CAN SPAIN LEAD EUROPE TO GREATER ECONOMIC FREEDOM?

By James M. Roberts and Daniel Lacalle, Ph.D. (Published by The Heritage Foundation)

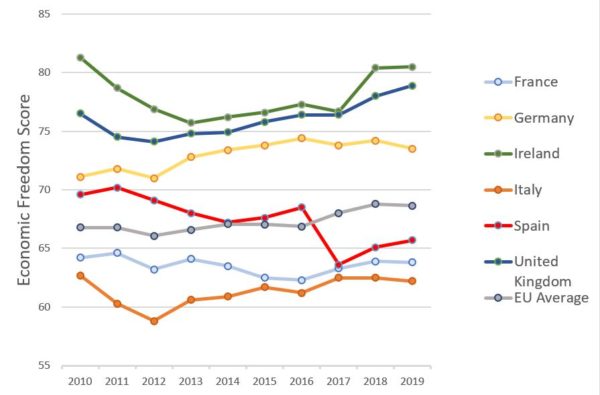

The 2019 edition of the annual Heritage Foundation Index of Economic Freedom[1] shows moderate slippage in the rankings of some eurozone economies. This is a concern, especially as this trend coincides with the peak of the largest monetary stimulus in European Union history, the goal of which was to provide EU economies with opportunities to modernize and to implement important structural reforms aimed at delivering more robust growth, more sustainable job creation, and the generation of higher-quality job openings.

In the midst of this decline in Europe, Spain’s 2019 economic freedom score has demonstrated encouraging improvement. It rose to 65.7,[2] making the Spanish economy the 57th freest in the 2019 Index, aided by a significant increase in fiscal health after tax cuts in 2015 and 2016 helped to boost the economy while preserving budgetary stability. Spain is ranked 28th among 44 countries in the Europe region in 2019, and its overall score is below the regional average but above the world average.

This paper will examine how the next government in Spain can continue on that upward trajectory in the years to come and propel the country to leadership in a race to the top for greater economic freedom in Europe.

A Role Model for Europe

Under the government of former Prime Minister Mariano Rajoy, which was in power from 2011 to 2018, Spain became something of a role model for how a country can implement significant and vitally necessary structural reforms during a financial crisis. Its labor market reform was key in stopping the massive increase in unemployment, but other crucial reforms also played an important part in the country’s rebound.

Spain’s subsequent recovery from its worst economic crisis in decades was impressive, especially because relatively few international observers expected the country to deliver consistent above-trend growth and rapid job creation. Between 2012 and 2017, Spain recovered more than half of the jobs lost during a crisis that was initially: (1) denied by the previous Socialist administration of José Luis Zapatero (in office from 2004 to 2011); and (2) afterwards exacerbated by Zapatero’s misguided policies, deficit spending, and mounting structural imbalances.

Since then, Spain has slashed its fiscal deficit by 70 percent and brought what had been a dangerously high trade deficit nearly into balance. The fact that exports have risen to 33 percent of GDP is also relevant, as Spain´s largest trade partners have remained stagnant or in recession during the same period.

External factors have helped, of course. Support from the European Central Bank (ECB), low interest rates, and cheap oil prices support the economy, but those factors should have also helped other European economies such as Italy, which are similarly vulnerable to volatile energy prices and interest rates. Nevertheless, it has been Spain that has created more than 1.5 million jobs in the past three years—the second-highest country in the European Union in terms of full-time job creation.

The main reason for the difference in performance of Spain relative to neighboring EU countries has been the achievement of a very ambitious set of structural reforms: A financial reform that helped change the perception of risk of the Spanish financial system; A labor market reform that turned around a seemingly unstoppable trend of rising unemployment and recovered jobs and salaries; A moderation in government spending without reducing social expenditures and; A fiscal reform in 2015 that reduced corporate and income taxes. Public debt, although elevated, has been contained relative to GDP in the past three years.

These have been deciding factors that have driven a recovery in which inflation was non-existent and global trade growth was slowing down. These structural reforms were achieved at a high political cost, however, as has been the case over the years in numerous other countries where tough decisions had to be made.

In the case of Spain, the Rajoy government paid that political price when it was unable to secure an absolute majority in the elections in 2015 and 2016 and, ultimately, was forced from power in 2018. A weak minority socialist government under Prime Minister Pedro Sánchez replaced it and proceeded to loose a variety of damaging internal forces that, together with some negative external developments, could put the Spanish recovery in jeopardy and weaken the economy again.

For example, Forbes reports that, at the end of 2018, the Sanchez government “approved the largest increase in the minimum wage since 1977, rising salaries up to €900 ($1,030) per month, representing an increase of 22 percent.”[3] Policy backsliding triggered by the implementation of these sorts of socialist policies is the main reason why a significant improvement in economic freedom is necessary.

A Complicated Political Landscape

In 2018 under the Rajoy government, Spain saw tax receipts rise more than nominal GDP and achieved record revenues after much needed tax cuts. Corporate tax receipts rose 29 percent after the nominal corporate tax rate was cut to 25 percent. Unfortunately, the Socialist Sanchez government has been dependent on the votes of radical left and nationalist parties, whose policy priorities are generally to increase spending, raise taxes, and run budget deficits. These historically bad policies alone will make pushing economic freedom in Spain higher a bigger challenge if another left-of-center coalition manages to win the April 28, 2019 election and form a new government.

Spain has had deficits every year since 1980 except during the years of the real estate bubble that preceded the crisis. Relying on tax increases and revenue measures has historically been a bad choice, however, because when spendthrift governments whose leaders are seeking to buy votes are in power, government spending consistently rises above those revenues and revenue estimates tend to be optimistic, as the ECB has pointed out in its paper “Fiscal forecasting: lessons from the literature and challenges.”[4]

Calls by Prime Minister Sanchez’s Socialist government to re-introduce previous rigidities and eliminate the Rajoy government’s 2012 labor market reform will also not solve Spain´s structural problems. Spain has had an average of 17 percent unemployment since 1980, with three different periods where it rose above 20 percent. Temporary jobs were already more than 25 percent of all contracts before the crisis. Going back to the mistakes of the past will not solve a long-term problem that has more to do with low productivity and the inefficiency of many small and medium Spanish enterprises (SMEs). Promising greater workers´ rights will do more harm than good in that context. Solving Spain´s unemployment problem can only be achieved by creating an economic climate conducive to the creation of many more private companies, attracting more investment, and letting SMEs grow.

There are also external forces looming on the policy horizon that could threaten growth and job creation. The IMF is requesting that Spain raise some Value-Added-Tax (VAT) rates (aka “tranches”), which could hinder nascent growth of consumption. Additionally, Brussels seems adamant on pressuring Spain into adopting anti-growth measures by returning to the old mistake of raising taxes.

This pro-higher-tax policy by the EU reflects the desperation faced by Brussels bureaucrats as they ponder how to confront the massive future unfunded spending liabilities resulting from decades of over-promising generous welfare state benefits to European voters. Brussels is also pushing the OECD’s “anti-tax base erosion” (BEPS) project with the aim to increase tax collections.[5]

Policymakers in Spain cannot and should not ignore the global trend to decrease, not increase, corporate taxes. That is because it has been well established that reducing the tax wedge has a direct positive impact on investment, job creation, and attraction of capital.[6] Likewise, they cannot ignore that the positive effects of labor market reform have been recognized even by countries such as France, which has been notorious for decades of labor code inflexibility but which is currently planning labor code reforms similar to Spain’s to boost job creation.

The bottom line that the next Spanish government must face is that the imbalances of the Spanish economy (an elevated public debt, a large deficit, and still-high unemployment) will not be solved by looking to the past, but improving in economic freedom. They can be solved through supply-side reforms, attracting foreign investment, allowing companies and families to keep more of their money, and improving public sector efficiency while retaining a strong but sustainable social component.

In this way Spain can grow faster than the rest of the European Union in 2019 and beyond, and faster than the forecast 2.5 percent in 2019 (as it has done in the past two years). Spain has proven that it can create more than 500,000 jobs a year. To do so, however, the next government will have to overcome the vast array of powerful forces mentioned above that would put the brakes on additional job creation.

Perhaps, as a start, it would be instructive for socialists in Spain to study the recent “success” enjoyed by “progressives” in New York City, whose unrelenting anti-business demands effectively killed the creation of 25,000 new high-paying jobs in that city by Amazon.

Assuming that saner heads prevail and a pro-free-market government takes power, how can it position Spain within the eurozone so that the country’s economic freedom score improves from its current “acceptable” level and the country makes the leap into the ranks of continental and even global leadership?

Recipe for Success

A careful analysis of the Spanish economy reveals the minor, but important, adjustments that can be made to increase the attractiveness of the economy.

Prudent Fiscal Policy and Spending Cuts

Spain is a country of small and medium enterprises (SMEs). Ninety percent of Spanish companies fall into this category. However, these Spanish companies tend to be smaller than those of peer countries. Furthermore, the vast majority of SMEs, almost 87 percent, are micro-companies (less than 9 employees, annual sales < two million euros). This corporate structure means that the Spanish economy is very vulnerable to economic cycles, and it means that unemployment can rise much faster than in other countries because more than 80 percent of jobs are created by SMEs. Better tax policy could reduce this vulnerability.

The Spanish tax wedge on companies is too high,[7] and ranks among the nine most onerous tax regimes for businesses in Europe. This substantial tax wedge is a very significant obstacle to growth and prevents many companies from transitioning from SME to large size. The Spanish tax system adds to their burden, since it is oriented towards trying to increase revenues at any cost, even if that makes companies weaker and more cyclically dependent.

Taxes on labor are particularly high as well. An average salaried worker in Spain pays almost 40 percent in taxes. Social contributions are among the highest in the OECD, and this works as a deterrent to job creation, as the cost for employers is almost twice what the worker receives as net salary.

In addition to the heavy tax burden, Spain retains an obsolete system of subsidies and deductions that could be reduced in order to make the tax system simpler and clearer. A simple, lower and attractive tax system can be implemented, and it would help boost receipts as economic activity rises and companies become more robust and grow in size.

Government public spending in Spain can be made significantly more efficient by eliminating the duplication and “parallel administrations” created by some regional communities. The savings from these cuts could be used to implement a large and innovative tax cut to boost productivity and growth.

Additional Labor Market Reforms through Administrative Reorganization

In addition to the reforms advocated above that are essential to reduce unemployment, further reforms and reorganization are needed in the bureaucracies that administer Spanish labor laws to reduce the costs to employers of hiring and employing Spanish workers.

The Spanish economy is held hostage by a tangled web of separate regional, local, and national labor regulations that make it very difficult for companies to manage such a complicated system when trading or conducting business between regions. An effort to normalize rules and regulations as well as a high-priority campaign to cut this red tape would benefit the economy enormously.

The Spanish legal and regulatory system is needlessly complex, too. It aims to contemplate all possible scenarios and tries to provide guarantees for any eventuality. However, it ultimately fails to deliver the job security it promises, and instead acts as a burden on growth and economic development. The next government should make the cutting of red tape and regulations “Job Number One” in order to boost competitiveness and attractiveness of the economy.

Conclusion

Spain can lead economic freedom in the eurozone by implementing the policies outlined in this paper. The next government should also study similar pro-market and pro-growth reforms and policies undertaken by Ireland, which have helped that country grow faster and attract more investment than its leading peers in the European Union. Thanks to the reforms implemented by successive Irish governments over the years, Ireland is now one of only six countries in the world, and the only EU country, that is counted as truly “Free” in the 2019 Index of Economic Freedom.

It is time to avoid the temptation of relying on low interest rates and falling into the trap of increasing imbalances, which has been Spain´s historical mistake. Every time that things start to improve, Spanish governments seem to backslide into a destructive pattern of excessive spending, more debt, and rigidity. The foundation for a more sustainable growth and higher job creation has been set. As was the case in 2012, however, the next government of Spain must be adamant about sticking to a reformist agenda and avoiding past errors. It will be challenging and difficult for all parties to agree, certainly, but they must not forget history: Raising taxes and spending never adds spice to a recipe for success. It ruins the dish.

—James M. Roberts is Research Fellow for Economic Freedom and Growth in the Center for International Trade and Economics, of the Shelby and Cullom Davis Institute for National Security and Foreign Policy, at The Heritage Foundation. Daniel Lacalle holds a Ph.D. in Economics and is a financial expert based in Madrid and London. He is the author of numerous books and articles, including “Escape from the Central Bank Trap” (BEP), “Life In The Financial Markets,” and “The Energy World Is Flat” (Wiley).

[1] Terry Miller, Anthony B. Kim, and James M. Roberts, 2019 Index of Economic Freedom (Washington, DC: The Heritage Foundation, 2019), https://www.heritage.org/index/

[2] Terry Miller, Anthony B. Kim, and James M. Robert, 2019 Index of Economic Freedom (Washington, DC: The Heritage Foundation, 2019), p. 386-387, https://www.heritage.org/index/country/spain

[3]Ana Garcia Valdivia, “Spain Approves An Outstanding Increase Of 22% Of The Minimum Wage To Fight Against Job Insecurity,” Forbes, December 29, 2018, https://www.forbes.com/sites/anagarciavaldivia/2018/12/29/spain-approves-an-outstanding-increase-of-22-of-the-minimum-wage-to-fight-against-job-insecurity/#3096d43278d1 (accessed February 15, 2019).

[4] Teresa Leal, Javier J. Pérez, Mika Tujula, Jean‐Pierre Vidal, “Fiscal Forecasting: Lessons from the Literature and Challenges,” Fiscal Studies, Vol. 29, No. 3 (November 21, 2008) https://doi.org/10.1111/j.1475-5890.2008.00078.x (accessed February 15, 2019).

[5] James M. Roberts, Adam Michel, “Trump Cut America’s Taxes: Now He Should Defund OECD Efforts to Raise Them,” Heritage Foundation Report, May 29, 2018, https://www.heritage.org/taxes/report/trump-cut-americas-taxes-now-he-should-defund-oecd-efforts-raise-them

[6] Karel Mertens, Morten O. Ravn, “The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States,” American Economic Review, Vol. 103, No. 4 (March 9, 2012), p. 1212-1247, https://economics.mit.edu/files/7666 (accessed February 15, 2019).

[7] Paying Taxes 2019, PriceWaterhouseCoopers and World Bank, November 2018, https://www.pwc.com/gx/en/services/tax/publications/paying-taxes-2019.html (accessed February 15, 2019).