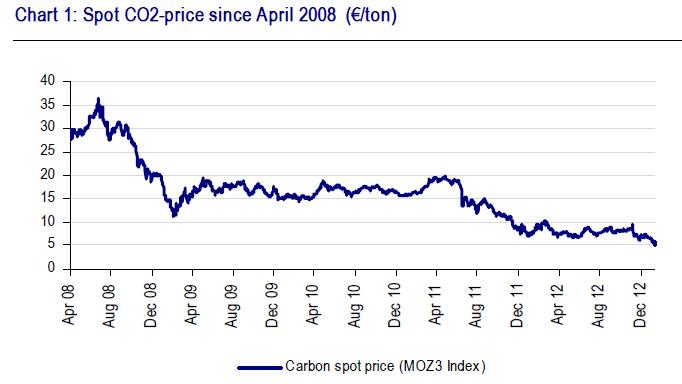

Is CO2 dead? This is something I have been warning for a few years now. The evidence is overwhelming. Flawed concept, massive oversupply of permits and politicians optimistic predictions. Great combination. Continue reading CO2 collapses to all-time low

Is CO2 dead? This is something I have been warning for a few years now. The evidence is overwhelming. Flawed concept, massive oversupply of permits and politicians optimistic predictions. Great combination. Continue reading CO2 collapses to all-time low

Category Archives: Energy

Commodities Weekly

Outperformance of WTI vs. Brent continued this week as the spread between the two benchmarks narrowed further to $15.5/bbl.

The WTI benchmark is receiving support from the start-up of the expanded Seaway pipeline, with the market factoring in this recent expansion in takeaway capacity (150 thousand b/d to 400 thousand b/d) as a precursor for a reduction of surplus crude oil inventories at Cushing over the coming weeks. It is important to note however, that in the meantime crude stocks continue to climb to new record highs.

Oil & Gas: Looking back at 2012… and a 2013 Outlook

2012 was a very tough year for global oil & gas, as the group underperformed the MSCI World by 10%. FTSE Oil & Gas was down 12% and SXEP down 4%.Starting with the disastrous performance of the US onshore-levered oil-field services stocks (the group was down 15% from the March peaks), sharp-sell off in US natural gas prices (-36% to the lows of $1.8/mcf only to end the year in the green) to profit-warnings from consensus top picks, we saw it all. Needless to say, dispersion of returns in 2012 was very high. Looking just at the top 25 oil & gas stocks by market capitalisation (>$40bn), which account for 55% of total global oil & gas market cap, performances range from -23% (Petrobras) to +42% (Ecopetrol). Continue reading Oil & Gas: Looking back at 2012… and a 2013 Outlook

Commodities Weekly

It was an uneventful week in crude markets. Continued delays in North Sea shipments continue to support Brent. However, OPEC production continued to slide in December, reaching a 0-month low. Cut in Saudi production is the main reason for the decline and was originally started to offset the gains in Libyan and Iraqi production. The decline is also in line with comments from Saudi oil minister and OPEC secretary general that the oil market remains well supplied. Continue reading Commodities Weekly