Anyone who believes the “rich” and large corporations will pay for $28 trillion in debt or the $2 trillion in new deficit has a real problem with maths.

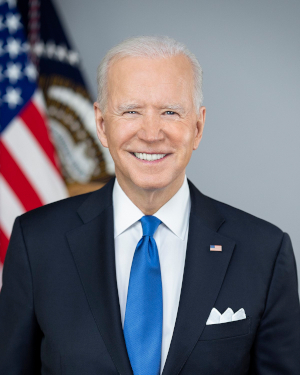

Biden’s announcement of a massive tax increase on businesses and wealthier segments of the population simply makes no sense. The tax hikes will have a significant impact on economic growth, investment and job creation and do not even scratch the surface of the structural deficit. Even if we believe the Gross Domestic Product growth and revenue estimates announced by the Biden administration, the impact on debt and deficit is negligible. So, what is their response? That debt and deficits do not matter because the key now is to spur growth and the cost of borrowing is low despite rising debt.

Furthermore, the Biden administration has been inundated by MMT (Modern Monetary Theory) proponents who passionately believe that deficits are good because they attend to the rising global demand for US dollars. Additionally, the Biden administration argues that the deficit increase is not a problem because the Federal Reserve continues to purchase government bonds, keeping yields low and debt costs stable.

Continue reading Three Reasons Why The Biden Tax Increase Makes No Sense