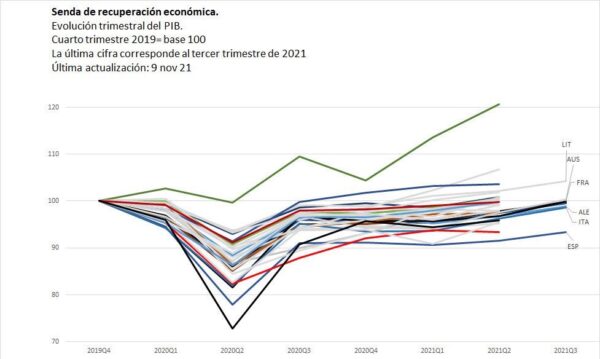

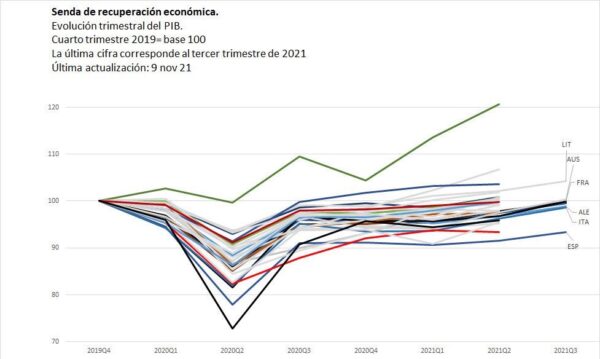

The Spanish government and its supporters question the GDP figures, which show a very poor recovery, lagging behind the OECD and European Union, stating that employment is recovering stronger therefore the GDP figure must be wrong.

The Spanish government and its supporters question the GDP figures, which show a very poor recovery, lagging behind the OECD and European Union, stating that employment is recovering stronger therefore the GDP figure must be wrong.

As more countries copy the Federal Reserve’s monetary policy without the global demand of the US dollar, financing trade and fiscal deficits printing a weakening currency, nations become more dependent on the US dollar.

Neither domestic nor international citizens demand local currency, and governments continue to build large fiscal and trade imbalances believing the magic money tree will solve everything. However, as confidence in their domestic currency collapses, global US dollar-denominated debt soars because very few investors want local currency risk and central banks need to build US dollar reserves to cushion the monetary debasement blow.

Continue reading Printing and Borrowing Always Ends Badly

Most emerging and developed market currencies have devalued significantly relative to the United States dollar in 2021 despite the Federal Reserve’s aggressive monetary policy. Furthermore, emerging economies that have benefitted from rising commodities prices have also seen their currencies weaken despite strong exports. As such, inflation in developing economies is much higher than the already elevated figures posted in the United States and the Eurozone.

The main reason behind this is a global currency debasement problem that is making citizens poorer.

Continue reading Money versus Currency. How Governments Steal Wealth

United States consumer confidence has plummeted to a decade-low in November. The University of Michigan’s consumer sentiment index fell to 66.8 in November, down sharply from the October figure of 71.7 and well below consensus forecasts of 72.4. Inflation is hurting consumers and the impact on daily purchases is more severe than what the Federal Reserve and consensus estimates may want to believe.

The Misery Index, which adds inflation and unemployment, is at 10.8%, the highest reading in a decade if we exclude the peak of Covid-19 lockdowns, when the Misery Index reached 15.13%. These are Carter-era levels for the Misery Index and stagflation alert signs.

Continue reading The US Misery Index Shows Weakness of the Recovery