Geopolitical black swans are impacting commodities this morning, with Iraq conflict worsening and Russia threat of cutting supplies to Ukraine.

Brent is at $113.02/bbl and WTI at $107.32/bbl driven by concerns about Iraq. Markets are reacting well as the physical market is not affected so far but concerns are justified.

Iraq produces 3.5mbpd, or 4% of global production and is seen as a key source of future supply growth. Production is mostly in the fields in the South, so far unaffected by the latest attacks, concentrated in the North, according to JP Morgan.

So far the physical market has not seen a relevant disruption, but markets will remain nervous as long as Malaki continues to lose the grip of the key cities, and the terrorists get close to Baghdad. Expect oil to move closer to $115/bbl Brent as the market analyses the risk of losing exportable production.

The Islamic State in Iraq and the Levant (ISIL) have seized the city of Tal Afar in Northwestern Iraq yesterday but have not continued to advance to Baghdad, so far only concentrating on northern Iraq. The rebels have control of Mosul, the second largest city in Iraq, along with Tikrit and the small towns of Dhiluiya and Yathrib, north of Baghdad. Iraq’s military spokesman Qassim Ata yesterday said that the Iraq army had killed more than 279 members of the rebel group. President Obama has indicated that he is reviewing military options to help Iraq in fighting the rebel groups.

Kurdistan PM is mentioning in the BBC the possibility of splitting Iraq into three separate regions.

The Kurdistan Regional Government has taken over security of the giant Kirkuk field (260k b/d of production) in the North Remaining oil production in the northern oil fields is another 435k b/d. Iraq has the 5th largest proven oil reserves & is the 2nd largest crude producer in OPEC, behind Saudi Arabia, at 3.5 mbpd. OECD oil inventories were 2,624mb at end April, 77mb lower than the 5-yr average & 53mb lower than last year.

My thoughts:

– The US is unable to get involved in a war. The fact that the US will likely be oil independent (including Canada) in 2016 gives little incentive to take action.

– There is very little real western support for Malaki and the country is currently too corrupt so there is risk of a bad public image and lack of popular support problem.

– Oil companies in the South have very strong armies and security is very tight. I see low risk of oil supply disruptions and the ports are working adequately.

– The three large oil companies must have anticipated these issues as they shipped most of their needed equipment last year. They also doubled security.

– Low probability of the ISIS reaching Baghdad but strong probability of a country that ends up broken in three (Kurdistan, a Sunni North capital Tikrit and a Shiia South capital Baghdad).

Helping reduce the geopolitical risk on oil is the FT reporting that US liquids production hit 11.27 mbpd in April, and is today above its previous peak in 1970 of 11.3 mbpd. With a higher percentage of NGLs, still crude production was 8.3 mbpd in April (now 8.5m), lower than the record high of 10 mbpd in November 1970.

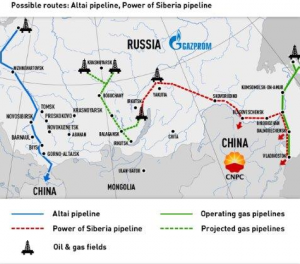

UK gas rises +7.1% at 45p/therm and European gas seems to rise in sympathy as Gazprom threatens to cut supply to Ukraine after the deadline to pay the outstanding bill of $2bn passed with no agreement on a timetable of payment or price. The Ukraine government is mentioning that the price has to be revised to international levels and that they cannot pay this figure or the revised price of $8.5/mmbtu. The EU is looking for an option that includes a revision of the price for a long term contract and gradual payments. Gazprom will cut off supplies unless Ukraine pays for the gas up front.

Gazprom however, will not disrupt supplies to Europe. 33% of Europe’s gas comes from Gazprom and 50% of it is transported through Ukraine. Ukraine has enough gas in storage (13bcm) to hold on to summer demand as its annual consumption is 33bcm according to UBS. Europe also has a record amount of gas in storage after a very warm winter.

Europe’s largest gas supplier after Gazprom is Statoil who mentions it can “easily” offset any short-term disruption of Russian supply.

Coal remains weak at $80.40/mt holding on to its support level despite news that freight rates for panamax dry bulk vessels are now below opex, and long-term forward rates have fallen below break-even. Chinese coal import is the most important trade for panamaxes and chinese imports of thermal coal are expected to be lower in 2014 than in 2013. Capesize rates have come down 43% YTD and forward rates for Q4 fell 4% this Friday.Adding to this a 100 milion tonnes of Australian capacity growth, the outlook for both coal prices and the Baltic Dry is not positive. Freight companies are growing the fleet by 4% this year so oversupply is even higher.

The Baltic Dry index is down 3% this month (-60% YTD) driven by oversupply of reights and weakening Chinese imports.

CO2 rises 53bps at €5.74/mt helped by backloading efforts to reduce the impact on CO2 prices of lower industrial demand and poor thermal output.

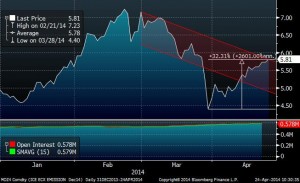

US gas rises 65bps at $4.67/mmbtu helped by the past six weeks injection data. It would require a very aggressive change in injection data in the next months to justify prices below $4/mmbtu… I believe we are going to see $5/mmbtu sooner rather than later. Weekly natural gas storage injection of 107 Bcf way below the consensus median injection estimate of 112 Bcf and the bears’ view of 161bcf. Total working storage is now at 1,606 Bcf, 727 Bcf below last year’s level and 877 Bcf below the 5-year average of 2,483 Bcf.

Power prices in Europe are reacting mildly… Germany at €34.70/mwh (-5.35% YTD), Nordpool at €30.78/mwh (-4% YTD). Spanish power prices are down 1.2% YTD and French -5.5% YTD.

Important Disclaimer: All of Daniel Lacalle’s views expressed in his books and this blog are strictly personal and should not be taken as buy or sell recommendations