyze investments, launched “diversification” strategies that have destroyed billions of market capitalization, began to relax their investment criteria … And the disaster was slowly brewing. A sector that generated 12% ROCE at $ 14 a barrel … went on to generate a lower profitability, 11%, at $ 130 (SXEP Index).

When I started working in the oil sector, planning was made using commodity prices that were much lower than the curve. Today, oil companies’ strategy departments are semi-religious centers dedicated to praying for the price of oil to rise, resorting to conspiracy theories and hopes of OPEC cuts, instead of planning at the low-end of the cycle, as the sector always did.

US companies learned this lesson years ago when they made strategic mistakes because they thought the price of natural gas “could not fall.” Acquisitions were made in the US that required $ 6/mmbtu. But natural gas prices plummeted to $ 2/mmbtu. A reality slap in the face that led companies to go back to basics. Put ROCE in the forefront of strategies and forget the mirage of high debt. Massive capital increases, cuts in capex and restructurings ensued.

Meanwhile, in Europe, big oil companies were launching a strategy of running to stand still. Adding debt, and investing in power and renewables.

To think that the problem of the European oil sector, of its lack of investment rigor and poor shareholder return, is going to be solved with higher crude prices, is to deny reality. Investments have already started to increase – an annualized 8% – even though balance sheets remain damaged and the enormous overcapacity created in the bubble period has not been reduced.

There are opportunities in the oil sector, but I fear they are not clearly defined in Europe. Any hint of hope in European conglomerate valuations requires an act of faith, while in the US, at least the investor has managers who are aligned with investors’ interests and better fundamentals.

If investors believe that oil prices will rise, there are better options in service companies that benefit from the return of investment plans or focused exploration and production companies, where one does not have to take believe in conglomerates. In any case, despite the OPEC “agreement”, crude oil does not easily move out of its lateral range, due to the obvious excess of supply.

The high dividend yield of integrated conglomerates is an indicator that should be carefully analyzed. When those dividends are unsustainable, paid with debt or, worse, with shares, a high dividend yield could be misleading.

I do not like oil conglomerates. They are value traps by the book. They always seem optically “cheap”, but their low multiples are justified by the atrocious profitability, lack of investment rigor and megalomaniac strategic decisions.

The two trends that do interest me are the return of capex, which benefits service companies, and the energy independence of the US, which benefits the focused North American producers. The rest, with all due respect, need to stop hiding under the long-term excuse, do their homework and carry out an exercise of self-criticism and restructuring after decades of empire-building with shareholders’ money. The electricity sector did it. The integrated oil sector, like many banks, continues to believe in unicorns.

Daniel Lacalle. PhD in Economics and author of “Life in the Financial Markets”, “The Energy World Is Flat” (Wiley) and forthcoming “Escape from the Central Bank Trap”.

Image courtesy Google.