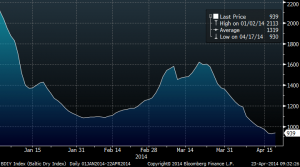

I mentioned it here. The Baltic Dry is showing that global trade is not improving while the fleet continues to grow.

It’s the same old scene… as Roxy Music would say. Too much supply, too little demand.

. Fleet growth +6-7% in 2014 and 4-5% in 2015. Roughly 16M DWT (dead weigh tonnage) of capacity was delivered in the first quarter of 2014 (annualized growth of 8%). A huge number not absorbed by demand.

. Spot rates in the 6 major global routes have averaged $10kpd YTD, down $4-5kpd from last year’s levels.

Demand slowdown:

. Reported chartering data have been relatively flat compared to last year. Chartering has grown less than 1% pa in the past two years while fleet grwoth has exceeded 2.5% pa.

Capesize rates continue their free fall. Despite a solid number of new charters to China, mostly from Australia, spot Capesize rates are now at $9kpd (-64% MTD). Brazilian activity is still low and Chinese steel demand remains poor despite stockpiles of flat and construction steel products falling, now -15% YoY.

Some positive support short term:

China continues to show strong demand for iron ore imports. Credit Suisse counted 27 iron ore fixtures last week, which is up 20% over the trailing two month average.

… But overcapacity is not addressed

The overall picture for the next two years is a moderation in the overcapacity increase, not an imprvement in the supply-demand balance. It is hard to see dayrates improving dramatically in such a scenario even if global chartering increases 5%.

Shipping Stocks, SEA, relative to the Baltic Dry Index, $BDI, that is SEA:$BDI, is trading quite high; and is going to plummet, driving bulk shipping rates down further; there is coming a wipe out of shipping companies; these will be the first going into the Pit of Financial Abandon.

The reason why Shipping stocks are trading high relative to the Baltic Dry Index, $BDI, is because Credit Madness, has sustained the EURJPY Currency Carry Trade Investments, such as Luxottica, LUX, Shipping Stocks, SEA, such as KEX, TK, TOO, TGP, SFL, GLNG, GLOG, SBLK, CMRE, NM, DLNG, GLBS, CPLP, GASS, Eurozone Nations, such as Netherlands, EWN, and the European Financial Institutions, EUFN, such as Switzerland’s, UBS, as well as the Design Build Companies, FLM, such as Switzerland’s FWLT.

The EUR/JPY is about to unwind as investors derisk out of the Euro, FXE. which closed at 136.95 on Friday April 2, 2014; look for great deleveraging rewarding stock market short sellers