In the economy, real economic return on investment is not just an important metric. It is crucial. That is why I find it so intellectually dishonest when some economists look at the GDP and employment growth without putting it in the context of the massive increase in debt, spending and money supply.

A stimulus plan is supposed to generate higher and faster growth than the normal trend would dictate. Furthermore, the definition of a stimulus plan is that it should improve the long-term trend.

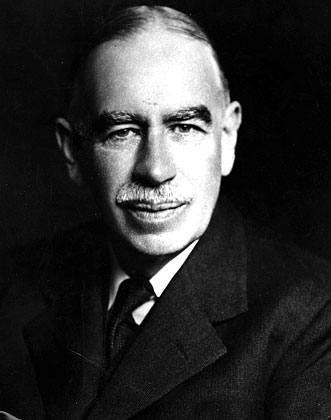

Continue reading Weak Jobs Report Shows Failed Keynesian Policies