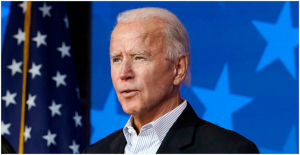

Many financial experts have rushed to make what has been regarded as “Biden trade” calls based on the projections by The Associated Press, NBC News and other news outlets of a Joe Biden presidency. The “Biden trade” is a synonym of a recommendation to invest in assets that may benefit from a Democratic presidency judging by the main policies announced throughout the campaign.

The first risk for investors is to make significant bets on radical changes of policy when the balance of power in the House and Senate may inhibit many of the headline-grabbing policy changes. We already have reports, for example, that show how the tax hikes may be halted due to a combination of a divided government and the negotiations of a new stimulus package.

The second risk for investors is to follow apparently well-argued bets based on a political outcome which end up creating the opposite effect. In 2017, Nobel laureate Paul Krugman wrote about the stock market after a Trump victory: “If the question is when markets will recover, a first-pass answer is never”. The S&P 500 broke new all-time records in the following three years. The Trump presidency saw a surge in stocks, an all-time low yield in US debt and record levels of employment, rising real wages and strong growth before the pandemic. A similar situation happened with the Obama administration. Many investors and experts predicted a surge in renewable stocks and a collapse in the US dollar and large American corporations and none of it happened as expected.

What are the most-called “Biden trades”? Essentially, we can summarize the following: A weaker dollar based on the aggressive fiscal plans and deficit spending of the Biden-Harris team, an overweight Europe and China based on an expected end of tariffs and trade measures as well as weaker corporate profit for US corporates due to more regulation and higher taxes. What surprises me is that many colleagues in the finance world and analyst community defend a weak dollar and surging debt as well as a poorer outlook for investment and business. These are outcomes that hurt consumers, taxpayers and job creation.

However, we must alert to the so-called “Biden trades” judging by experience. We know from the Obama-Biden tenure that making aggressive policy-related bets may be a noticeably big mistake.

Despite consensus calls for a weaker US dollar, between the 20th of January of 2009 and the 20t January 2017, when Obama and Biden were in power, the US Dollar Index (DXY) rose 16.8%, the trade-weighted dollar index rose 15.9%, the dollar strengthened vs the euro by 20.6% and also strengthened compared to the yuan.

The idea that Biden will end tariffs and so-called protectionism is also denied by history. According to the Geopolitical Intelligence Service the United States implemented more protectionist measures than any other country in the world during the Obama administration, more than 600 measures limiting free trade including tariffs on solar panels and trade barriers on capital and imported products.

We must also remember that the fracking revolution in the United States and the biggest increase in domestic oil production happened during the Obama-Biden tenure, while solar bankruptcies soared to all-time highs between 2010 and 2017 as prices plummeted and debt became unpayable. The call to invest in the Clean Energy space based on a change of policy generated a massive underperformance relative to the S&P 500 and the Nasdaq. Good and solid renewable companies did relatively well as technology leaders strengthened, but the broad-based call yielded a mere 2% return of the Clean Energy Index (NEX) relative to a 182% rise in the S&P 500 and a whopping 285% of the Nasdaq.

Calls for an outperformance of China and Europe may also be misguided judging by the past. European stocks (Stoxx 600) underperformed the S&P 500 in the Obama-Biden tenure delivering almost half the return, currency adjusted, than the US broad index. A similar pattern happened with Chinese stocks, with the broad China index delivering a third of the performance of the US index, and Emerging Markets, also massively underperforming the S&P 500 and the Nasdaq.

Other calls assume a massive spending spree but are surprisingly benign with the deficit and debt outcome. According to the Committee for a Responsible Federal Budget, Biden’s proposals will increase the US deficit from 2021 to 2030 by 5.6 trillion US dollars and up to 8.3 trillion. As such, calls for a massive Keynesian effect of spending plans is likely to be -again-wrong, as growth estimates undershoot expectations and debt balloons.

Investors may want to believe in the magic wand of a president, but the reality is that the United States level of state independence, the system of checks and balances, the control of the Senate and the diversification and innovation of US entrepreneurs make it almost impossible to believe that the radical policies announced will be implemented as planned, let alone generate the consensus estimates.

If we can learn anything from the past is that the United States economy proves to be far more resilient than what analysts predict and that betting against America is a bad idea, even if the administration tries to advance anti-business proposals. The “blue wave” calls were wrong, and the likely outcome of these elections may show that we need to pay more attention to the reality of the US economy and its small and medium businesses than to headline-grabbing politics.

Betting on Keynesian and interventionist policies to work is bad for the economy and worse for investors.